Against the Current, No. 38, May/June 1992

-

The Crime of the Centuries

— The Editors -

The Democrats' Wasteland

— Peter Drucker -

1992: A Palestinian View

— Yasmin Adib -

Reproductive Justice for All

— Ron Daniels -

Why I'm Supporting Ron Daniels

— Sabrina Virgo -

The Rebel Girl: Dow Bows, FDA Applauds

— Catherine Sameh -

South Africa: Towards Grassroots Socialism

— Patrick Bond -

Letter to the Editor

— Val Moghadam, Helsinki, Finland -

Letter to the Editor

— Dave Linn, Berkeley, CA - Globalization and Resistance

-

Peru: A People Under Siege

— Socialist Challenge -

Our Roots, Our Revolution

— Hugo Blanco -

Random Shots: The Revolution Looks Forward

— R.F. Kampfer - Globalization and Resistance

-

A Hawaiian Activist's Fight

— Nancy Holmstrom interviews Haunani-Kay Trask -

Guatemalan Women: Organizing Under the Gun

— Deborah J. Yashar -

Native American Struggles Today

— Jennifer Viereck - Reflections on Socialism After the USSR

-

Nationalism at the End-of-Century

— Michael Lowy -

The Future of Marxism

— The Editors -

Privatization and Russian Workers

— Milton Fisk -

Socialism Is Not Stalinism

— Suzi Weissman interviews Mansoor Hekmat -

Worker-Communist Party of Iran

— Mansoor Hekmat and others -

End of Stalinism, Beginning of Marxism

— Hillel H. Ticktin - Dialogue

-

Before Stalinism (a continuing symposium)

