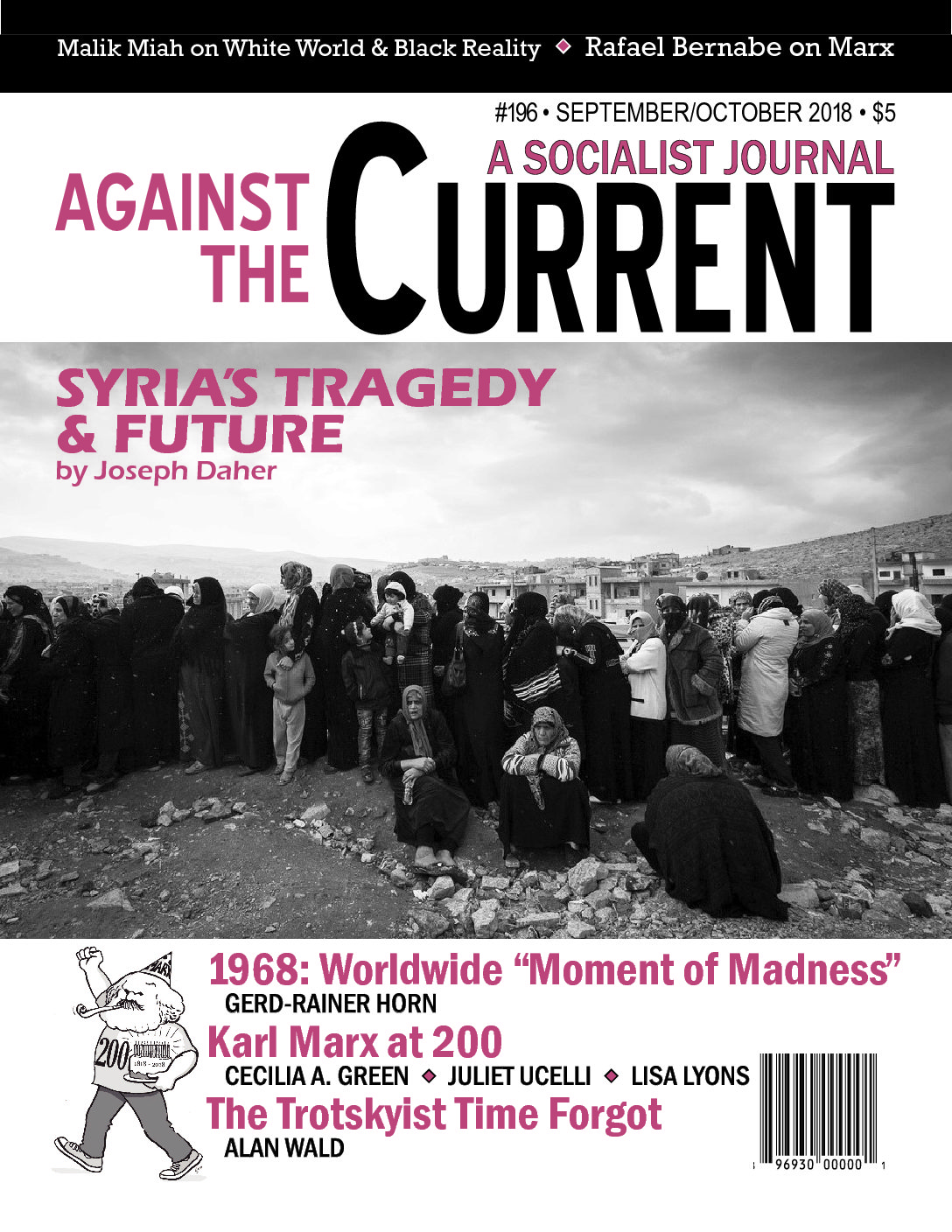

Against the Current, No. 196, September/October 2018

-

Where to Begin?

— The Editors -

The White World and Black Reality

— Malik Miah - Who Killed Marielle?

