Against the Current, No. 14, May/June 1988

-

From Locked Out to Locked In?

— The Editors -

Our Heroes, As We See Them

— Sol Saporta -

Eyewitness to the Palestinian Uprising

— an interview with Marty Rosenbluth -

Latin American Women: "We're All Feminists"

— Joanne Rappaport -

Chile in 2000: The Generals' Blueprint

— James Petras -

Revolutionaries in the 1950s

— Tim Wohlforth -

Victor Serge's Critique of Stalinism, Part II

— Suzi Weissman -

Random Shots: The Bones Break, the Clubs Hold

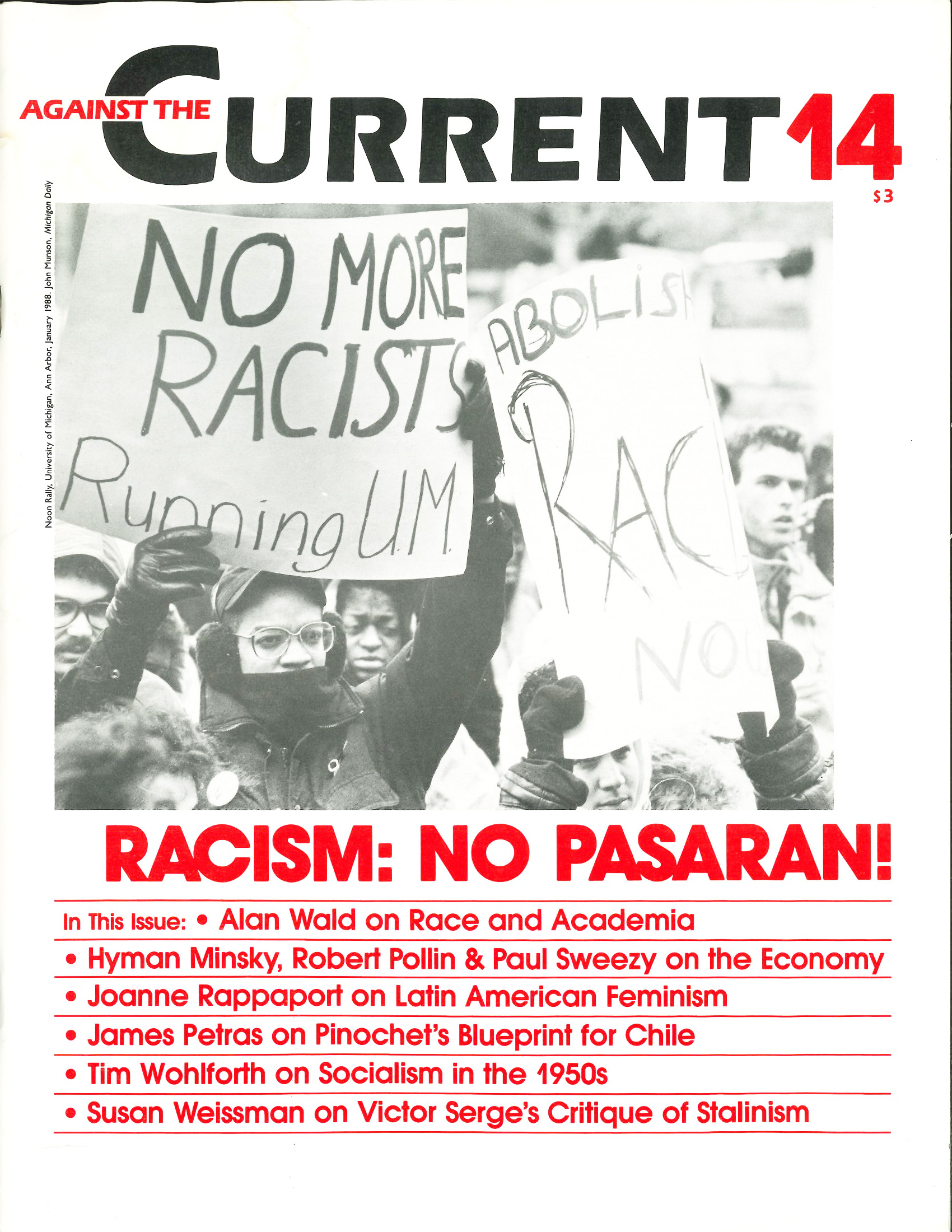

— R.F. Kampfer - Resisting the New Racism

-

Racism and the University

— Alan Wald -

South Africa's Media Scam

— Dianne Feeley - The Economy & the Crash

-

After the Crash: A New Stage?

— Frank Thompson -

Accumulation Leads to Crisis

— Paul Sweezy -

Who's Been on a Binge?

— Robert Pollin -

In a World of Uncertainty

— Hyman P. Minsky - Review

-

What Makes Things Change?

