Against the Current, No. 204, January/February 2020

-

Hope in the Streets, continued

— The Editors -

On the Coup in Bolivia

— Bret Gustafson -

Canada's 2019 Election

— Paul Kellogg - Students in Pakistan

-

Introduction to H. Chandler Davis

— Alan Wald -

Speaking Up in Ann Arbor

— H. Chandler Davis -

Beyond the 2019 UAW Negotiations

— Dianne Feeley -

100 Years of U.S. Communism

— Alan Wald -

Introduction to Socialist Perspectives on the 2020 Elections

— The Editors -

Socialists and the 2020 Election

— Linda Thompson and Steve Bloom - Black History

-

How Race Made the Opioid Crisis

— Donna Murch -

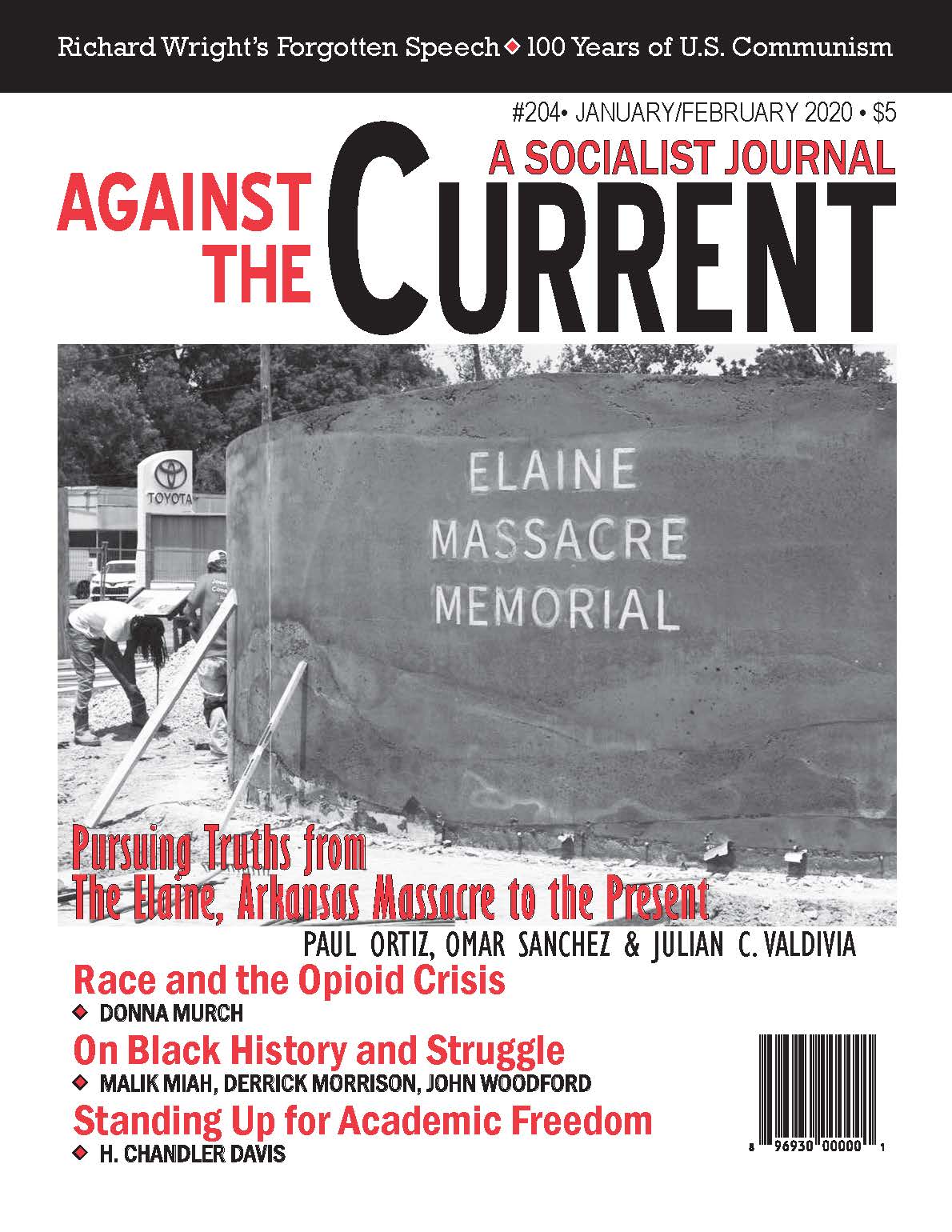

The Pursuit of Truth in the Delta

— Paul Ortiz -

1919 Elaine Massacre

— Paul Ortiz -

Discrimination in the Delta

— Julian C. Valdivia -

A Freedom Odyssey

— Omar Sanchez -

Introduction to Richard Wright's Forgotten Speech

— Scott McLemee -

Such Is Our Challenge

— Richard Wright -

"Not racist" vs. "Antiracist"

