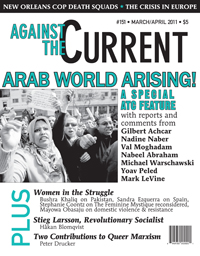

Against the Current, No. 151, March/April 2011

-

Change of the Century

— The Editors -

New Orleans' Police Death Squads

— an interview with Malcolm Suber -

Whither Social Security?

— Malik Miah -

Campaigning with Issues

— an interview with Ann Menasche -

Renewing New York

— an interview with Howie Hawkins -

Stieg Larsson in the Struggle

— Håkan Blomqvist - Arab World Uprising

-

Egypt and Beyond

— an interview with Gilbert Achcar -

The Meaning of the Revolution

— Nadine Naber -

Women, Revolution and the Future

— Val Moghadam -

From Tahrir to Palestine

— Nabeel Abraham -

A View from Israel

— Michael Warschawski -

Egypt Shakes the World

— Susan Weissman interviews Yoav Peled & Mark LeVine - Crisis in Europe

-

FRANCE: Battling Over Pensions

— Jason Stanley -

IRELAND: Slaying the Celtic Tiger

— John O'Connor -

GREECE: The Crisis Continues

— Nikos Tamvaklis -

UNITED KINGDOM: Students Fight the Fees

— interview with Ashok Kumar -

SPAIN: Women's Crises

— Sandra Ezquerra - Women in the Struggle

-

Pakistan's Dark Journey

— Bushra Khaliq -

Interrogating the Feminine Mystique

— an interview with Stephanie Coontz -

Claiming the Power to Resist

— Mayowa Obasaju - Triangle Fire Remembered

- Reviews

-

Arabs and the Holocaust

— David Finkel -

Toward A Queer Marxism?

— Peter Drucker

John O'Connor

LIKE MOST NATIONS, Ireland has its share of myths and legends. Most of us know a few of them — Saint Patrick drove out the snakes, the Children of Lir were turned into swans, the ancient warrior Cúchulainn took on all comers. And, since the mid-1990s, Ireland and the international community trumpeted a new myth and legend, the so-called Celtic Tiger.

Unfortunately, myths and legends are no match for a global economic storm. Today’s economic crisis has hit Europe hard, washing away jobs, homes, pensions, wealth, banks, and financial institutions. It has killed off the Celtic Tiger and put Irish workers in a precarious position.

For years the Celtic Tiger has been celebrated as a neoliberal success story.(1) Reportedly put together in a Dublin pub by a number of economists and politicians, the island’s embrace of neoliberal policies radically changed its reputation and performance. In the 1980s, Ireland was considered an economic mess; it suffered from high levels of inflation/debt, high taxes, sluggish growth, and a bloated welfare state. Unemployment and underemployment contributed to the migration of many young Irish men and women.

Ireland’s turn toward prosperity and notoriety rested on three policy shifts, initiated by the rightwing populist political party Fianna Fáil: first, the deficit was reduced by squeezing the public budget; second, unions and employers agreed to a political configuration of “social partnership,” through which workers’ wage gains were tempered; and third, thanks to a low corporate tax rate, the Industrial Development Authority (IDA) actively recruited multinational corporate investment onto the island.

Irish neoliberalism produced results. Economic growth (real GDP) grew by an average of 6.5% per year between 1990 and 2007. Foreign firms took advantage of Ireland’s skilled labor force, adding approximately 50,000 jobs annually throughout the 1990s. U.S. companies, such as Intel, Compaq, Motorola, and Hewlett-Packard, used Ireland as a staging platform to enter the European Union (EU). Export-driven manufacturing provided an economic dynamism that was reflected in high levels of productivity. And, rather quickly, Ireland’s budget deficit disappeared, and inflation faded from view. The economic returns of the Celtic Tiger were so positive that many skilled Irish returned home.(2)

Yet, the economic returns of neoliberalism were uneven and unequal. Although politicians and people from the business community were doing very well, life was still a struggle for most Irish workers. While there were jobs, social partnership increased economic inequality, as the wage share of national income decreased. High profits were tied to a public policy of wage moderation. The dark side of Celtic Tiger prosperity was declining levels of unionization, increased work intensity, and political corruption.

A celebrated part of the Irish economic model was a thorough transformation of its tax system. Apart from having one of the lowest corporate tax rates in the world (turning the island into a tax haven á la Bermuda or the Caymans), tax revenue in Ireland relied on goods/services and property sales, and less on personal income. This reliance on corporate and property tax revenue left the country structurally vulnerable to an economic tremor.

The Crisis Hits

The Celtic Tiger changed over time, mostly due to foreign companies looking toward Eastern Europe for even cheaper labor. When foreign investment started to dry up, Ireland’s economic profile shifted. Joining the Eurozone in 2002, Ireland was awash in money, as low interest rates in Europe made easy credit available. This had a twofold effect.