-

Worldwide "Moment of Madness"

— Gerd-Rainer Horn -

European Communist Parties and '68

— Gerd-Rainer Horn - Fascist Attack in Chile

- UPS Update

- Update on Syria

-

Syria's Disaster, and What's Next

— Joseph Daher - Karl Marx at 200

-

Janus and My Ode to Capital

— Juliet Ucelli -

Historical Subjects Lost and Found

— Cecilia A. Green - Review Essay

-

Marx Turns 200: A Mixed Gift

— Rafael Bernabe - Marx's Capital

-

On the "Transformation Problem"

— Barry Finger -

Reply

— Fred Moseley -

Marx, Engels and the National Question

— Peter Solenberger - Revolutionary History

-

Nicolas Calas: The Trotskyist Time Forgot

— Alan Wald - Reviews

-

Struggling for Justice

— Cheryl Higashida -

The Power of Story, the Evidence of Experience

— Sarah D. Wald -

An Unrepentant '68er's Life

— K. Mann - In Memoriam

-

Martha (Marty) Quinn, 1939-2018

— Patrick M. Quinn -

Joel Kovel (1936-2018)

— DeeDee Halleck and Michael Steven Smith

Fred Moseley

THANKS VERY MUCH to Paul Burkett for writing an excellent review of my recent book Money and Totality (with a long subtitle: A Macro-Monetary Interpretation of Marx’s Logic in Capital and the End of the Transformation Problem) and also to Barry Finger for writing a substantial comment on Burkett’s review and my book.

I will reply to three of Finger’s points. It’s hard to tell sometimes if he is criticizing Marx’s theory or my interpretation of Marx’s theory; it seems to me that he is mostly criticizing Marx’s theory and me for following Marx.

Finger’s first criticism is that I uncritically accept Marx’s theory that surplus-value-flows between sectors“ in the transformation of values into prices of production, as if surplus-value is some kind of liquid that can be poured from one industry to the next.

In order to clarify Marx’s theory of the distribution of surplus-value across industries, we must first understand that there are two main levels of abstraction in Marx’s economic theory: a macro theory of the production of surplus-value in Capital Volumes 1 and 2, in which the main question is the determination of the total surplus-value produced in the economy as a whole, and a micro theory of the distribution of surplus-value in Volume 3, in which the main question is the division of the total surplus-value into individual parts (first the equalization of profit rates across industries in Part 2, and then the further division of the total surplus-value into commercial profit, interest and rent in Parts 4, 5 and 6).

The key point about this logical method is that the production of surplus-value is theorized prior to the distribution of surplus-value, i.e. the total surplus-value produced in the economy as a whole is determined logically prior to the division of the total surplus-value into individual parts (the whole before the parts). The total surplus-value is determined in the first level of abstraction (the production of surplus-value), and then this total surplus-value is presupposed in the second level of abstraction (the distribution of surplus-value or the subsequent division of the total surplus-value into its individual parts).

This logical progression from the total surplus-value to the individual parts of surplus-value follows directly from Marx’s labor theory of value and surplus-value, according to which all the individual parts of surplus-value come from the same source — the surplus labor of production workers. Therefore, the total surplus-value must be determined first — by surplus labor — and then this total surplus-value is divided into the individual parts, which also depend on other factors besides surplus labor, such as competition among capitalists which tends to equalize the rate of profit.

Marx referred to these two levels of abstraction in quasi-Hegelian terms of capital in general and many capitals (or competition).

“Flow” of Surplus Value

In order to equalize the rate of profit across industries, individual commodities exchange at their prices of production that differ from their values, and as a result some of the surplus-value produced in industries with a higher than average proportion of labor is appropriated in other industries with a lower than average proportion of labor. So in this logical sense surplus-value does indeed “flow” between industries; surplus-value that is produced in some industries is appropriated in other industries.

There is nothing mysterious about this; it is based on Marx’s logical method of the two levels of abstraction of the production and distributrion of surplus-value, and it happens through the price mechanism of individual prices of production differing from values. The total surplus-value is not a liquid but a quantity of money, ∇M in Marx’s symbol, which is determined by the total hours of surplus labor (SL) in the economy as a whole multiplied by the money-value produced per hour of labor (m).

Written algebraically: ∇M = m (SL). This total amount of money is divided up among individual industries (according to the capital invested in each industry) by commodities exchanging at prices of production.