— Malik Miah -

A Chronicle of Struggle

— Derrick Morrison -

Justice Denied

— John Woodford - Reviews

-

Latin America's Caldron

— Folko Mueller -

Syria's Unfinished Revolution

— Ashley Smith -

The Power of Gulf Capitalism

— Kit Wainer -

Lawyers of the Left

— Barry Sheppard

Kit Wainer

Money, Markets, and Monarchies:

The Gulf Cooperation Council and the Political Economy

of the Contemporary Middle East

By Adam Hanieh

Cambridge University Press: Cambridge, UK. 2018,

269 pages + references and index, $32.99 paper.

ADAM HANIEH HAS produced a compelling and well-documented account of the modern evolution of capitalism in the Persian Gulf. Skillfully utilizing the Marxist categories of class, state, and mode of production he situates the role of Gulf capitalists, organized around the Gulf Cooperation Council (GCC), within the larger global capitalist economy. His concluding chapter ties the economic trends he details to an analysis of the political crises of the past decade.

In the first two chapters Hanieh shows how hydrocarbon wealth has tied the five states of the GCC — Saudi Arabia, Kuwait, Bahrain, Qatar and Oman — to various sectors of the world economy.

Hanieh insists on a multi-spatial analysis in which the Gulf is seen not as a distinct region, but one closely tied to other regions and to global manufacturing and finance. “Ranging from banking, industry, technology, and real estate across Western Europe and North America, through to farmland, retail chains, and manufacturing plants in some of the poorest places on the planet,” he writes, “Gulf investments are encountered in virtually all countries and economic sectors.” (1)

Hydrocarbon exports have generated trillions in disposable wealth within the GCC countries. Saudi investors, for example, use petrodollars to buy U.S. Treasury bills in exchange for U.S. commitments to buy Saudi oil and sell weapons to the kingdom. Saudi purchases of U.S. Treasury bills have strengthened the U.S. dollar, allowing the Treasury to print more currency without triggering inflation, and have kept bond yields — and consequently home mortgage rates — in the United States low.

GCC surpluses also flow into the City of London, currently the world’s largest banking center. Loans from London banks have fueled the extraordinary construction boom in the Gulf. Yet deposits from GCC nationals in London banks exceed GCC borrowing.

The City of London is thus a net borrower from GCC countries, although it’s a net lender to the United States. Thus GCC surplus capital has bolstered the role of London banks in the world economy and helped the United Kingdom maintain its position as a major imperialist power.

Gulf States and Gulf Capitalism

Within the GCC nations, Hanieh argues that the state plays an integral role within the economy. He rejects analytical efforts, viewing state intervention in the region as an impediment to private-sector growth.

He demonstrates how interconnected the state is with the capitalist class. Thus he does not find the concept of the “rentier state,” where the state operates as a major capitalist that generates income through “rents” (eg., oil drilling concessions, or user fees), applicable to the GCC economy.

Instead, he explains, “[T]he Gulf state is — as in all capitalist societies — a class state, not a neutral or parasitic institution severed from the social relations of production and accumulation or one that ‘crowds out’ the private sector.” (67)

To illustrate his point, Hanieh details the role of the state in the development of key industries within the Gulf. The availability of low-cost hydrocarbon fuels has stimulated the growth of energy-intensive firms producing aluminum, steel and cement.

The GCC now hosts some of the largest smelters in the world. The six primary smelters in the region are state-owned but downstream manufacturers of cable and other supplies are private. Thus the state and private enterprises are intertwined. (71-72)

The state also boosts Gulf capitalism by passing repressive labor legislation. A small number of investment firms control a great deal of construction within the GCC countries. What makes construction companies so profitable is the large supply of cheap labor from South Asia.

