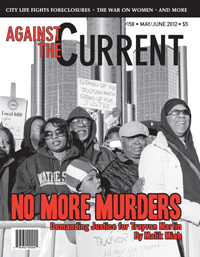

Against the Current, No. 158, May/June 2012

-

What Choice in 2012?

— The Editors -

The Murder of Trayvon Martin

— Malik Miah -

The War on Women--And Us All

— The Editors -

The Takeover of Motor City

— Dianne Feeley -

Campaigning for A Millionaires Tax

— Bill Balderston and Claudette Begin -

"Occupy Everywhere"

— James Clark -

Resistance After Foreclosure

— Dave Burt -

A Diversion We Don't Need

— Kevin Laird -

Egypt's Year of Revolution

— an interview with Carl Finamore -

Portuguese Workers vs. Austerity

— Joana Mortágua -

Perspectives on Putin's Russia

— Alexei Gusev -

Flag, Fetish and Illusory Community

— Bertell Ollman - Reviews

-

A Wisconsin Idea Resurgent

— Allen Ruff -

Melting Into Air?

— Sheila Cohen -

Power and Pitfalls of Historical Fiction

— Mavuso Dingani -

Building Identify Through Struggle

— Charlie Post -

Looking Back and Forward at Cuba

— Frank Thompson - In Memoriam

-

Remembering David Montgomery

— Alice Kessler-Harris

Bill Balderston and Claudette Begin

IN FEBRUARY 2012, the California Federation of Teachers (CFT) launched a simple, clear initiative to raise taxes on Californians with incomes greater than $1,000,000 per year. The folding of this campaign for the California Funding Restoration Act of 2012, better known as the Millionaires Tax (MT), following a compromise with the governor, has been felt as a seismic shock for many activists in California.

The following account will attempt to assess both the particulars of the significant effort around this initiative, which went beyond simply an electoral project, and the broader context of progressive taxation organizing, the meaning of such revenue-generating measures for a transformative political program, and its interface with the rise of radical populism both on the right and left (including the varied manifestations of the Occupy movement).

Taxation in a Regressive Era

Efforts at making corporations and the rich pay a larger share of California state revenues have a significant history over the last three decades. Obviously, the point of reference for taxation politics in California goes back to the infamous Jarvis-Gann Initiative of 1978. Popularly referred to as Proposition 13, it not only recalculated how home and business properties were assessed (significantly decreasing property taxes over the long term), but also established a super-majority requirement (two-thirds) for the passage of any state or local taxation from that point on.

The most obvious fiscal impact of this “taxpayer revolt” was the beginning of a long-term decline in revenues for California. This has combined with the loss of other state income and an incredibly regressive tax system to create an annual budget “crisis,” often bringing the state to the brink of halting payments for its social programs and the salaries of state workers for months while finalizing its budget.

Attempts to redress this structural problem took varied forms. One major effort was around protecting funds for K-14 public education (including community colleges). This also took the initiative route with the passage of Proposition 98 in 1988.

Prop 98 guaranteed approximately 60% of the California budget going to K-14 and was consistent with the Serrano v. Priest case, which mandated state funding for the public schools at an relatively equalized level for all students. Ironically, this was the last time that the California Teachers Association (CTA) — now one of the main actors in blocking the MT — would organize for a successful initiative in which they were a prime mover.

But California did not suffer only from Proposition 13. A massive reduction in taxation, especially of progressive taxes, started nationally with the Reagan years, where the ratio between spending cuts and tax increases was three to one; all this a strategy to justify massive slashing of social programs. This filtered down to states like California, where the top tax bracket was reduced from 11% of income in 1993 to 9.3%; meanwhile, the top one percent’s share of state income rose from 8% in 1980 to 23% in 2009.

Similarly, corporate taxes contributed 15% of the state budget in 1980 and only 11% by 2009. In the previous 15 years, $12 billion in annual tax cuts was given to mainly wealthy individuals and families as well as corporations. In addition, California has the only political body in the world that does not tax oil taken from the ground (an interesting contrast with Sarah Palin’s Alaska).

In order to meet growing deficits, the state has increasingly turned to bonds (whose value is more and more questionable). The difficulty was especially aggravated by the phony state energy crisis of the late 1990s, for which we are still paying. In 2010, California faced a $26 billion deficit, even while the top fifty-seven corporations in the state had over $1.1 trillion in revenues.

There were other sporadic efforts to address this regressive direction. The California Tax Reform Association (CTRA), an organization founded in 1976 to advocate for tax justice, helped launch a campaign in the 1990s for a “split roll” tax, which would reassess commercial property and tax it at a higher rate. This nearly won, garnering over 48% of the vote, despite having been organized on a shoestring budget.

The aforementioned California Teachers Association also launched an effort in 2005, for public education and child services funding. This was cynically withdrawn before submitting the petitions, in a maneuver to limit corporate funding for a number of regressive ballot measures backed by then governor Arnold Schwarzenegger.

