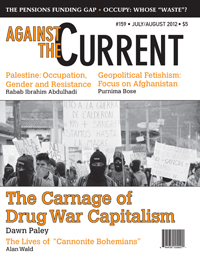

Against the Current, No. 159, July/August 2012

-

Swing of the Pendulum?

— The Editors -

Immigrant Youth Victory!

— The Editors -

Rolling Back Reconstruction

— Malik Miah -

The Pensions Funding Gap

— Jack Rasmus -

The Media's Dirty War on Occupy

— Jacob Greene -

"Authoritarian Populism" and the Wisconsin Recall

— Connor Donegan -

Marching for Life, Water, Dignity

— Marc Becker -

Geopolitical Fetishism and the Case of Afghanistan

— Purnima Bose -

Living Under Occupation

— Rabab Ibrahim Abdulhadi - Samiha Khalil (1923-1999), Resistance Organizer

-

Drug War Capitalism

— Dawn Paley -

Cannonite Bohemians After World War II

— Alan Wald -

Why Music Must Be Revolutionary -- and How It Can Be

— Fred Ho - Reviews

-

Letter on Trayvon Martin

— Christina Reseigh -

Soldiers of Solidarity

— Mike Parker -

Organizing Is About People

— Carl Finamore -

An Unfinished Revolution

— Derrick Morrison -

The Black Panthers in Portland

— Kristian Williams

Dawn Paley

Dawn Paley probes beneath the surface of the drug war in Colombia and Mexico. She explores the mechanisms employed, reports on the economic and human devastation, analyzes the possible reasons for continuing the war and suggests further areas of inquiry. PDF of an extended edition for the web.

IN BOTH THE United States and Canada there have been sustained grassroots efforts to spotlight the unjust mass incarceration and criminalization of poor people, and especially poor people of color, for drug-related arrests. But there has been too little analysis about the reasons behind and mechanisms of this war, and its economic impact on Mexico and beyond.

Even before a withdrawal from Iraq or Afghanistan has been achieved, the United States has become involved in a series of intensifying conflicts taking place from Mexico’s north border through Peru. Governments and mainstream media label it a “war on drugs.” It is important to examine how the expanding “war on drugs” connects to the expansion of transnational corporate control over markets, labor and natural resources.

In Honduras, four Indigenous people were shot and killed in May, when Honduran forces opened fire from a U.S. State Department helicopter, all under the supervision of uniformed U.S. agents. In Mexico — under the guidance of the United States, Canada, Israel and Colombia — the police and army are being transformed.

In Colombia, the war has gone on for decades and involved billions of U.S. dollars, but is being rebranded as a fight against crime. Through the 1980s, the Colombian state became increasingly paramilitarized, a process which “manifested itself as threats, bombings, and selective assassinations or collective massacres of government officials (principally but not exclusively from the left), and of popular political leaders, workers, peasants, professors, human rights activists, and members of nongovernmental organziations.”

U.S. assistance to Colombia in the form of anti-narcotics program funding resulted in the strengthening of paramilitary and unofficial police groups, reported to have patrolled alongside the Colombian Army and involved in the vast majority of massacres and forced displacements in the country.

“Saying that the drug war has failed is to not understand something,” remarked Noam Chomsky in a speech this May. “One must ask oneself what is it that the planners have in mind given the amount of evidence that what they are trying to achieve doesn’t work. What are the probable intentions?”(1)

Chomsky’s comments point to an urgent area of research for activists and journalists wishing to understand today’s drug wars. It is increasingly clear that there is more work to be done in order to properly piece together the reasons for U.S.-led militarization in the Americas.

Reconsidering the so-called drug wars requires — in part — evaluating how they have encouraged the expansion of foreign direct investment and extractive industries in Colombia, Mexico and Central America.

War, When Shocks Aren’t Enough

“This is what the beginning of neoliberalism felt like,” said Raquel Gutiérrez, reflecting on what it is like to try and understand the ongoing war in Mexico. Now a professor at the Autonomous University of Puebla, Raquel was an underground militant in Bolivia in the mid-’80s when the first neoliberal policies took effect there, pauperizing the working class. It’s been 10 years since she’s returned to Mexico.

Raquel pauses and drags on a cigarette, as if trying to remember a language she’s forgotten. It doesn’t come. Then she asks me if I’ve read Naomi Klein’s book The Shock Doctrine. I nod. Silence. “The thing is, in Mexico, the shocks didn’t work,” she says.

It’s not that there was a shortage of shocks. Neoliberal economic policies were first introduced in the form of structural adjustment programs. These ended a period of steady economic growth, import substitution industrialization, and high oil prices known as the Mexican Miracle.