— The Editors -

Rejoinder: Revolutionary as Conservative

— Tim Wohlforth -

Of Lenin and Leninism

— Bernard Rosen - Reviews

-

The Politics of Affirmative Action

— Aaron Brenner

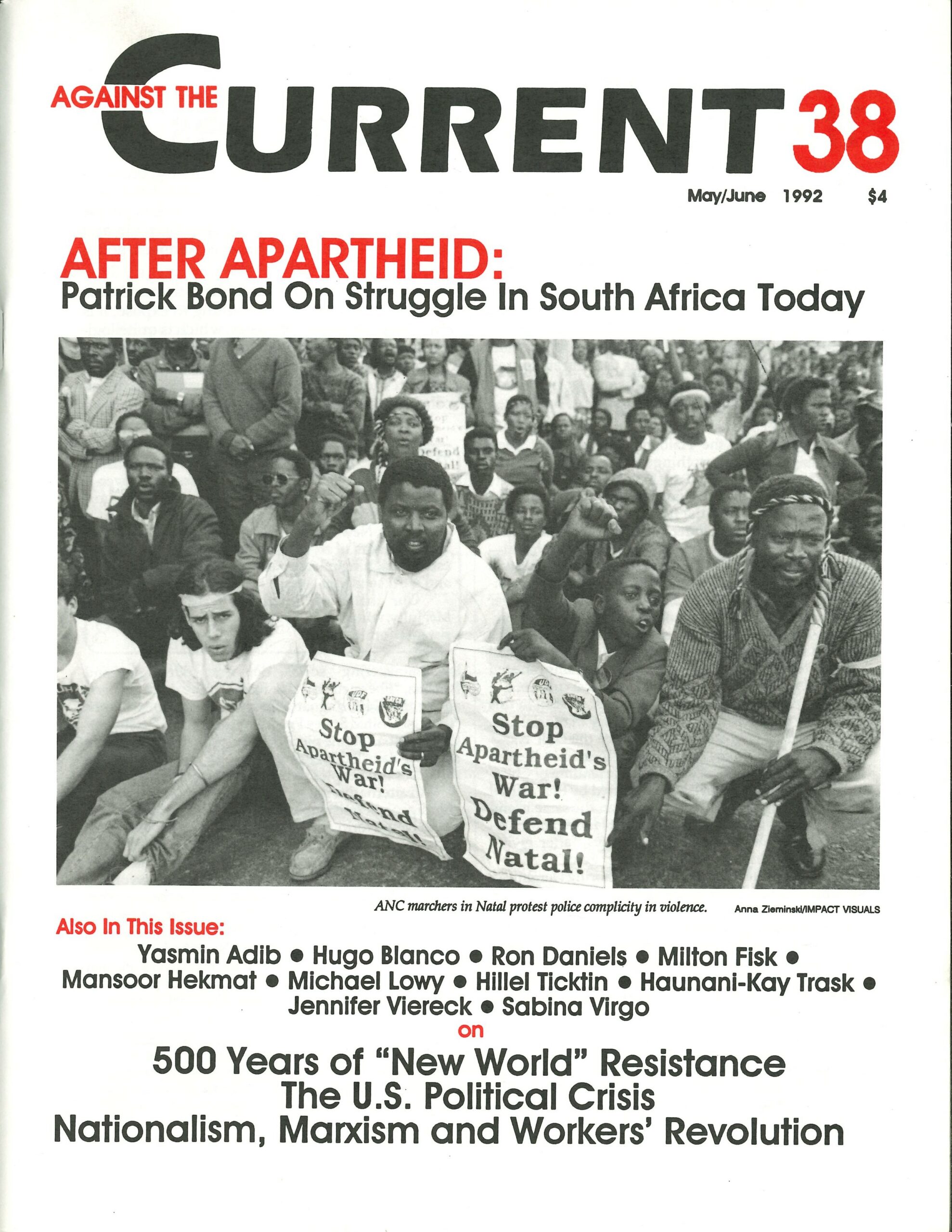

Patrick Bond

IT IS DEFINITELY NOT time to give up on South Africa; neither to put it safely to bed as a nation whose peoples’ drive for democracy will soon be satisfied, nor to downplay the prospects for socialist transformation, even as withering compromises with the capitalist state and international capital are reported daily. No, South Africa is alive with radical ideas and prospects.

You know this if you listen, for example, to the political discourse of the enemy. They’re worried. Top Johannesburg bankers gradually learn to utter “comrade” when appropriate. Industrial relations gurus prattle on about the benefits of a non-racial shopfloor cooperation–to the extent (in even the racist bastion of Pietersburg) of permitting workers to fire supervisors. And state bureaucrats in Pretoria actually speak of “empowerment” and sustainable development for impoverished black communities.

Of course, if you spend time in a Soweto shebeen (bar) with African National Congress (ANC) members and sympathizers, you will gather that traditional movement Freedom Charter discourse, “the [wealth of South Africa] shall be shared by all,” seems also to be going by the wayside under the weight of centrism. Yet the mass democratic movement’s shift from explicit Freedom Charter objectives (such as widespread nationalization) to implicit realpolitik processes (such as local-level negotiations) may not represent quite as obvious a decay of traditional progressive values as those on the far left and the soft middle might sometimes have outsiders believe.

Notwithstanding the formation in December of a new antinegotiations front–combining the Pan Africanist Congress (PAC), Azanian Peoples Organization and some smaller left groupings–it is clearer by the hour that previous forms of struggle against the system, which sustained so many valiant activists under adverse conditions, must now give way to new approaches.

This is even more true in the wake of the landslide 68% pro-reform vote in the March 17 whites-only referendum, whose primary practical effect was to raise the white middle classes’ expectations that black militants are putty in the hands of F.W. de Klerk. That outcome reflects de Klerk’s amoral appeal to white economic self-interest, and definitely not to the idea that apartheid was a crime against humanity. And if de Klerk cannot control the masses and their demands for economic justice, the whites’ expectation is that Nelson Mandela will.

In contrast, the big problem for most left activists is maintaining a sense of organizational coherence, direction and vision under the weight of several competing strategic options.

There are practical problems, of course, too obvious to bear reminder–but official hit squads, torture, kidnapping, police harassment, Inkatha’s proto-fascism, so many forms of capitalist exploitation and degradation, and widespread brute racism must never be underestimated in their capacity to dull human ambitions. On the other hand, there is also the deep, inspiring, and often mighty rumble of mass action, summoned and realized all too infrequently by the nationalist liberation movement leadership. And there are splendid moments when cross-cultural, cross-class and even cross-gender encounters of activists point to a left-wing synthesis that will continue its struggle within the struggle.

The warmest moments of this sort confirm the faith in internationalism which a number of us (mainly white) “U.S. Americans,” largely educated by mid-1980s ANC-dominated student divestment politics, bring to solidarity work here. Our debt to the South African liberation struggle goes without saying. For now, it is the sense of optimism about future possibilities–and for some of us, a growing comfort in delving into and beyond the limits of African nationalism for the first time–making South Africa exceptionally fulfilling during, and hopefully after, the phase of political transition.

Perspectives on Change

The biggest interpretive problem is identifying the muddy boundaries between the politics of negotiation, and old-fashioned collusion with an enemy that sometimes won’t or can’t deliver the goods. These are the boundaries which will probably demarcate the capacity for a revival of the socialist project in South Africa. Edging towards and beyond the boundaries of what is feasible, and doing so in a manner that weakens the state and capital, strengthens grassroots organization and develops mass consciousness, is a task that today occupies many a movement strategist.