— Tony Smith - Dialogue

-

Against Radical Mythology

— Peter Drucker -

The Power of Radical Religion

— Ken Todd - Letters to the Editors

-

Clarify Palestinian Self-Determination

— Charlie Post -

Market Socialism through Socialist Feminist Analysis

— Ilene Winkler

Paul Sweezy

I’M NOT going to dwell on the crash itself–inevitable, but its trigger and timing were indeterminate. When it did come, it could not but mark a break in the continuity of the history of the period.

After the crash, the direction is downhill and will be for as far ahead as it is useful to try to look What is now uncertain is only the speed and severity of the decline.

Having said that, I want to focus on locating the present period in the history of the United States and the history of capitalism.

The early stage of capitalist development is characterized by two fundamental economic factors: an extreme shortage of investment capital and by comparison what appears to be an unlimited demand. But as capitalism spreads, absorbing its non-capitalist environment and always adding to the capital intensity of its productive structure, this relation between the supply of and demand for investment capital changes.

The system’s ability to accumulate new capital rapidly grows; the need for more capital slows down as basic industries, the housing stock, means of transport, and other elements of infrastructure are built up.

Quite early in the history of political economy, the prospect of reaching a state of capital satiation was raised, became a prominent theme and from then on a recurring subject of debate.

On the whole, the mainstream of economic thought held that capital satiation was not likely or, alternatively, impossible. Those who argued that it was unlikely cited an alleged insatiability of consumer needs and a supposedly inexhaustible future stream of new technologies and new products. But it is not consumer needs (or wants) that count but consumer purchasing power, and the two are only distantly related–if at all; and in a developed capitalist system the financing of innovations can be handled from the massive flow of depreciation allowances and may require little if any new net capital formation.

As for those who argued that capital satiation is impossible, their reasoning has been more subtle and complex. Basically, the contention is that capitalism contains a sort of automatic mechanism, like the demand-supply interaction that regulates the prices and quantities produced of ordinary commodities, a mechanism that sees to it that no more new capital is accumulated than can be profitably invested at the going rate of interest.

Or, to put it differently, if more capital is accumulated than can be profitably invested at the going rate of interest, then the rate of interest will decline and this will have two consequences: (I) the rate of accumulation will slow down and (2) the rate of investment will pick up until equilibrium is reached.

The classical economists envisaged a time when this process would reach a state of zero accumulation, which they called the “stationary state.” As described by John Stuart Mill, this was, I would say, a rather pleasant and enjoyable state of affairs. Neoclassical economists, on the other hand, were mostly much more optimistic about the demand side of the new capital equation and didn’t foresee any drastic slowing down, not to mention satiation.

All this of course changed with the Great Depression and John Maynard Keynes, who turned around conventional economic thought. The mam points of the new theory are: (1) capital accumulators and capital investors are two separate groups, each with its own motives and intentions; (2) the rate of interest does not provide any automatic equilibrating mechanism between them; (3) if accumulators want to accumulate more than investors want to invest, the result is recession or, if the imbalance is great, depression. This was the fundamental explanation of the Great Depression.

From Stagnation to Collapse?

Now for the history. Through roughly the 19th century, abstracting from ups and downs, the demand for new capital outran the supply, and growth was rapid if uneven. By the 20th century, the country was rich and the wealth unevenly distributed to the point where supply began to outrun demand. World War I and the ripple effects of the automobile masked this growing imbalance from about 1914 to 1929. Then came the collapse which lasted for the whole decade of the 1930s.

Recovery came not through any revival of demand but from World War IL. After World War II, many factors came together to generate a quarter-century-long boom in capital investment. The main ones were wartime destruction and under maintenance of plant and equipment, the unprecedented liquidity of consumers and businesses, new global patterns of trade and capital flows, commercializing military technologies, two major regional wars and a huge peacetime military buildup.

All of these factors, however, were essentially temporary. Taken together they began to peter out by the late 1960s and early 1970s.

On the supply side, the wealth of the country as well as its skewed distribution increased rapidly by historical standards. Both expanded the accumulation potential. The combination of an expanded potential and a faltering demand had its inevitable consequence in the return of deepening recession and stagnation.

I won’t belabor the counteracting factors of the 1970s and ’80s that prevented the stagnation from turning into a collapse-the growth of all kinds of debt and speculation, the mindless military buildup, the ballooning federal deficit. They worked, after a fashion.

These last few years have even been spoken of as a boom. But now, after the Crash, all that seems to be over. The moment of truth is approaching if it hasn’t already come.

In earlier times, we were saved by wars and automobiles (and suburbs). Is anything comparable on the horizon today? Or anything not comparable but equally effective?

These are the questions we should be asking. My own answer is no. From which I draw the conclusion that it is time to pronounce capitalism a failure and to get on with the search fora better system.

May-June 1988, ATC 14