“From 1980 to 1991, Mexico received thirteen structural adjustment loans from the World Bank, more than any other country,” wrote Tom Barry in his 1995 book Zapata’s Revenge. “It also signed six agreements with the IMF, all of which brought increased pressure to liberalize trade and investment.”(2)

In the 1980s, sometimes called the “lost decade,” oil prices collapsed along with the peso. “From over a thousand state enterprises in 1983, the Mexican state owned around two hundred by 1993. In 1991, the Mexican program brought in more money to government coffers (US$9.4 billion) than all other sales of public companies in Latin America combined.”(3) By the end of 1994, Mexico had signed on to the North America Free Trade Agreement, witnessed the Zapatista uprising, and undergone another major currency devaluation.

But by the turn of the 21st century, Mexico’s territory and economy still weren’t fully open to foreign investors. “Regardless of the reforms, the performance of the Mexican economy over the last three decades has not been satisfactory,” read a report released earlier this year by the Mexican Central Bank.(4)

Peasant and Indigenous communities continued to exercise communal title over lands rich in resources. A large middle class owned small businesses, and the richest Mexican families kept control over lucrative sectors of the economy. According to the U.S. State department, Mexico’s 10 richest families “are not the only obstacle to improving competition in the Mexican economy.” Pemex, the 17th largest oil company in the world by oil reseves, remained in state hands.(5)

Something more than an economic shock was in order: a comprehensive strategy proven to increase foreign direct investment. It had to ensure that the local police and army, and eventually the entire legal system, would operate according to U.S. standards. This strategy is colloquially known as the war on drugs.

Since the Nixon presidency, the U.S. government has poured almost a trillion dollars(6) into the “war on drugs” in countries such as Colombia and Afghanistan. Direct links between drug war policies and improving investment climate are revealed through careful examination of U.S. engagement in Colombia from 2000-2006. The strategy has been refined and expanded over the past two decades through experimentation both domestically and internationally.

Economics of the Colombia Model

Plan Colombia was a six-year anti-narcotics program jointly funded by the United States and Colombia. Non-U.S. diplomats claim that the first draft of Plan Colombia was written in English, and later translated to Spanish.(7)

In the 11 years since Plan Colombia was launched, the U.S. government has spent over $3.6 billion on narcotics and law enforcement initiatives. Yet the U.S. government reports that “Colombia remains one of the world’s largest producers and exporters of cocaine, as well as a source country for heroin and marijuana.”(8)

A 2008 U.S. Government Accountability Office (GAO) report on Plan Colombia found that the agreement failed to meet its targets for reducing drug production, with the “estimated flow of cocaine towards the United States from South America” rising from 2000-2006.(9)

Instead of a causing a change in strategy, Plan Colombia’s failure to reduce drug trafficking and production was minimized in favor of an emerging series of metrics linked to security and improving the business environment. Bradford Higgins, U.S. Assistant Secretary for Resource Management, argued, “In many ways, Colombian programs and U.S. support have evolved from our original, more narrow focus into a comprehensive strategy that can now serve as a model to inform efforts in other challenged or failing states.”(10)

Previous U.S. efforts to enforce narcotics-related sanctions on Colombia had negatively impacted U.S. investments. The Council of American Enterprises — an American business consortium in Colombia — reported that in 1996 its member companies lost $875 million in sales because of the sanctions.(11) That same year the State Department reported that the sanctions required the Overseas Private Investment Corporation and the Export-Import Bank to freeze about $1.5 billion in investment credits and loans. This included a $280 million loss to a U.S. company active in Colombia’s oil industry.(12)

According to a report prepared by the Colombian government, the objectives of Plan Colombia are “promoting conditions for employment generation and social stability” and expanding “tariff preferences in compensation for the negative effects of the drug trade and to favor a Free Trade Agreement that will broaden employment opportunities.”(13)

At the outset of Plan Colombia, total Foreign Direct Investment (FDI) was calculated at $2.4 billion.(14) By 2011, Colombia’s FDI stood at $14.4 billion, the fastest growth rate in Latin America.(15) Oil and gas make up an increasingly important portion of FDI, increasing from around one tenth in the mid ‘90s to almost one third by 2010, when it reached $4.3 billion.(16)

A decree passed in 2003 allowed for private investment in Colombia’s oil sector and the partial privatization of formerly state-owned Ecopetrol.(17) As of 2010 FDI in the mining sector (including coal mining) stood at over $2 billion, accounting for more than half of all non-petroleum investment.(18)

In 2008, the United States Agency for International Development (USAID) boasted that “Colombia’s economic takeoff after 2003 did not happen by chance.” Fifty-two areas of Colombia’s economic system were targeted for reform, and under Plan Colombia, “USAID provided technical assistance to the [Government] to help it design and implement policies ranging from fiscal reform to financial sector strengthening to improving the environment for small businesses, and many others.”(19)

This was accomplished through a combination of legal reforms and tax breaks, the signing of new Free Trade Agreements (between Colombia and the United States as well as between Colombia and Canada) and the militarization of the extractive industry. U.S. trained “energy battalions” protected pipelines, roads and other infrastructure.