It is precisely this sort of muddy boundary that must be considered with the utmost caution, looking first at the objective conditions under which such engagements occur, second at the roots–not merely symptoms–of the problems, and then at the prospects for something different.

These subjects relate rather explicitly to the role of the U.S. anti-apartheid movement now and in coming years, and in that sense also require a more strategic input from the U.S. side. In Washington D.C. last autumn, I witnessed a meeting of national anti-apartheid strategists with a key ANC leader. “Nothing has changed in South Africa,” said Walter Sisulu. “You must keep doing your work as before.”

But of course with regard to sanctions everything had indeed changed, and the U.S. strategists glanced at each other, fittingly dubious. The next day a conference began at Notre Dame at which ANC shadow foreign minister Thabo Mbeki encouraged post-apartheid investment by U.S.-based transnational corporations.

There is, no question, a transition underway, but transition to what? The ANC has led a valiant attack on apartheid, whose demise as a formal philosophy and juridical system is certain. Beyond that, though, lies what could be a very long struggle indeed for full political democracy and socio-economic equality. Consider at least three broad strategic perspectives. (Omitted here are those of the PAC and Black Consciousness Movement, which are racked by internal ideological commotion and external posturing, with no coherent approach to transformation yet evident.)

First, readers may have noted recent accounts by well-respected correspondents in Socialist Review (Robert Paul Wolff) and In These Times (Craig Charney) which suggest social democracy is a most likely, and appropriate, outcome.(1) Even aside from the oft-reported predilections of key movement leadership–especially those around Thabo Mbeki–this could conceivably be a valid perspective given a) the failure of “guerillaism” and associated maximalist positions of the 1980s; b) the enormous international pressures toward this compromise outcome; and c) the nature of the well-developed state (which is not about to be smashed by revolution) and its present and future tendency to “clientelism,” favoritism toward selected groups.

In this camp can be found the 25,000-strong South African Communist Party (SACP). While apparently split internally along at least three fault lines (old Stalinist, old syndicalist or “workerist,” and post-Marxist), the SACP has reaffirmed, on paper anyway, the principles of Marxism-Leninism and dropped the proposed prefix “democratic” from “socialist” in its most recent manifesto–and yet still remains explicitly gradualist, a minor parrot of the ANC on most substantive issues.

Second, in quite vigorous opposition to the social-democratic perspective, there are active (if somewhat sectarian) revolutionaries in several left formations. Within the ANC are the Marxist Workers Tendency (aligned to the British Labor Party’s beleaguered Militant Tendency) and Workers International League of South Africa; and outside the ANC, Workers Organization for Socialist Action (influenced by the Fourth International), the Cape-based New Unity Movement, and International Socialists of South Africa (affiliated to Britain’s Socialist Workers Party).

“Insurrection” is their general clarion call, attractive indeed given the brute conditions of daily life, although without a great deal of strategic subtlety at this stage. (None of the groups have yet broken the 1,000 mem<->ber barrier.) Many of those who posit the opportunity for a far more insurrectionary politics acknowledge it will come after the <169>period of the nationalists,<170> which by some accounts must be suffered through for a decade or more. What hope for radical socio-economic change in the short and medium term, then?

There is emerging, third, a fairly coherent activist line that derives from a class-conscious appropriation of the much-abused notion of “civil society.” This position has an internal logic arising from the nature of the current crisis and the particularities of South Africa’s own struggle for social and racial justice, but it has something in common with social movement politics in other places.

The Objective Conditions

The principal short-term challenge facing enlightened state bureaucrats and neo-liberal capitalists is whether the “social contract” they now desperately seek with the liberation movement, big labor and the urban civic movement can actually be established and maintained in the context of debilitating economic downturn.

The current three-year recession here is the longest-running in the industrial world, and an even worse picture emerges for coming years due to the universally acknowledged need to “restructure” the economy. Perhaps only Eastern Europe faces a more comprehensive rationalization of plant and equipment in order to gear up for the world market. It is not an easy process to manage, as the orthodox Finance Minister, Barend du Plessis, is learning.

The two-day, 3.5 million worker stayaway last November was targeted at du Plessis’ hated tax scheme (the details of which were designed by the International Monetary Fund). The strike paralyzed South Africa and disproved corporate allegations that the Congress of South African

Trade Unions (COSATU) federation was a paper tiger.

Union leader Jay Naidoo used the opportunity to call for an “Economic Negotiating Forum” involving the progressive forces, state and capital, to parallel the crucial political negotiations (“Convention for a Democratic South Africa,” or CODESA). Meanwhile, however, the recession continues. Recent reports of even more financial hemorrhaging from various parts of the country give a flavor of the objective conditions which any sort of restructuring agreement would face.