“A variety of mechanisms give GCC construction companies considerable power over these workers, including the denial of mobility between jobs, the withholding of workers’ passports, and extremely restrictive laws that ban migrant workers in the Gulf from forming unions, going on strike, or engaging in any kind of political protest …” (81)

GCC capital and Gulf states have also become significant players in the global food economy. Although Saudi Arabia and the United Arab Emirates export food to the other three GCC member nations, the region is a net importer.

Responding to rising food prices and reduced imports from Russia, India and Argentina, Saudi and UAE investors along with the Saudi and UAE governments have purchased agricultural lands throughout the world. They have therefore enmeshed themselves in the global politics of food and food insecurity.

The globalization of food production and distribution led to increased inequalities and food riots in at least 25 countries in 2007-2008. Most writings on food insecurity have assumed capitalist systems of food production and distribution and have also assumed that solutions, even those emphasizing access to food for all, must be based on modern developmentalist and market-based strategies. (112-114)

“[P]aradoxically, in other words, the policies associated with achieving food security act to deepen the food insecurity that arises from the current world order.” (114)

Privatization and Inequality

The Saudi state and Saudi investors insist upon local policies which protect property rights and liberalize exports when considering where to purchase lands. However, revolts by threatened or displaced farmers in poorer countries forced Saudi Arabia to reorient over the past decade toward wealthier countries with stronger protection for private property. These include Poland, Ukraine, Brazil, Canada and western states in the United States. (121-123)

Although Gulf states have been important partners for GCC capitalists, the entire Arab world has come under the influence of neoliberalism.

Gulf state leaders and investors are now enthusiastic advocates of wholesale privatization of public services and real estate, at home as well as in other countries, Hanieh asserts (and in the process, eroding some of the historic privileges that GCC citizens had over immigrant labor).

GCC investors are deeply involved in real estate privatization throughout the Arab world. Egypt, for example, liberalized land-holding policies in the 1990s when former dictator Hosni Mubarak reversed the Nasser-era prohibition on rural tenant evictions. GCC capital has moved into Egypt and several Arab countries which have gradually abandoned Ottoman-era renter protections.

GCC capitalists often work in partnership with local investors, particularly Palestinian and Lebanese. As banks have also been privatized, a market for residential home mortgages has blossomed throughout the region.

Encouraged by the European Bank for Research and Development and the World Bank, Arab governments have also undertaken the privatization of infrastructure and transport such as bus companies and schools. Egypt led the way with infrastructure reforms in 2010 followed by other Arab states. (164)

Hanieh does not view GCC investments in the Arab world as a form of subordination of Arab capitalism to Gulf interests. Quite the contrary, Gulf capital has aided the development of an Arab capitalist class, providing it with necessary financing. “In short, GCC financial circuits are not external to the national scale of other Arab countries but, rather, should be seen as internally related to processes of class and state formation across the entire region.” (193)

GCC Capital and Political Turmoil

As oil prices dropped in the 21st century, GCC state leaders have pursued structural adjustment and privatization with even greater vigor. Saudi Arabia now employs global consulting firms to help downsize the state and privatize public services.

This has sparked some objections from middle- and lower-level government employees, who are losing coveted positions typically reserved for Saudi citizens. Many Saudi citizens have had to accept lower-paying private sector work. Nonetheless, Saudi capitalists seem firmly behind the austerity measures.

Cuts in government spending have also led to a decline in government construction contracts. Consequently, the largely immigrant construction workforce has faced rising unemployment and the Saudi government has responded with mass deportations and immigration restrictions.

The political and historical import of Hanieh’s economic analysis reveals itself starkly in the final chapter. He demonstrates the ways in which the patterns of Gulf and Arab capitalism, and the neoliberal redesign of the region, sparked the wave of protests in 2010-2011 known as the Arab spring.

This has also shaped the response of Arab states to the uprisings. In one gruesome example, Hanieh documents the ways in which Gulf investors are planning to reap billions from Syrian reconstruction contracts.

Hanieh’s work requires some patience on the part of the reader. Much of the book explores complicated economic themes. However, it is worth the effort. He shines an important light on the workings of global capitalism and the international commonalities of neoliberal policies. Finally, his analysis helps us better understand the origins and patterns of political crises in the Middle East today.

January-February 2020, ATC 204