Against the Current, No. 69, July/August 1997

-

The Republicrats' Phony Budget War

— The Editors -

The Los Angeles Bus Riders Union

— Scott Miller -

The Consumer Price Index "Reform"

— James Petras -

Britain's "New Labour"

— Harry Brighouse -

Woman-Centered, Activist Agendas

— Deborah L. Billings -

The Remaking of the Congo

— B. Skanthakumar -

The Roots of the Rebellion

— B. Skanthakumar -

Kabila's Friends

— B. Skanthakumar -

Mobutu's Loot and the Congo's Debt

— B. Skanthakumar -

Humanitarian Intervention

— B. Skanthakumar -

The AFDL and Its Program

— B. Skanthakumar -

Mining Congo's Wealth

— B. Skanthakumar -

Pornography, Violence and Women-Hating

— Ann E. Menasche interviews Diana Russell -

The Rebel Girl: Looking at the Gender Grid

— Catherine Sameh -

Random Shots: Fables of Bill and the Newt

— R.F. Kampfer - Exploitation and Upsurge

-

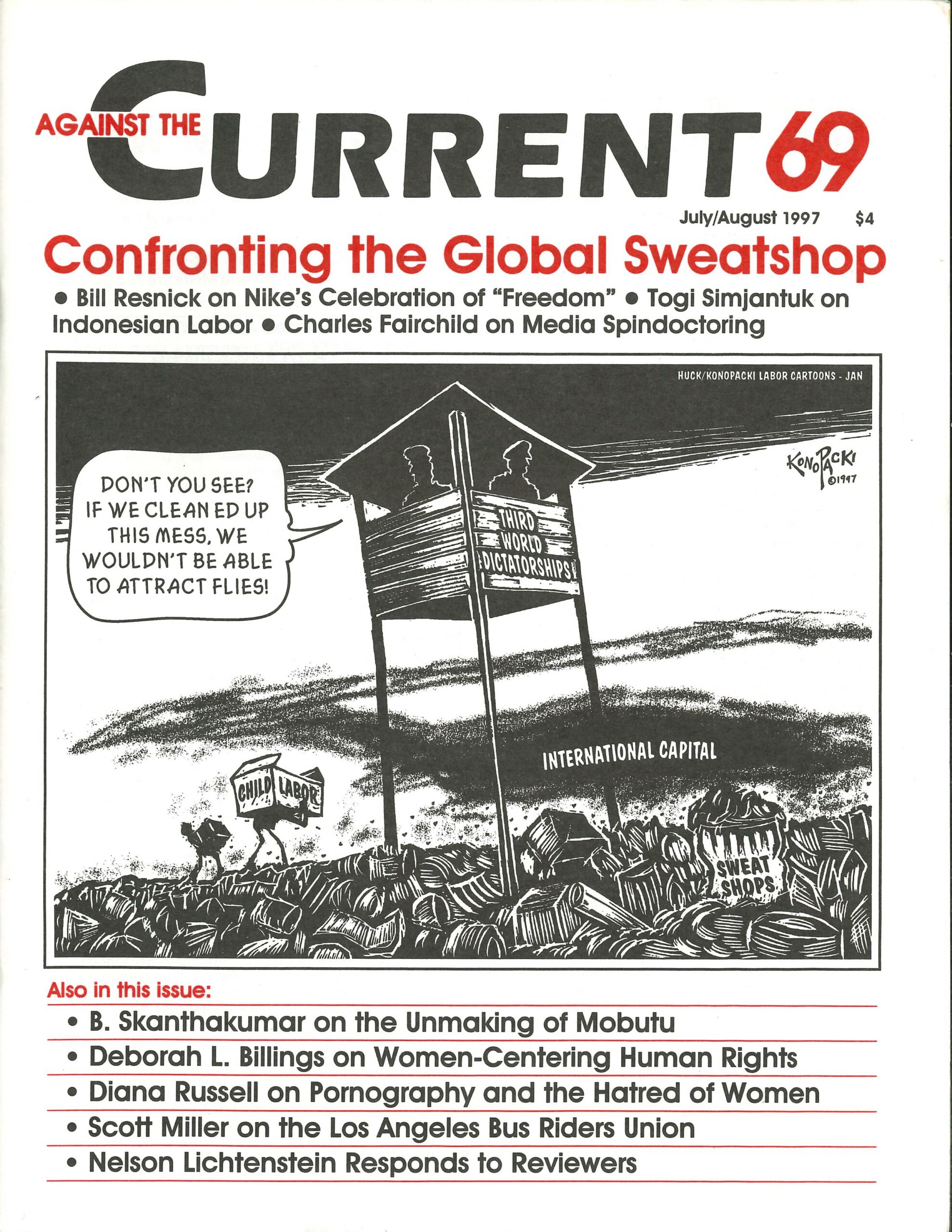

Global Sweatshops' Media Spin Doctors

— Charles Fairchild -

Socialism or Nike

— Bill Resnick -

Indonesia's New Social Upsurge

— Togi Simanjuntak -

Fellow Workers, Fight On!

— interview with Muchtar Pakpahan - Reviews

-

Asian American Incorporation or Insurgency?

— Tim Libretti - Dialogue

-

A Response to Reviewers

— Nelson Lichtenstein - In Memoriam

-

Albert Shanker, Image and Reality

— Marian Swerdlow and Kit Adam Wainer

B. Skanthakumar

Cobalt, copper, diamonds, oil and zinc are mined in Zaire and historically the mining companies have played an important political role. As early as the 1920s it was predicted that the region would become a more powerful industrial complex than Johannesburg. Instead it has become an archipelago of rusty plants and “hit-and-run” mines.

Mining production has slumped in recent years because of the deteriorating political and economic situation and the collapse of the rural infrastructure. In some cases mine production is one-tenth of what it was in the 1950s. The violence and breakdown of civil administration encouraged mines to hire FAZ units as private guards. And much of the Congo’s mineral wealth has been smuggled across borders.

Part of the military strategy of the AFDL was to capture the mining concessions and starve the Mobutu regime of foreign exchange. The AFDL made clear that it didn’t recognize previous agreements, which had been sealed with commissions and bribes to Mobutu. They invited the companies to bid again for their concessions. What the companies sought, and received, were assurances that their investments would not be expropriated by the AFDL, that the regime-to-be would guarantee stability for investment.