Finger’s second point is that he interprets the transformation of values into prices of production to be an actual process over successive periods, in which commodities first exchange at their values which results in unequal rates of profit, and then there are transfers of capital from industries with lower than average rate of profit to industries with higher than average rate of profit, which in turn results in changing quantities of output produced and changing prices that gravitate toward prices of production.

But I argue that Marx’s theory of prices of production is about the end result of this equalization process, not about the equalization process itself. Marx’s theory assumes that the equalization of the profit rates has taken place and thus the economy is assumed to be in long-run equilibrium, and the prices of production determined under this abstract assumption are long-run equilibrium prices.

Marx’s theory of the production and distribution of surplus-value is in terms of a single period (e.g. a year); first the total amount of surplus-value produced in that period is determined and then the division of the total surplus-value across industries in that same period is determined, in such a way that all industries receive the same rate of profit (as in Marx’s single period tables in Chapter 9 of Volume 3).

This is not to say that the equalization process itself is not important. But Marx abstracted from the process in order to explain the end results of this process — prices of production as long-run equilibrium prices, with equal rates of profit.

The main purpose of Marx’s theory of prices of production was to answer the main criticism of Ricardo’s labor theory of value — that the labor theory of value was contradicted by equal rates of profit across industries and was unable to explain long-run equilibrium prices with equal rates of profit. Marx answered this main criticism of the labor theory of value on its own terms and showed how long-run equilibrium prices could be explained on the basis of the labor theory of value.

Marx’s main purpose was not to explain the adjustment process. Indeed, Marx was of the opinion that Adam Smith had already explained this process pretty well (transfer of capitals in response to unequal profit rates, etc., much as Finger describes). But Marx emphasized that neither Smith nor Ricardo was able to explain long-run equilibrium prices with equal rates of profit that are the end result of this adjustment process, and that was Marx’s decisive advance.

Rates of Exploitation and Profit

Finger’s third criticism is that I follow Marx and assume equal rates of surplus-value across industries, and there are two problems with this assumption. First, Finger asserts, equal rates of surplus-value (rates of exploitation) are not compatible with equal rates of profit; it is not possible to have both equalities in the same price system.

The answer to this criticism is based again on the two levels of abstraction in Marx’s theory — the production and distribution of surplus-value.

The assumption of equal rates of surplus-value applies to the first level of the production of surplus-value, and the assumption of equal rates of profit applies to the second level of the distribution of surplus-value. Equal rates of surplus-value at the level of production is entirely compatible with equal rates of profit at the level of distribution.

In this criticism, Finger interprets the transformation problem in the standard way — as being about two sets of micro prices of individual commodities, where the transformation is from one set of micro prices (values) to another set of micro prices (prices of production).

But I argue — with substantial textual evidence; see Chapter 3 (80 pages) of my book — that the transformation problem is not about two sets of micro prices, but is instead about the transformation from macro total value and total surplus-value to micro prices of individual commodities. The transformation problem is really a disaggregation problem — how a predetermined total is divided up into individual parts.

Finger also argues that there is no actual competitive mechanism to achieve the equalization of the rate of surplus-value (like the transfer ot capitals to achieve equal rates of profit). I agree with this point, but I argue that the assumption of equal rates of surplus-value is not meant to be a realistic assumption in Marx’s theory, but is instead a simplifying assumption that could be relaxed without changing anything fundamental.

The amounts of surplus-value produced in each industry would be different (from the amounts if equal rates of surplus-value is assumed), but these different individual amounts of surplus-value would still be added up in order to determine the total surplus-value, and this total surplus-value would still be used to determine the general rate of profit and prices of production in the same way as Marx did in Chapter 9 of Volume 3.

I discovered recently in volumes of the German Marx-Engels Collected Works that Marx relaxed the simplifying assumption of equal rates of profit in a few pages in two manuscripts that were written after Volume 3 in 1868 and 1875. (I would be happy to provide references.)

Thanks again to Barry Finger for his substantial and stimulating comments. I hope I have understood his comments correctly and that my reply has helped to clarify the issues, especially the two levels of abstraction in Marx’s theory. And I would be happy to continue the discussion by email: (fmoseley@mtholyoke.edu).

September-October 2018, ATC 196