On the one hand, it unleashed financial capital in Ireland to an extent not seen before. At the time that Irish banks had joined the global casino, Dublin became a hotbed of shady financial accounting, with international firms trying to take advantage of Ireland’s 12.5% corporate tax rate.

On the other, a “housing bubble” emerged that became the driving force of the Irish economy. This asset-price bubble became an important source of employment, since the construction, real estate, and mortgage broker industries exploded. It was estimated that the housing boom was responsible for one-fifth of all the jobs on the island, and state revenues relied heavily on property taxes.

The Irish crisis started as a financial meltdown and then transformed into a crisis of sovereign debt.

Against a backdrop of global liquidity and low interest rates, Irish banks (like banks elsewhere) were dangerously overexposed in the housing bubble, all trying to cash in on the 250% increase in housing prices from 1985 through 2006. When Wall Street imploded in the fall of 2008, the Irish real estate bubble deflated, and the economy went into freefall.

Given that consumer spending crashed, housing prices fell, and unemployment grew the economy contracted in an instant. With the Irish landscape littered with unsold/unfinished homes, foreclosures escalated as jobs were eliminated and wages slashed. Similar to Greece, Portugal, and the United States, the human cost of the crisis has been severe.

Institutionally, the country’s banking system teetered on the edge of collapse. The Anglo-Irish Bank, a major lender to property developers, lost close to 98% of its value. All together, the value of the four major Irish banks fell from €52.8 billion in 2007 to €4 billion in 2008. The Fianna Fáil/Green Party governing coalition struggled to control the situation, cutting the 2009 budget and — to ensure that there was no run on bank deposits — promised that they would guarantee the banks’ debt.

In refusing to have the banks cover some of their losses — while tax revenues were plunging — Fianna Fáil Prime Minister Brian Cowen set in motion the country’s vulnerability to bond market pressure and the public debt spiraled out of control.

Although the government nationalized Anglo-Irish Bank in early 2009, it also created a new state agency known as the National Asset Management Agency (NAMA) to house the banks’ bad assets and allow banks to operate normally. Irish socialist Kieran Allen estimated that, by the fall of 2010, the government had committed around €50 billion ($66 billion) to bail out its banks.(3)

The end result was that the country’s level of debt was now dangerously high. In 2009 the deficit was 14.3% of GDP (worse than Greece) and heading higher, whereas two years before the budget had a surplus. Debt default seemed on the agenda.

Capital Scrambles

From the start, the EU was very concerned about the Irish crisis. The European Central Bank (ECB), for example, did not like that the price of Irish sovereign bonds had plummeted nor did it want other European banks to become vulnerable just by holding Irish debt.

The ECB bought some of this debt from exposed banks, and it pressured the government to request a bailout from the EU’s European Financial Stability Facility (EFSF) fund, established in the spring of 2010 to limit the financial contagion.

After resisting EU aid, the Cowen government finally acknowledged that it couldn’t resolve the island’s economic problems and formally requested help. In trying to escape default, billions of euro bailout money was linked to harsh domestic austerity.

In late November 2010, EU finance ministers approved an €85 billion ($112 billion) bailout package, with €22.5 billion of that coming from the International Monetary Fund.(4) By joining Greece in the bailout line, Ireland helped take pressure off the euro, and enabled the country to save both its failing banks and allow it to borrow money in the international bond markets. Although Cowen claimed that no one was micromanaging the Irish economy, the ECB has the authority to oversee whatever economic steps the Irish take.

By early December, Irish Finance Minister Brian Lenihan presented the toughest budget in Irish history.(5) This four-year budget plan (the National Recovery Plan) was a collection of tax increases and spending cuts, all intended to reduce the deficit from 32% of GDP to 3% by 2014. Supposedly $20 billion would be saved over these years. Lenihan’s budget axe cut public sector jobs, child benefits, health care, and the minimum wage. At the same time that low-income workers would be forced to pay more in taxes, the welfare state was cut by 15%. Of course, the governing coalition’s brutal austerity plan did not touch Ireland’s low corporate tax rate.(6)

Although the EU bailout and austerity measures narrowly passed, Cowen and Fianna Fáil were finished politically. In November, the Greens declared that they would walk away from the coalition in January, and after a number of internal squabbles and leadership challenges, Brian Cowen resigned as Fianna Fáil’s leader. Left with nothing but poor opinion polls, Cowen dissolved the Dáil [parliament] in January and set new elections for February 25.

Although opposition parties Fine Gael and Labor appear set to benefit from the crisis, Irish workers have been venting their anger through massive public demonstrations and the questioning of their union leadership.(7) They have taken to the streets in large numbers to protest austerity and the state of the economy.