While there are other possible measures such as restoration of the vehicle license fee, the repeal of which cost the state $5 billion a year, as well as a significant raise in income taxes on the top bracket, there is general agreement that the primary fiscal measure to resolve the budget deficits would be the “split roll,” which could also lead to a campaign to significantly alter the 1978 Prop 13 language.

The Meaning of Tax Reform

Many radicals, including large numbers of Occupy activists, see tax reform measures as purely adapting to the capitalist system. Such taxation was undoubtedly central to social democratic programs in Europe and elsewhere, especially in the post-war period, helping to fund a wide range of social welfare services, job creation and industrial policy. Even in the United States, progressive taxation was considered essential to political projects from the New Deal years to those of the “Great Society.”

But as federal spending took on growing debt from wars and interventions in the 1960s and the rate of profit began its long-term decline in the 1970s, such redistributive demands took on a more radical thrust, as in Dr. Martin Luther King, Jr’s organizing of the “Poor Peoples Campaign.” In our era of neoliberalism, such demands not only address the massive inequalities created by this assault on the wages and standard of living of working people and the slashing of the social wage and programs, but also take on ideological importance.

One of the primary ways the pseudo-populist right and its corporate backers (most recently in its Tea Party manifestation) has rallied middle income and even working people to its banners has been around the “tax rebellion” (in which the Jarvis-Gann initiative played a pioneering role). This has been linked to labeling government programs as wasteful and only of value to the most destitute, usually a racial stereotype. Thus, the call for progressive taxation must be linked to priorities for programs addressing the education, housing, health, transportation and environmental needs of working people.

The Rise of the Millionaires Tax

The most recent efforts have arisen in the context of a new aggressiveness by activists, and even confidence in the general working public, largely generated by various manifestations of the Occupy movement. Such redistributive demands can well be seen as a rallying cry to force “the one percent” to “bail out” the 99%, after financial institutions received at least $3.5 trillion in federal taxpayer funds — and even to put the forces of corporate power on the defensive.

Early in 2011, a variety of organizations such as the CTRA and ACCE (Alliance of Californians for Community Empowerment, the former ACORN), along with unions including AFSCME and locals of SEIU, began agitating around a renewed effort to launch a new progressive tax initiative.

Even CTA, after cuts in public education of well over $20 billion in the last two years, began calling for “tax fairness” and advocated both a split roll and an increase on income tax for the top one percent.

The California Nurses Association (CNA) was also demanding corporate taxation (a financial transfer tax) albeit at the national level, with their “Main Street, Not Wall Street” campaign. But it was the California Federation of Teachers (CFT), especially the head of their Communications Department, Fred Glass, who most consistently educated and organized around such tax measures.

There had also been a number of local activities in the Bay Area leading up to the launch of a state campaign, including a Labor Notes workshop, a conference of local union leaders for progressive taxation sponsored by the San Francisco Central Labor Council (which has an economic justice committee that works on such efforts in an ongoing way), a tax justice conference in October called by University of California graduate students and community organizations, and finally a Tax the Rich conference in November, built over many months and backed mainly by one union (the Oakland Education Association, a local within CTA) and the Alameda Central Labor Council.

But these latter efforts were increasingly eclipsed by a coalition effort launched earlier by the CFT and a variety of community-based organizations connected with the largely southern Californian grouping “California Calls” and the Courage Campaign. There was considerable hope that a petition-gathering effort could be launched by late October 2011, but negotiations were bogged down over the language of the initiative, especially whether it would simply be a restoration of a previous 1% cut of state income tax on the top 1% of incomes.

The final language was readied by November, proposing a 3% rate increase on those with incomes over $1 million and 5% on incomes over $2 million — thus the name Millionaires Tax (MT), with no one earning less than that sum paying an additional penny). This was projected to generate from $6 to $9.5 billion in revenues, designated for a variety of social programs, infrastructure and public safety as well as all levels of public education, including state universities. One controversial stipulation was that these funds would be channeled directly through counties and school districts, not through the state general budget.

But there was already another tax initiative, launched by Governor Jerry Brown, starting with a 1% increase for those making $500,000 and over, up to 2% on those making over $1 million. This was combined with a half percent increase in the state sales tax — currently at 7.25%, the highest in the nation. In addition, the Brown proposition would generate fewer monies than the MT and would “sunset” in four years, while the MT had no expiration.

Still another tax initiative, launched by wealthy lawyer Molly Munger, ironically would raise more more funds ($10 billion) but would be accomplished by raising income tax rates even on those earning as little as $7000 per year, and would be used exclusively for K-12 and early childhood education.

The real problem with the Brown initiative was that it was linked at the hip with the governor’s budget proposal, which includes half a billion dollar cuts in MediCAL and in CALWorks (providing some jobs funding for the poorest of the unemployed) as well as $200 million cuts for both the University of California and California State University systems, as well as prioritizing debt reduction over social spending.

Yet the leadership of the CTA, despite significant opposition from the union’s urban locals, consistently supported the Brown measure because, in their reasoning, it partially protected the Prop 98 monies. But much of the support for Brown’s initiative came from corporate sources such as Occidental Petroleum and the California Hospital Association, as well as Native American gambling interests.