For instance, during a December strike wave, several thousand mine workers were laid off in the coalfields of the Eastern Transvaal, not to be rehired. The country’s major denim producer, in Natal, shut its doors for good. Another finance house in speculative Cape Town went belly-up. Battles over protection of the Western Cape’s textile sector from cheap foreign imports intensified. Tens of thousands of jobs are to be cut in the auto and auto parts industries in the Eastern Cape in the near term, with even deeper rationalization required by the mid-1990s.

Across South Africa, fixed manufacturing investment continues to decline radically from even very weak levels of a year ago. Construction work is down 21%, and machinery and equipment sales are off 11%. To top it off, in the third quarter of 1991, company bankruptcies jumped 45% from 1990 levels. An estimated 1,400 workers lose their jobs every day, most in the industrial heartland of the Southern Transvaal. Unemployment is at least 40%, and inflation-adjusted wages are declining for those who are formally employed.

Inflation recently reached a frightening level of 17% due to new tax-related price increases, while interest rates are among the world’s highest, and savings remain at historic lows. More than three-quarters of the rural population are technically below the poverty line.

Ironically, over the past three years while fixed capital stock declined and state investment in township housing ground to a halt, the Johannesburg Stock Exchange was the fastest growing major exchange in the world (thanks to exchange controls which have trapped capital in the country). In a structural sense, we see what James Petras (ATC 34) describes as the “neo-liberal counterrevolution and ascendancy of speculative-finance capital … The survival and reproduction of fictitious capital depends not on healthy, educated workers–as was the case under industrial capitalism–but through their continual and deepening marginalization.”

If this combination of parasitical economy and social immiseration continues to provide the backdrop for power-sharing talks, there would not appear much chance of success. While a slight upturn may occur in late 1992, prospects are even gloomier unless radical changes are made. Top Johannesburg stockbrokers Hayes Cutten & Co. predict “civil war and fragmentation” spreading in South Africa over the next couple of years, largely because of the difficulty in coming to a political resolution under these conditions. Only a firmer gold price–due to higher world inflation, and possible political transitions in the United States and Britain–will offer economic relief, say the stockbrokers.

Responding to the threat that a new South Africa might be built upon the proverbial sand of a wasting economic base, State President F.W. de Klerk recently launched a public appeal for new business investment. But, business leaders ask, why invest in stagnant South Africa? A decade ago, the major car companies sold 300,000 vehicles–this year 200,000 sales were considered a near-miracle.

The giant Anglo American Corporation responded within days to de Klerk–but with another widely publicized foreign investment through its off-shore subsidiary Minorco (already one of the largest foreign companies operating in the United States). Even after buying British-based ICI’s lime mining operation–and nearly $1 billion worth of Portuguese, German and Canadian mining (and Austrian paper mills and Irish metals) in the past eighteen months–South Africa’s biggest conglomerate still has $1.75 billion earmarked for new Minorco acquisitions. Anglo’s sister De Beers continues to tighten its grip on the world diamond cartel, from Russia to Botswana and everywhere in between.(2)

To end financial sanctions once and for all, de Klerk hopes for the much-discussed solution of an interim coalition, a National Party-ANC-Inkatha government later in 1992. If the local corporations spurn their home markets, however, what hope is there for new investments from transnational corporations such as those represented at the Notre Dame conference? The looming predicament is that such investments could amount, in the end, merely to acquisitions of existing firms, with little scope for actually building new factories or retooling with new equipment.

In contrast, during the 1950s and ’60s, transnationals flooded into South Africa with new plants to take advantage of cheap black labor and a captive white consumer market protected by high tariffs. In the 1990s, if South Africa moves back into the world economy with gusto (or borrows massively from the IMF), as the Finance Ministry and big business desire, then those barriers will have to fall, under the whip of the General Agreement on Tariffs and Trade. In addition, South Africa’s labor movement remains the world’s most militant; wages here are far higher than in Southeast Asia.

Yet there is presently a surge of foreign interest in banking, and U.S. activists should note this carefully. Trips to Europe last year by de Klerk and du Plessis raised the specter of new foreign loans, as German banks led the way with DM200 million. According to top corporate consultant Clair Herbst, “There are thirty-two banks interested in setting up branches for trade-related loans. But the big unknowns are the violence and what sort of political settlement will emerge.”

If this is to be an export-oriented upturn, as the establishment believes is absolutely necessary, the world economy remains just as unknown–and formidable–a short-term variable. The past decade was a disaster for South African merchandise trade, both for absolute levels of exports, and because of declining terms of trade. (Thanks to stifled imports, however, South Africa managed to run a positive trade balance during the late 1980s.)