Well before Mobutu fell, planeloads of mining executives were meeting with AFDL leaders. An interesting trend is that Belgian and French mining companies — as well as the South African giant, Anglo American. and its sibling De Beers — appear to be losing ground to upstart arrivistes from North America. The Belgian concern Union Miniere is remembered for its use of forced labor, involuntary resettlement and torture during the colonial period. Other companies are associated with the Mobutu era and blamed for financing his dictatorship.

The US/Canadian company American Mineral Fields (AMFI), based in Bill Clinton’s home state of Arkansas, signed a US$1 billion contract with the AFDL on April 16 (a month before the end of the war) for exclusive exploration rights for zinc, copper and cobalt in Shaba province. It also has a diamonds exploration permit in Kasai. An AMFI director loaned his private Lear jet to Kabila during the military campaign.

Other important players include the Canadian firm Barrick Gold Corporation, whose directors include ex- U.S. President George Bush, ex- Canadian Prime Minister Brian Mulroney and ex- CIA Director Richard Helms. There are fortunes that will be made in the Congo, but little of it looks set to be enjoyed by its people.

However attractive it sounds, nationalization is simply not a short- term option. The harsh reality is that with the purchase, distribution and sales monopoly which, for example, De Beers has in the diamond trade, no country can alone successfully aim to eject transnational corporations and then expect to find export markets abroad. It would be ostracized from international markets and face credit restrictions and tremendous political pressures. The relationship of forces internationally makes this a risky proposition.

But the state has considerable leverage through its mining arm Gecamines and should use it to improve its bargaining power with the mining companies. For instance, royalties and other taxes could be increased and the sums invested in training local people to manage the mines and operate cleaner technologies.

The communities in whose midst these mines are found need decent homes, schools, health clinics and infrastructure. Their natural environment, land and resource use patterns must not be sacrificed to unrestrained mineral exploitation as at present. All of these advances can be made and the ground prepared for future struggles.