This leads to the question of political forces. The MT was built around not only the CFT and the broad community coalitions mentioned earlier, but also ACCE and potential input from the affiliates of PICO (Pacific Institute for Community Organizing), which has over a hundred thousand members. But key to the organizing strategy was including major statewide unions beyond the CTA, especially SEIU and CNA.

Unfortunately, conservative elements of SEIU, especially United Healthcare Workers West, outvoted more progressive locals at their state council in December and shifted their previous support for the MT to the Brown initiative. CNA finally came on board for the MT in early February, but it soon it became evident they were not about to mobilize or provide resources. The MT CFT coalition marshaled strength from the repeated polls indicating mass support for the MT, outshining the governor’s initiative.

Despite the problems, campus activists, both staff and students, rallied to the cause of the MT (as well as a proposed oil severance tax). This activist momentum was largely built through Occupy Education NorCal as well as a similar coalition in southern California, and a statewide grouping named Refund California organized around campus unions, especially the graduate student UAW 2865 as well as the Union of Professional and Technical Employees (UPTE).

These forces staged actions on March 1st and 5th (in Sacramento, drawing 10,000) around opposition to the cuts in higher education and for the progressive tax initiatives. While not identical to other components of Occupy, the MT campaign had a distinct connection with Occupy as well as many other campus, community and political groups such as the Richmond Progressive Alliance. A number of Central Labor Councils, smaller unions and even CTA locals were supportive. The campaign was gaining momentum and daily there were polling results and press articles reflecting the growth of support.

But on March 14th came a public announcement from the CFT and some other campaign partners that a new “compromise” measure was to replace the MT. The decision was attributed to lack of funds and inadequate organizing (though over 400,000 signatures of the million needed had been collected). This turn of events shocked much of the left, especially radical labor and student activists.

Collapse and the Balance Sheet

The “compromise” proposition was the result of negotiations with Brown and others in the Democratic Party leadership. Its advocates noted that it “improved” the original Brown initiative, increasing the tax rate on those earning more than $1 million to 3% and reducing the sales tax component to a 0.25% increase. Also noted was that 85% of revenues would come from the highest income brackets, the longevity of the tax would be extended to seven years, and the measure would now generate $8-9 billion (up from the original $4.8-6.9 billion).

Days before the compromise was announced, the CNA and SEIU put out major media attacks on the Millionaires Tax. The visible support from the student mobilizations in Sacramento, however, had given MT a boost.

There is a sense not only of betrayal over the closed-door process of making the decision for the “compromise,” but of a loss of a major organizing moment linked to the Occupy movement and broad anti-corporate sentiment. Following the Sacramento education mobilization, there was a palpable sense that a movement could be built around this initiative. It could have served as a plebiscite against the 1%.

Even the immediate struggle to halt many of the most onerous budget cuts, and to build up to an effort to achieve the split-roll property tax, is now severely weakened.

Although the “compromise” is connected to the horrific state budget, many labor groups have quickly embraced it as the only way to avoid even more horrendous cutbacks. The governor attempting to draw in the mass support indicated by repeated CFT polls, has labeled his compromise as the New Millionaires Tax. The student movement, however, has not expressed such support, disillusioned with the demise of the original MT referendum.

As Adam Hefty, member of UAW Local 2865 and graduate student Occupy/education activist at UC Santa Cruz remarked,

“The Millionaires Tax campaign was beginning to be a rallying point for Occupy activists, the student movement, teachers and union members concerned with the state’s multi-year fiscal crisis. While it wouldn’t have solved everything, it would have changed the conversation from one of shared sacrifice to one of progressive taxation. The compromise measure, which now looks to be on the ballot, is an improvement over Governor Brown’s original measure, but it has serious flaws and won’t evoke the same kind of movement enthusiasm there was for the Millionaires Tax. My guess is that a lot of people will vote for it as the best measure available to staunch the bleeding, but the project of building a coalition that can challenge the rule of the 1% in California politics remains for another day.”

In agreeing to the compromise, the Governor pledged a significant paid campaign to make sure the measure got on the ballot, paying an unprecedented $3 per signature. As we go to press the New Millionaires Tax seems certain to qualify.

Regardless of the electoral results, one must understand that there is a divide between those who simply see such efforts (even one as bold as the MT) as linear, incremental advances versus those who seek structural, qualitative change. This is not to beat up on the CFT for advancing and largely financing the MT effort, but largely to challenge the socialist left on how to strategize and organize around a campaign that had transitional potential.

A large part of the balance sheet must once again point to the organic links between the Democratic Party and the labor bureaucracy. While the CTA and SEIU behavior was most worthy of criticism in this case, these links remain a problem for any project rooted in the political independence of working-class forces. Supporters of the original Millionaires Tax will continue to look for opportunities to mobilize around the issue. Those devoted to such redistributive demands will not give up.

May/June 2012, ATC 158