Can trade improve quickly enough to provide the immediate economic space that short-term political negotiations may require to succeed? Notwithstanding the lifting of most trade sanctions, the answer is probably not, with the United States into a second “dip” of its downturn, and the mighty Japanese economy preparing for recession this year.

Even if trade were to pick up slightly, Pretoria still has rather tenuous relations with the world economy, and as a result, repaying the foreign debt will again be a challenge this year (although not as bad as 1991, when South Africa forked out $4.85 billion). In 1992, $1.44 billion must repaid, but 1993 offers the prospect of another major debt rescheduling unless South Africa can raise $7.33 billion.

Once the ANC has formally taken over the full reins of government, it may be just as easy to reconsider the $19 billion in total outstanding foreign loans. As a new ANC handbook on banking and finance suggests: “Morally, it could be argued that this debt, used to bolster apartheid, should be used to assist economic reconstruction in South Africa.”(3)

No matter how the foreign debt picture is resolved, South Africa’s financiers are expressing even deeper concern about the domestic situation. A crash of the overvalued stock market is not impossible, acknowledges the chief executive of a major bank, Nedbank.

Moreover, the financiers’ speculative real estate investments are increasingly sickly. As is the case nearly throughout the world, Johannesburg and Cape Town corporate headquarters buildings now appear hugely overbuilt. Vacancy rates are so high that Anglo American’s property company is offering rent-free periods and other incentives to new tenants, and the other giant financiers–Old Mutual, Sanlam, and Liberty Life–are moving in the same direction.

Both the CODESA political negotiations and an Economic Negotiating Forum will, no doubt, try to assuage the qualms of local and international investors, but given these conditions the outcome remains very much in question.

The Roots of the Crisis

To put this barrage of economic skepticism in context, and to help develop a rigorous program of action, let us step back to reconsider crisis theory. Why, after all, has the recent economic crisis led South African capital and the state to jettison apartheid?

The dominant framework of left intellectuals here is the “regulation theory” approach imported from France by COSATU’S “Economic Trends” group of mainly university-based consultants. Stephen Gelb, Mike Morris, Vishnu Padayachee and others have produced major papers and a book (South Africa’s Economic Crisis, Cape Town: David Philip, 1991), which define the South African economic crisis in terms of the contradictions inherent in “racial Fordism” (the idea was recently reviewed, glowingly, by DSA’s Democratic Left).

The argument, simply, is that the racially-defined “articulation” of white mass consumption and black mass production which made South Africa among the most profitable capitalist settings during the 1950s and 1960s, broke down in the 1970s. From 1974, growth began declining noticeably. Reasons cited for this are varied, but while liberals typically blame statist apartheid inefficiencies, Gelb and the regulationists suggest the causes of decline include intensified worker militancy and rising wage demands, the changing role of gold in the world economy, and the transmission to South Africa of the international slump. Restoring the conditions for profitability, Gelb argues, will entail “wage restraint” in addition to a new mode of regulating the economy.

In a recent New Left Review, ATC editor Robert Brenner and Mark Glick forcefully negated the analytical framework and the concessionary politics implicit in regulation theory.(4) The theory’s application to South Africa is just as problematic. For example, a classical Marxist economist based at the University of Natal, Charles Meth, queries arguments about the roots of crisis which “lay a large portion of the `blame’ on `apartheid’ and much of the rest of it on the `unreasonable’ (politically motivated) wage claims of the workers.”

Regulation theory’s focus on institutional aspects of the apartheid economy distracts attention from deeper crisis tendencies that continue to manifest themselves even as formal racial policies are withdrawn.

The crisis is therefore better conceived as a standard dilemma of overaccumulation of capital, beginning even prior to the 1974 slump. There was too much investment in luxury consumer goods in relation to capital goods and to the size of the local market, and with increased automation in the early 1970s the rate of profit fell inexorably. Countervailing tendencies (the search for absolute and relative surplus value, speedup of the turnover time of capital, etc.) have only exacerbated the crisis, and set the stage for social conflict that will not easily be alleviated.