A 2007 report by the Centre for Strategic and International Studies(20) claimed that Colombia “made a strong recovery…with impressive rates of growth, reduced unemployment, increased levels of investment, expanded trade, lower inflation, and a surge in investor confidence.” These gains, they report, “are closely linked to improved security and, in turn, help create more jobs in the legitimate economy as an alternative to illegal pursuits.”

From the perspective of the U.S. State Department, Plan Colombia is not a failure. Quite the contrary: it has allowed for the creation of an effective new model for U.S. intervention. By 2010 Colombia’s largest foreign investors were Panama and Anguilla (a British Overseas Territory), both tax havens, followed by the United States, England, Canada, Bermuda and Spain.(21)

The language of a “comprehensive strategy,” used to play up Plan Colombia, mirrors the official language of counterinsurgency warfare. “[Counterinsurgency] is an extremely complex form of warfare…. Achieving these aims requires synchronizing the efforts of many nonmilitary and [Host Nation] agencies in a comprehensive approach,” reads the U.S. Military Counterinsurgency Manual, released in 2006.(22)

Even the GAO’s director of international affairs and trade, in testifying before the House of Representatives, stated that “international programs face significant challenges reducing the supply of illegal drugs but support broad US foreign policy objectives.”(23)

But as Gian Carlo Delgado-Ramos and Silvina María Romano have noted, the drug war “strategy is complex and dangerous, since it links a multiplicity of apparently opposed legal and illegal actors who nevertheless receive benefits in the form of increased power or wealth.” At the same time it is clear that “the exploitation of the people and of the nations’ and the region’s resources deepens.”(24)

With this background, let us examine the threads in Mexico.

Applying the Model in Mexico

One Friday in September 2006, just after his disputed election as President, Felipe Calderón and his wife invited Antonio Garza, then U.S. Ambassador and his wife over for dinner. At some point, Calderón told the ambassador that improving security would be a key part of his administration.

When Garza submitted his written recap of the evening to his State Department bosses, he included Calderón’s comment. According to his own notes, the Ambassador replied “Gains on competitiveness, education and employment could be quickly overshadowed by narcotics-related organized crime.”(25) To jump-start Mexico’s economy, “foreigners and Mexicans alike had to be reassured that the rule of law would prevail.”(26)

Barely two months later, Calderón launched the war on drugs in Mexico. The following year, the U.S. and Mexican governments announced the Mérida Initiative, described as “a package of U.S. counterdrug and anticrime assistance for Mexico and Central America.”(27) By the time it was signed by George W. Bush in 2008, Garza’s prodding about cracking down on narcos in order to boost business was forgotten. Instead, the primary justification for lawmakers endorsing the bill was to stem the flow of drugs to the United States.(28)

Both the U.S. government and critics agree that the Mérida Initiative in Mexico and Central America is a refined iteration of Plan Colombia. “We know from the work that the United States has supported in Colombia and now in Mexico that good leadership, proactive investments, and committed partnerships can turn the tide,” Hillary Clinton lectured delegates to the Central America Security Conference in Guatemala City last summer.(29)

Total U.S. funding for the Mérida Initiative between 2008 and 2010 was $1.3 billion for Mexico, whose government matched the funds 13 to 1.(30) Mérida/Central America Regional Security Initiative funds flowing to Central America during the same period stood at $248 million, while the Merida/Caribbean Basin Security Initiative funds of $42 million went to Haiti and the Dominician Republic.(31)

Merida’s “comprehensive strategy” includes funds for training police and soldiers to protect critical infrastructure, militarizing police and outfitting local security forces with U.S. equipment, transforming the Mexican judicial system to a U.S.-style oral trials system, modernizing the U.S.-Mexico border and promoting institutional building and economic reform.

One of USAID’s program goals is that the “Government of Mexico becomes more effective in curbing monopolies and eliminating anticompetitive practices.”(32) They focus on legislation related to telecommunications, banking and energy regulation. Another important objective is to advocate a new regulatory regime and additional privatization, deregulation, and foreign direct investment in the transportation, financial, energy and telecommunications sectors.(33)

Pemex — along with the Federal Electricity Commission — is the crown jewel of the privatization effort. Many prominent Mexicans, including Enrique Peña Nieto, the Institutional Revolutionary Party (PRI) candidate and frontrunner in the 2012 presidential elections, have advocated its privatization. Some, like the head of the Mexican Stock Exchange, have proposed using as their model Colombia’s oil sector reform.(34)

In a March 2012 presentation, a Bank of Mexico representative talked about the pending reform agenda for the country’s central bank. This includes improving the ease with which companies can do business in Mexico, removing “legal obstacles,” preventing labor flexibility, “strengthening the rule of law,” and consolidating macroeconomic policies.(35)

In 2008, before the financial crisis spread to Mexico, FDI reached $23.2 billion but fell the following year to $11.4 billion.(36) However FDI has rebounded and by 2011 stood at $19.43 billion, primarily in the manufacturing sector (44.1%) followed by financial services (18%) and mining (8%).(37) Recent announcements indicate that there will be a surge of new investment in auto and aerospace manufacturing in central Mexico.