On February 21, 2009, after a number of smaller, earlier protests by civil servants and taxi drivers, more than 100,000 people marched through the capital and threatened a national strike. But the Labor party helped squash that action, saying that it would not be good for the country.

In late 2010, the Irish Congress of Trade Unions (ICTU) led a Dublin march and rally that again drew 100,000 people. Although the ICTU worked hard to control the demonstration and its message (Ireland’s sovereignty has been undermined), union leaders (David Begg of the ICTU and Jack O’Connor of Services, Industrial, Professional and Technical Union) were booed and heckled by the protesters, who increasingly see the unions as partly responsible for Ireland’s economic crisis.

The union line has been that austerity needs to be implemented in a much more equitable way. While this is undeniable, Irish labor’s acceptance of social partnership has left it weakened. For more than 20 years, unions have traded wage moderation and industrial peace for promises and rewards from Irish capital; these were benefits that never came. Given that the cost of austerity is being paid solely by workers, it wasn’t much of a partnership.

The most important legacy of social partnership is that Irish workers lack the experience and the confidence to fight their employers and politicians. With wages set nationally, worker activism and self-activity has been undermined. This social partnership explains why Greek protesters, in demonstrating against their cutbacks, chanted: “This is Greece not Ireland, we fight back.”

Opening for the Left?

In this time of crisis the long splintered Irish left moved to provide political leadership. On November 29, 2010, the Socialist Party, the People Before Profit Alliance, and the South Tipperary Workers and Unemployed Action Group formed the United Left Alliance (ULA) to run candidates in the general election.

The ULA aims to be a political alternative to Fine Gael, Labor, Fianna Fáil, and Sinn Féin, rejecting all capitalist solutions to the crisis and refusing to make deals with rightwing parties. The ULA program comprises seven demands: 1) end the bailout of banks/developers; 2) tax the rich; 3) create jobs; 4) defend public services; 5) eliminate discrimination; 6) protect the environment; and 7) build a left alternative in Ireland and Europe.

All ULA candidates pledge not to work with Ireland’s conservative parties nor implement their self-serving crisis solutions. In a context of national anger, if the ULA can elect a number of candidates, it has the potential to build a militant and oppositional pole within the Dáil.(8)

The ULA project is riddled with tensions and difficulties, but its entry into the electoral fray is positive. At best, a ULA presence in the Dáil could help push the Labor Party and Sinn Féin to the left or, at least, would expose these entities once again for the pro-neoliberal political parties that they are.

Second, ULA electoral success could contribute to building Irish workers’ capacities for struggle by mobilizing working people for the defensive actions that will be needed in the months ahead. Finally, the ULA could be a vehicle in bringing the left together to defend workers’ rights against austerity.

The radical milieu in Ireland encompasses a number of unique formations — Socialist Democracy, the Independent Workers’ Union, the republican left, radical independents, forces associated with the Irish Communist Party, and the Irish Socialist Network, to name but a few. The time may be right that these groups act as one.

With the help of a unified and an engaged left, the Irish have an opportunity to turn an old myth into a new reality. Through struggle in the workplace, on the street, and in the Dáil, the Irish working class would do well to mimic St. Patrick, and drive out all its neoliberal snakes.

The United Left Alliance represents a first step in that direction.

ATC 151, March-April 2011

Notes

- An interesting mainstream account of the Celtic Tiger is Ray MacSharry and Padraic White’s The Making of the Celtic Tiger (Mercier Press, 2000). Radical critiques include: Denis O’Hearn’s Inside the Celtic Tiger (Pluto Press, 1998) and Kieran Allen’s The Celtic Tiger (Manchester University Press, 2000).

back to text - The statistics cited in this article come from The Economist, Financial Times, New York Times, and the Socialist Democracy website.

back to text - “The Cause of Ireland’s Crisis: An Interview with Kieran Allen” International Socialist Review #75 (Jan.-Feb. 2011).

back to text - It was reported that the interest rate on the Irish bailout was higher than what the Greeks received.

back to text - As a member of the euro, Ireland did not have the option of devaluing its currency. Budget reduction was going to come out worker’s wages.

back to text - A number of EU countries have criticized Ireland’s corporate tax rate and wanted it increased. Both Germany and France have argued that it distorts competition within the Eurozone.

back to text - Both of these parties are right wing and accept the bailout/austerity path, albeit disagreeing on some of its different elements.

back to text - Irish socialist Des Derwin has written the best account of United Left Alliance, considering both the pros and cons of the new formation. Derwin’s paper “The United Left Alliance in Ireland: Is this the Left Unity we were hoping for?” has been posted on both the Irish Left Review and the Links websites. It is worth a read.

back to text

ATC 151, March-April 2011