In turn, these contradictions shape the progressive responses to the current set of objective conditions. For example, with the demise of formal influx control (the “Pass Laws”), apartheid geography is being reorganized, in ways that correspond much more to the logic of the market and that leave those lacking financial resources without access to cities. This is illustrated well by African access to housing credit during the last half of the 1980s, as banks and building societies (the equivalent of S&Ls) invested $2 billion in township mortgages (here called “bonds”). This was enough to saturate only the top ten percent of the market–those who could afford new houses costing in excess of $15,000 (smaller loans are administratively too costly).(5)

As a result of playing lightning rod for the deeper crisis, the financial markets were themselves becoming a nexus of both power and vulnerability by the late 1980s. Stock market shares and real estate speculation delinked from the productive economy. Banks and insurance companies increasingly controlled the contours of development, but from an ever-shakier capital base (South African banks are among the world’s most overextended). Over the past decade, outstanding bank loans have nearly doubled in relation to Gross Domestic Product. Yet reflecting an official return to monetarist ideology and the might of anti-apartheid financial sanctions, nominal interest rates soared from 12.5% in 1988 to 21% (then 6% in real terms) in 1989.

As argued below, the nature of these crisis tendencies affected strategies of popular resistance in important ways. At the point of production, meanwhile, clear tendencies are emerging that herald the split of the industrial working class. According to the establishment’s chosen export-oriented growth trajectory, a privileged upper sliver of manufacturing workers will labor over new high-tech capital goods imported from Europe. Given continuing local stagnation (and the need to cut back domestic production even further to restore profitability), their output will be sent into the global economy in search of mythical market niches.

For the unemployed, there is no hope of entering the formal sector in the near future. Women and children face a dual cruelty, lacking relations to the formal economy while entrepreneurial prospects fade in the ever poorer townships. Even the much-heralded black commuter taxi industry is stricken with overcompetition and indebtedness. Economists predict of those formally employed workers who currently produce textiles, chemicals, automobiles, etc. for local consumption, between a third and a half will probably lose their jobs when the competitive pinch of the world market is felt.

In sum, the devaluation of overaccumulated capital is still ahead, and this makes for arduous circumstances in which to stitch together a “post-Fordist” growth strategy and social contract compromise. However, there are also responses already emerging from the grassroots which correspond to the sorts of conditions imposed by apartheid capitalism in crisis.

From Analysis to Politics

James Petras’ prescription for direct action movements has relevance for South Africa: “Movements on the left face an unprecedented opportunity and challenge–to insert themselves in the gap between the neo-liberal electoral class and the abstentionist alienated majority, creating through the movements organizations of political power to control territory, factories, community services and land.” (ATC 34)

There is already a portentous move to locally-controlled development in South Africa, even if it will likely take an election or two and bitter disappointments before the majority begin to abstain from what might well become neo-liberal politics (in Zimbabwe, elections in 1980 and 1985 witnessed more than 90% participation; in 1990 just 53%). But it is no secret that there are already rifts between formal ANC organs and the grassroots. These might widen, depending on how the next few months of political negotiations shape up.

In negotiations over the next weeks, the ANC and its allies aim to win an interim government as soon as possible, which would set the stage for a “constituent assembly” (an elected forum convened to draw up the next constitution) before the end of 1993, and formal democratic elections in 1994. The regime, on the other hand, wants a coalition government that would co-opt the ANC into obscure cabinet ministries along with Inkatha and the (white liberal) Democratic Party, and possibly even parties to the right including black bantustan parties. (At this writing, the white right wing has boycotted CODESA, and the PAC/AZAPO/left walkout seems permanent.)

The effect of the state strategy would be the ANC taking “joint responsibility” for administering a still-not-dead apartheid framework (and all the repression that entails), with the prospects of a new constitution developed internally by the interim government (not a constituent assembly), and a full election in another ten years.

It is in this conflict of vision that real material power will be tested, and that the ANC could stumble, possibly disastrously. It is here, too, where imperialism will enter with enormous incentives to establish neo-colonialism, such as the $5 billion Rockefeller Bank, and billions in World Bank loans.

However, the dangers of the situation are well understood by movement leaders. According to the ANC’s Trevor Manuel, “The ANC cannot accept an interim constitution without danger of losing the international sanctions weapon.” In large part because of ANC ambivalence and mixed signals, that weapon is now reduced to financial sanctions. Nevertheless, the continued stamina of existing financial sanctions, in a context in which foreign debt repayments put a significant squeeze on domestic growth, remains significant.

This was illustrated in 1991 by U.S. anti-apartheid activists. Trading in Johannesburg Stock Exchange (JSE) shares by at least two major U.S. banks–JP Morgan (the leader of the $1 billion industry) and Security Pacific–was halted through sanctions pressure applied mainly by the Amalgamated Clothing and Textile Workers Union. In what is the most interesting twist yet on sanctions, the ANC gained international condemnation from capital and mouthpieces like the Financial Times during a 1991 tussle with JP Morgan. (Morgan was a founder of Anglo American Corporation in 1917, and maintains two representatives in South Africa.)