Mexico’s Finance Minister Bruno Ferrari told Bloomberg in an English interview in August 2011 that “Nowadays what we are seeing is that we are having a big fight against crime so that, as I said, [it] guarantees the future investments and the investments we are having right now because what we are seeing is that Mexico is fighting to prevail against crime.”(38)

Ferrari’s statement is backed up by the experiences of the transnational business elite. According to a 2009 Business Week cover story,(39) attacks on foreign staff and factories have been rare in Juárez and other border towns along drug-trafficking routes, including Reynosa, Nuevo Laredo, and Tijuana.

Police are already deployed with special instructions to care for transnational corporations. Following the kidnapping of a corporate executive, the police suggested managers alter their work routines, leave Juárez by sundown, and stick to two key roads. Patrols were beefed up along these roads, “creating relatively safe corridors between the border and the industrial parks.”(40)

Even more important is another kind of security transnational corporations need. As the director of the Economic Commission for Latin America and the Caribbean underscored, “What is important for an investor in regards to security has to do with legal security and country risk.”(41)

This notion of “security” calls up the Colombia model: paramilitarization in the service of capital. This model includes the formation of paramilitary death squads, the displacement of civilian populations, and an increase in violence. In the commercial sector, it is workers, small businesses and a sector of the local elite who are hit hardest by drug war policies.

Though these non-official aspects of the war on drugs are sometimes presented as damaging or threatening foreign direct investment, in fact it is violence that controls workers and displaces land-based communities from territories of interest to transnational corporate expansion.

Underside of the Colombian Model

For generations, Indigenous and peasant communities in Colombia had defended their collective title to their lands, yet paramilitary groups effectively forced them to flee. This phenomenon is concisely described by David Maher and Andrew Thompson:

“…paramilitary forces continue to advance a process of capital accumulation through the forced displacement of communities in areas of economic importance. Large sections of Colombia’s citizenry continue to abandon their lands as they are forcibly displaced from their homes, satisfying the voracious appetite of foreign (mainly U.S.) multinational corporations (MNCs) for Colombian territory as the neo-liberal economic programme is further entrenched in Colombian society.”(42)

In 2001, paramilitaries were responsible for half of all forced displacements in Colombia. Guerrilla groups caused 20% of the cases, with paramilitaries and guerrillas together for another 22%.(43) “Paramilitary groups not only bear the bulk of the responsibility, they are also more effective in instigating displacement.”(44)

In Colombia, paramilitarization is also beneficial to transnational corporations wishing to dissuade labor organizing:

“As part of the protracted U.S.-supported counterinsurgency campaign, paramilitary–state violence continues to systematically target civil groups, such as trade union organisations, which are considered a threat to the political and economic ‘stability’ conducive to the neo-liberal development of Colombia. This has made Colombia very attractive to foreign investment as poor working conditions and low wages keep pro?t margins high.”(45)

Well-documented cases of Chiquita Brands, Drummond mining corporation, and BP, the oil giant, have traced the links between paramilitary groups and U.S. and transnational corporations.(46) In March of 2007, representatives of Chiquita Brands pled guilty in a Washington, D.C. court to making payments to the Autodefensas Unidas de Colombia (AUC) paramilitaries.(47)

“Chiquita made over 100 payments to the AUC amounting to over $1.7 million,” according to the U.S. Department of Justice. “Chiquita Brands paid blood money to terrorists like Carlos Castaño to protect its financial interests,” according to the law firm representing the victims.

The Experience (So Far)

Direct collusion between U.S. and transnational corporations and paramilitaries is generally difficult to prove — and when evidence emerges it is not likely to be discovered quickly.

But already we know that a group of Texas companies are accused of colluding with the Zetas to illegally import stolen fuel.(48) (The Zetas were the armed wing of the Gulf Cartel, which is active in northeast Mexico. The two groups split in 2010, and since then the Zetas have essentially become a narco-paramilitary group, though they are often referred to in the media as a drug cartel.)

“The Zetas are a paramilitary force,” Dr. William Robinson, author of A Theory of Global Capitalism, told me when I interviewed him last summer: “Basically it’s the creation of paramilitarism alongside formal militarization, which is a Colombian model.”