In the wake of the JSE trading embarrassment, the huge New York bank was anxious to package a safe South African loan with potential public relations value. Morgan encouraged a state-linked development agency, run by a sophisticated liberal Afrikaner, to solicit support from ANC President Nelson Mandela and General Secretary Cyril Ramaphosa.

Initially, the two unwittingly signed on to what would have been a $100 million loan, purportedly for education funding. With the foreign input costs of education next to nothing, the (U.S. dollar) loan made bad economic sense. More importantly, it would have been the key break in financial sanctions. Pretoria made no secret that the Morgan loan would be followed by many more which will be necessary to meet payments next year’s huge foreign interest repayment bill.

Fortunately, after three disconcerting ANC policy reversals–and with firm encouragement from U.S. and British anti-apartheid forces–the loan was squashed last November. The implications for Pretoria’s next round of foreign bond offerings are not yet clear, but with heightened political tension and the worker stayaway, de Klerk’s glee at regaining access to international financial markets may turn out to be premature.6

The key political lesson is that if the ANC has a chance of gaining power through negotiations, certain strategies that can exploit the South African capitalist state’s most serious vulnerabilities must be maintained. To the degree that it will be necessary to apply those strategies again in 1992, U.S. activists must continue to be vigilant. A great deal of trade continues to be financed by major banks in U.S. cities, which still could be (and should be) cut off in line with ANC financial sanctions policy.

The Promise of Civil Society

What lessons are there for grassroots resistance and the construction of a political economic power base, which will continue the struggle against post-apartheid capitalism? Is there a translation from economic crisis to local political action that takes advantage of the system’s vulnerabilities with such sophistication?

The answer appears to be yes, in view of an important ideological development here. “Civil society” is now the watchword of many on the left who view the post-apartheid state with apprehension. Across the continent, the lessons of clientelist African nationalism at the helm of the neo-colonial state, especially in relation to repression of trade unions, peasants, squatters and students, are well known.

The problem is to maintain a class-conscious perspective on this overused phrase, which has also been colonized by conservative forces hostile to any social welfarist form of state power. The worst outcome for South Africa, and not an unlikely one, could be a state denuded of redistributive functions but with policing powers intact.

On the other hand, a radical version of civil society takes on added meaning when considering the plight of the black townships. If the current crisis is one whose most fundamental characteristic will entail further divisions of privileged workers from the vast majority of poor people, then strengthening the unity of poor and working people is logically one vital aspect of resistance.

There are countless examples of this unity, mainly drawn from community struggles, since apartheid has had the effect of segregating and constraining, within the townships, the organic intellectuals who might otherwise have turned to a petty-bourgeois existence away from the residential location of the majority. As a result, in most townships there is a strong leadership actively debating and workshopping the pros and cons of their own local negotiations for the end of urban apartheid, for instance for democratic local elections and shared tax bases. (Rural settings exhibit much different forms of resistance, beyond this author’s experience.)

Many of the urban “civic associations” (equivalent to militant U.S. groups like ACORN) are moving into community-controlled development, and in a number of townships “Community Development Trusts” have been formed to control new sources of funding.

For example, drawing in part on U.S. ghetto experiences, the civic association leaders of the overcrowded Johannesburg township of Alexandra determined that a Land Trust would play a crucial role in maintaining access by poor people to what will become a large stretch of decommodified local land. A cooperative housing construction program combining collective labor and building materials co-ops, along with group financing through a People’s Bank, have also been projected in Alexandra and other townships.

At one level these sorts of initiatives are aimed at sowing the seeds of a new mode of production within the decay of the old. But it does not end there. Community-controlled development is also a profoundly struggle-oriented process, since there are all manner of state and for-profit developers anxious to insert their own agenda into black communities. Hence the importance of identifying the negotiations/struggle boundaries we noted at the outset.

The bottom line is that the market system cannot provide the goods, at present, to 90% of the population. Huge subsidies will be needed to acquire land, build houses, and provide infrastructure and services. But the failures of township capitalism go deeper still.

Recall the earlier description of the contradictions involved in the provision of housing bonds during the late 1980s. When interest rates skyrocketed, the monthly mortgage bill doubled, and repayment became impossible for many households. Moreover, many houses were shoddily built by developers, and the only recourse of residents was to the financier. These gave rise to “bond boycotts” (collective refusal to repay) in a number of townships, which Alexandra Civic Organizer President Moses Mayekiso accurately labels an “atom bomb” against the vulnerable banks.

Patrick Klaas, a leading civic activist from the Cape Town area, is aware of the need for unity of poor and working people. This is reflected in his comments on the bond boycott in Khayelitsha, a sterile area for Africans set up by the P.W. Botha government in the wake of the destruction of much of the Crossroads shack settlement:

“After the area where I lived was destroyed by vigilantes I went to live in the backyard of a lady who’s got this house that is bought from the bank. But the problems that she related to us about banking institutions and the fights that are going on, made me realize that to solve my housing problem by approaching the formal institution is going to have a problem that I’m not aware of. Now people who live in shack settlements are not aware of the problems of those people who have bonds, but by discussing those problems we might start realizing that those institutions are not going to be to our benefit. We must be resourceful enough to think creatively about what other methods we suggest.

Bond boycotts are just one method of anti-capitalist grassroots resistance to the high interest rates and other objectionable features that have accompanied the displacement of overaccumulation crisis into financial markets. There are others, including land invasions in protest against real estate speculation, the occasional factory occupation when a shutdown is imminent, and evolving labor strategies that link shopfloor, consumer and political issues.

The expansion of such community-labor struggles will probably evolve, in coming years, into a better framework for relating to nationalist political parties; more sustained demands on the state and capital; concrete proposals for a Southern African regional macroeconomic program stressing production of basic needs goods and services (along the lines now being drawn up in Zimbabwe); and increasing links to international social movements (such as in Brazil and the Philippines) waging similar struggles.

If the international economy continues to play a homogenizing role, and if a self-reliant, inward-oriented growth path for South Africa cannot be won, then these movements will face a common enemy as well, namely the World Bank, IMF, GATT and other organs of international capital.

The ANC, to its credit, is formally supporting the development of a strong civil society to serve as watchdog for the interests of poor and working people. One key ANC economist’s slogan for a “strong but slim state” offers a promise that huge subsidies can one day be drawn away from speculative financial markets (through “prescribed assets” or even nationalization of certain institutions), through a neutral central apparatus of some form, and into townships. There, using democratic methods of resource allocation, the implementation of housing, infrastructure and other services can proceed via community-controlled institutions.

Under conditions of worsening capitalist crisis in which a future state may have to give up the goal of (or simply breach) a formal social contract, and in which the formal capitalist sector goes through enormous devaluation, this is a framework that offers at least one route forward. It is a route simultaneously more radical and realistic than the possible liberal statism of social democratic politics, or than a more probable neo-liberal conflagration of speculative-finance capital and the social movement.

If other more insurrectionary and truly revolutionary currents do emerge from class conflicts that will intensify in coming years, they in turn will draw sustenance from the advances made at this stage of building South African socialism from the grassroots.

Notes

- Wolff, for example, writes: “I conclude that the chances for the development of socialism in South Africa are, at this point, vanishingly small. The most we can hope for–and I do hope for it fervently–is the advent of genuine welfare-state capitalism, with major housing, public health, and education programs, financed by taxes on the wealthiest portion of the population and by economic growth” (Socialist Review, Jan.-Mar. 1991, 50-51).

back to text - In addition, the Afrikaner powerhouse Rembrandt, Liberty Life insurance company and other major firms are emphasizing their extensive foreign operations again. A corporate “chicken run” is a real possibility, and this contributes to the pressure on the South African Reserve Bank to phase out the country’s dual currency system of exchange control sometime in 1992. The problem: this can apparently only be done by borrowing $5 billion from the International Monetary Fund, which is currently forbidden under the U.S. Gramm Amendment. This underlies the current political maneuvers toward an interracial coalition government to bring about an end to sanctions.

back to text - Namibia’s Finance Minister made precisely this appeal to Pretoria in mid-December, requesting absolution from repayment of $350 million in Southwest Africa “colonial debts” then guaranteed by South Africa. U.S. activists could now begin softening up U.S. banks which hold apartheid debt, especially Citibank.

back to text - Robert Brenner and Mark Glick, “The Regulation Approach: Theory and History,” NLR 188 (July-August 1991), 45-120.

back to text - The variable-rate bonds were largely granted at an initial 12.5% interest rate (a very low 7% in real terms), reflecting an oversupply of money. Consider the reasons for that oversupply: the displacement of overaccumulation to the financial sector; a lack of other profitable productive investment possibilities; and a perceived need to identify a new outlet for funds (black townships) that would combine the potential for adding even more consumer credit once collateral (the house) had been established, and establishing a new form of social control (FHA programs in the 1930s had a similar effect on the U.S. working class.}

back to text - One key test in 1992 will be a similar “development” loan to be requested from European bankers by Pretoria’s Development Bank of Southern Africa.

back to text

May-June 1992, ATC 38