The Zetas are active in various parts of Mexico, particularly Tamaulipas, Nuevo Leon and Veracruz, and they are also blamed for massacres in the state of Jalisco and Petén, Guatemala. Although they are not the only paramilitary group in Mexico, they are the group that receives by far the most media attention.

“We need to keep in mind that Colombian President Santos, like [Guatemalan President Otto] Pérez Molina, wants to expand Plan Colombia, which doesn’t just mean strengthening the fight against narcotrafficking, but actually means converting it into a form of paramilitarism in order to generate a new kind of counterinsurgency, not against social movements, but against indigenous communities,” said Maximo Ba Tiul, a Mayan Poqomchi analyst and professor based in Guatemala.

While there is a hesitation on the part of journalists to link their coverage of the “drug war” with struggles around natural resources, there is a growing list of places where this theme — and the lessons from the U.S. war in Colombia — can be further explored.

• Residents of Ciudad Mier, a small community in Tamaulipas, left en masse because of paramilitary violence. The town sits on top of Mexico’s largest gas field, as does a large portion of the violence-ridden state.

• In the Juárez Valley, considered the most dangerous place in Mexico, killings and threats have forced many to leave, just as a new border crossing between the U.S. and Mexico is being constructed.

• In Santa Maria Ostula, a small Indigenous Nahuatl community in coastal Mexico, at least 28 people have been killed (and four others disappeared) by paramilitary and state violence since 2009. Their territory is in a mineral rich and strategically located area.

• In the Sierra Madre mountain range in northern Mexico, Canadian mining companies operate in areas where even government officials fear to enter because of the presence of armed narcotraffickers.

• In Petén, Guatemala, government officials militarized the area and declared a state of emergency because of the presence of Zetas that lasted eight months, ending in early 2012. Recent announcements indicate that a new oil rush is taking place in the same region.

Paramilitarization can also impact local, regional and even national capitalists connected to the domestic economy, forcing them to close their shops and businesses. This, in turn, opens up space for transnational corporations and investors to gain access to sectors of the economy previously dominated by local capitalists.

“The businesses that are most affected by the violence are the smallest and those that are located in the states of northern Mexico,” writes Guadalupe Correa Cabrera, a professor at the University of Texas in Brownsville. “The lack of security hurts small and medium producers, businesses and vendors to a larger degree, due to the fact that organized crime has ‘a higher ease of penetration with them than with the directors of large companies, which, in many cases, operate from outside the country.’”(49)

According to COPARMEX, a Mexican business association, 160,000 businesses closed because of insecurity during 2011.(50) “There is a reconversion of the economy taking place at the national level that is favoring [large companies], and it is making more [Mexicans] into employees instead of entrepreneurs,” said Correa Cabrera during a presentation in Baja California Sur in February.

Precedents in Colombia and ongoing events elsewhere suggest possible areas for deepening the research in order to better ascertain to what extent Mexico and Central America are being subjected to a model whereby as David Maher and Andrew Thomson report, paramilitary terror “…continues to be instrumental in the creation and maintenance of conditions, such as low labour costs and access to land, which are conducive to the expansion of the neo-liberal programme…”(51)

Increased study and research of the new economic policies encouraged through U.S. anti-narcotics policy could help reveal the full extent of the economic transformation that has been initiated in Mexico and Central America.

Upcoming elections in Mexico promise no relief from the horror and violence of the war, which will most likely carry on for at least another six years. “All the presidential hopefuls propose to continue or intensify the war against the gangsters,” reads a recent piece in The Economist.(52)

Without a better understanding, discussions about the war in Mexico could remain contained within the rhetoric of drug prohibition versus liberalization. This kind of debate is wholly inaccurate as a means of denouncing and mobilizing resistance to a “war on drugs” that may be better understood as being about increased social and territorial control over lands and people, in the interest of capitalist expansion.

Notes

- La Jornada. “‘Fracaso de lucha antinarco es intencional’, asegura Chomsky.” May 13, 2012. Retrieved May 14, 2012 from: http://www.diario.com.mx/notas.php?f=2012/05/13&id=31c61357e326f44eaad52d40dac06e74.

back to text - Barry, Tom. Zapata’s Revenge. South End Press, 1995. pp. 43.

back to text - Teichman, Judith. Privatization and political change in Mexico. Pittsburgh: University of Pittsburgh, Digital Research Library. 2009-12-22. Retrieved March 10, 2012 from http://digital.library.pitt.edu/cgi-bin/t/text/text-idx?idno=31735055592376;view=toc;c=pittpress.

back to text - Sánchez González, Manuel. “Economía Mexicana: Una mirada de largo plazo.” Banco de México. March 8, 2012. Retrieved March 20, 2012 from: http://www.banxico.org.mx/publicaciones-y-discursos/discursos-y-presentaciones/presentaciones/%7B694E563B-9721-B4A2-3023-D914148CCC91%7D.pdf p. 24.

back to text - Petro Strategies Inc. “World’s Largest Oil and Gas Companies.” Retrieved May 10, 2012 from: http://www.petrostrategies.org/Links/worlds_largest_oil_and_gas_companies.htm.

back to text - Robert J. Bunker (2011): “Grand strategic overview: epochal change and new realities for the United States.” Small Wars & Insurgencies, 22:5, 736.

back to text - Chomsky, Noam. “Plan Colombia.” Excerpted from Rogue States. Retrieved March 17, 2012 from: http://www.chomsky.info/books/roguestates08.htm.

back to text - Just the Facts. “Grant Aid to Colombia through International Narcotics Control and Law Enforcement.” Retrieved March 17, 2012 from: http://justf.org/Program_Detail?program=International_Narcotics_Control_and_Law_Enforcement&country=Colombia. BUREAU OF INTERNATIONAL NARCOTICS AND LAW ENFORCEMENT AFFAIRS. “2012 INCSR: Country Reports – Colombia.” March 7, 2012. Retrieved March 9, 2012 from: http://www.state.gov/j/inl/rls/nrcrpt/2012/vol1/184098.htm#Colombia.

back to text - United States Government Accountability Office. “ PLAN COLOMBIA: Drug Reduction Goals Were Not Fully Met, but Security Has Improved; US Agencies Need More Detailed Plans for Reducing Assistance.” October 2008. Retrieved March 9, 2012 from: http://www.gao.gov/new.items/d0971.pdf p. 17.

back to text - United States Government Accountability Office. “PLAN COLOMBIA: Drug Reduction Goals Were Not Fully Met, but Security Has Improved; US Agencies Need More Detailed Plans for Reducing Assistance.” October 2008. Retrieved March 9, 2012 from: http://www.gao.gov/new.items/d0971.pdf p. 90.

back to text - United States General Accounting Office. “DRUG CONTROL: US Counternarcotics Efforts in Colombia Face Continuing Challenges.” February 1998. Retrieved March 13, 2012 from: http://www.gao.gov/archive/1998/ns98060.pdf p. 6.

back to text - United States General Accounting Office. “DRUG CONTROL: US Counternarcotics Efforts in Colombia Face Continuing Challenges.” February 1998. Retrieved March 13, 2012 from: http://www.gao.gov/archive/1998/ns98060.pdf p. 28.

back to text - National Planning Department of Colombia, Department of Security and Justice of Colombia. “Plan Colombia Progress Report, 1999-2005.” September 2006. Retrieved April 7, 2012 from: http://www.dnp.gov.co/Portals/0/archivos/documentos/DJS/DJS_Documentos_Publicaciones/bal_plan_Col_ingles_final.pdf (pp. 9).

back to text - Banco de la Republica. “FLUJO DE INVERSION EXTRANJERA DIRECTA (IED) EN COLOMBIA – BALANZA DE PAGOS.” 2011. Retrieved March 20, 2012 from: http://www.banrep.gov.co/economia/flujos/C2Flujo_Paises_2007.xls.

back to text - Gordon, Julie. “PDAC-Colombia to award mining concessions gradually.” Reuters. March 5, 2012. Retrieved March 17, 2012 from: http://www.reuters.com/article/2012/03/05/canada-mining-pdac-colombia-idUSL2E8E57EP20120305.

back to text - Banco de la Republica. “FLUJOS DE INVERSION EXTRANJERA DIRECTA EN COLOMBIA SEGÚN ACTIVIDAD ECONOMICA – BALANZA DE PAGOS.” 2011. Retrieved March 20, 2012 from: http://www.banrep.gov.co/economia/flujos/C1flujoinv.xls. The Economist. “Gushers and Guns.” The Economist. March 17, 2012. Retrieved March 20, 2012 from: http://www.economist.com/node/21550304.

back to text - Ecopetrol. “Perspectiva histórica.” Retrieved May 14, 2012 from: http://www.ecopetrol.com.co/contenido.aspx?catID=32&conID=36271.

back to text - Banco de la Republica. “FLUJOS DE INVERSION EXTRANJERA DIRECTA EN COLOMBIA SEGÚN ACTIVIDAD ECONOMICA – BALANZA DE PAGOS.” 2011. Retrieved March 20, 2012 from: http://www.banrep.gov.co/economia/flujos/C1flujoinv.xls.

back to text - United States Government Accountability Office. “ PLAN COLOMBIA: Drug Reduction Goals Were Not Fully Met, but Security Has Improved; US Agencies Need More Detailed Plans for Reducing Assistance.” October 2008. Retrieved March 9, 2012 from: http://www.gao.gov/new.items/d0971.pdf p. 101.

back to text - DeShazo, Peter, et al. “Back from the Brink evaluating Progress in Colombia, 1999–2007.” Centre for International and Strategic Studies. November, 2007. Retrieved March 11, 2012 from: http://csis.org/files/media/csis/pubs/071112-backfromthebrink-web.pdf.

back to text - Banco de la Republica. “FLUJO DE INVERSION EXTRANJERA DIRECTA (IED) EN COLOMBIA – BALANZA DE PAGOS.” 2011. Retrieved March 20, 2012 from: http://www.banrep.gov.co/economia/flujos/C2Flujo_Paises_2007.xls.

- Department of the Army. “Counterinsurgency.” FM 3-24, MCWP 3-33.5. December, 2006. Retrieved May 11, 2012 from: http://www.fas.org/irp/doddir/army/fm3-24.pdf (p. 1-28).

back to text - Ford, Jess T. “DRUG CONTROL: International programs face significant challenges reducing the supply of illegal drugs but support broad US foreign policy objectives.” Testimony Before the Subcommittee on Domestic Policy, Committee on Oversight and Government Reform, House of Representatives. July 21, 2012. Retrieved March 11, 2012 from: http://www.gao.gov/products/GAO-10-921T.

back to text - Delgado-Ramos, Gian Carlo, Romano, Silvina María “Political-Economic Factors in U.S. Foreign Policy: The Colombia Plan, the Mérida Initiative, and the Obama Administration” 2011 38: 93 Latin American Perspectives. pp. 94.

back to text - Embassy Mexico. “Ambassador’s Private Dinner With President-elect Calderon.” September 29, 2006. Retrieved March 9, 2012 from: http://cablegatesearch.net/cable.php?id=06MEXICO5607#para-4964.

back to text - Embassy Mexico. “Ambassador’s Private Dinner With President-elect Calderon.” September 29, 2006. Retrieved March 9, 2012 from: http://cablegatesearch.net/cable.php?id=06MEXICO5607#para-4964-1.

back to text - Seelke, Clare R. “Mérida Initiative for Mexico and Central America: Funding and Policy Issue.” Congressional Research Service. April 19, 2010. Retrieved March 9, 2012 from: http://fpc.state.gov/documents/organization/141560.pdf.

back to text - “The drug crisis facing the United States remains a significant national security threat,” reads the first congressional finding in the Merida Initiative. Cited in: 110th Congress (2007-2008). “Merida Initiative to Combat Illicit Narcotics and Reduce Organized Crime Authorization Act of 2008 (Referred in Senate – RFS).” H.R.6028. SEC. 101. FINDINGS. Retrieved March 9, 2012 from: http://www.gpo.gov/fdsys/pkg/BILLS-110hr6028rfs/pdf/BILLS-110hr6028rfs.pdf.

back to text - Clinton, Hillary R. “ Remarks at the Central American Security Conference (SICA).” June 22, 2011. Retrieved March 9, 2012 from: http://www.state.gov/secretary/rm/2011/06/166733.htm.

back to text - Voice of America. “Merida’s New Direction.” March 3, 2012. Retrieved March 9, 2012 from: http://www.voanews.com/policy/editorials/MERIDAS-NEW-DIRECTION-141416863.html (This represents a far better ability on the part of the US to leverage Mexican funds as compared to the Colombian commitment under Plan Colombia, which was closer to 2 to 1). See: National Planning Department of Colombia, Department of Security and Justice of Colombia, pp. 9.

back to text - Seelke, Clare R. “Mérida Initiative for Mexico and Central America: Funding and Policy Issue.” Congressional Research Service. April 19, 2010. Retrieved March 9, 2012 from: http://fpc.state.gov/documents/organization/141560.pdf p. 2.

back to text - US AID Mission to Mexico. “Competitiveness program – 2nd quarter FY 2010.” (January-March 2010). Retrieved May 11, 2012 from: http://pdf.usaid.gov/pdf_docs/PDACR720.pdf.

back to text - Lara Monroy, Magdalena, Ed. “ACCIONES CRUCIALES en competencia y regulación.” Centro de Investigación para el Desarrollo, A.C. 2011. Retrieved May 12, 2012 from: http://accionescruciales.cidac.org/documentos/acciones.pdf.

back to text - Férnandez, Diana. “PEMEX can be more competitive.” April 2, 2012. Retrieved May 14, 2012 from: http://eng.fundsamericas.com/news/business/8845/PEMEX-can-be-more-competitive.

back to text - Sánchez González, Manuel. “Economía Mexicana: Una mirada de largo plazo.” Banco de México. March 8, 2012. Retrieved March 20, 2012 from: http://www.banxico.org.mx/publicaciones-y-discursos/discursos-y-presentaciones/presentaciones/%7B694E563B-9721-B4A2-3023-D914148CCC91%7D.pdf p. 22.

back to text - Lange, Jason. “Mexico sees 2010 FDI bouncing back.” Reuters. Retrieved May 14, 2012 from: http://www.reuters.com/article/2010/05/04/us-latam-summit-mexico-investment-idUSTRE64351D20100504.

back to text - COMISIÓN NACIONAL DE INVERSIONES EXTRANJERAS. “INFORME ESTADÍSTICO SOBRE EL COMPORTAMIENTO DE LA INVERSIÓN EXTRANJERA DIRECTA EN MÉXICO.”(Enero–diciembre de 2011). Retrieved May 14, 2012 from: http://www.economia.gob.mx/files/comunidad_negocios/comision_nacional/Informe_2011_IV.pdf.

back to text - Bloomberg. “Mexico’s Ferrari on Foreign Investment, Economy.” August 22, 2011. Retrieved March 13, 2012 from: http://www.bloomberg.com/video/74229052/ (19:45 – his comments were made in English.)

back to text - Engardio, P., Smith, G. “The Other Mexico: A Wave of Investment.” Businessweek. April 9, 2009. Retrieved March 19, 2012 from: http://www.businessweek.com/magazine/content/09_16/b4127034232864.htm.

back to text - Smith, G. “Doing Business in Harm’s Way.” Businessweek. April 9, 2009. Retrieved March 19, 2012 from http://www.businessweek.com/magazine/content/09_16/b4127034241721.htm.

back to text - Cited in: Duff, Devon, Rygler, Jen. “Drug Trafficking, Violence and Mexico’s Economic Future.” Knowledge@Wharton. January 26, 2011. Retrieved April 7, 2012 from: http://knowledge.wharton.upenn.edu/article.cfm?articleid=2695.

back to text - Maher, David, Thomson, Andrew. “The terror that underpins the ‘peace’: the political economy of Colombia’s paramilitary demobilisation process.” Critical Studies on Terrorism, 4:1. (2011). pp. 96.

back to text - Ibánez, A., Vélez, C. “Civil Conflict and Forced Migration: The Micro Determinants and Welfare Losses of Displacement in Colombia.” World Development, Vol. 36, No. 4, 2008. pp. 661.

back to text - Ibánez, A., Vélez, C. “Civil Conflict and Forced Migration: The Micro Determinants and Welfare Losses of Displacement in Colombia.” World Development, Vol. 36, No. 4, 2008. pp. 661.

back to text - Maher, David, Thomson, Andrew. “The terror that underpins the ‘peace’: the political economy of Colombia’s paramilitary demobilisation process.” Critical Studies on Terrorism, 4:1. (2011). pp. 96.

back to text - National Security Archive. “The Chiquita Papers.” April 7, 2011. Retrieved May 14, 2012 from: http://www.gwu.edu/~nsarchiv/NSAEBB/NSAEBB340/index.htm.

back to text - U.S. Department of Justice. “Chiquita Brands International Pleads Guilty to Making Payments to a Designated Terrorist Organization And Agrees to Pay $25 Million Fine.” March 19, 2007. Retrieved June 4, 2012 from: http://www.justice.gov/opa/pr/2007/March/07_nsd_161.html.

back to text - Paley, Dawn. “Gulf of Mexico Agreement: Increased Oil Cooperation in a Time of?War.” Upside Down World. February 25, 2012. Retrieved May 14, 2012 from: http://upsidedownworld.org/main/mexico-archives-79/3477-gulf-of-mexico-agreement-increased-oil-cooperation-in-a-time-of-war.

back to text - Correa Cabrera, Guadalupe. “Flujos de Inversión, Desarrollo Empresarial y Seguridad en México: Las Empresas Mexicanas y Extranjeras en un Entorno Violento.” 1er Congreso Internacional: Gestión y Administración Empresarial para el Siglo 21. February 2012. P. 18-19

back to text - Desigaud, A. “No más retórica: soluciones concretas a la inseguridad.” Señal Coparmex 120. April 3, 2012. Retrieved April 8, 2012 from: http://www.coparmex.org.mx/upload/SC_0120_AED_Inseguridad_al_alza.doc.

back to text - Maher, David, Thomson, Andrew. “The terror that underpins the ‘peace’: the political economy of Colombia’s paramilitary demobilisation process.” Critical Studies on Terrorism, 4:1. (2011). pp. 103.

back to text - The Economist. “Mexico’s Drug War: Storm Clouds with Silver Linings.” The Economist. May 19, 2012. Retrieved June 15, 2012 from: http://www.economist.com/node/21555593.

back to text

.

July/August 2012, ATC 159

Cross-posted to brechtforum.org/economywatch