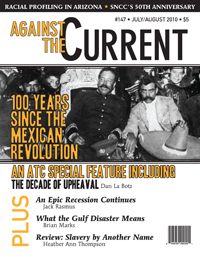

Against the Current, No. 147, July/August 2010

-

Bigger Slicks, Sicker Society

— The Editors -

Arizona's Racial Profiling Push

— Malik Miah -

Louisianans, Oil & Petro-Addiction

— Brian Marks -

The Unfolding Epic Recession

— Jack Rasmus -

The Limits of State Intervention

— Barry Finger -

After Obama's Health Care Law

— Milton Fisk - The U.S. Social Forum in Detroit

-

The Victory for Workers' Rights in Honduras

— Anthony Graham -

World Cup Woes for South Africa

— Ashwin Desai & Patrick Bond -

The 1960 Sit-ins in Context

— Marty Oppenheimer -

SNCC's 50-Year Legacy

— Theresa El-Amin - The Mexican Revolution at 100

-

¡Viva la Revolución!

— Dan La Botz -

Trotsky, Guest of the Revolution

— Olivia Gall -

Miners Protest Brutal Beatings

— Dan La Botz - Reviews

-

African Americans' Forced Labor

— Heather Ann Thompson -

Peace, Freedom and McCarthyism

— Mark Solomon -

Waging the War on Slavery

— Derrick Morrison -

Fighters with Disabilities

— Chloe Tribich - In Memoriam

-

Berta Langston, 1926-2010

— Alan Wald - Barbara Zeluck, 1923-2010

-

Recollections of Harry Press

— Carl Anderson, Arthur Brodzky & Dave Bers -

Lena Horne & Her Times

— Kim D. Hunter

Barry Finger

THE NATION, AS befits the preeminent journal of left-liberal opinion, has run a series of articles by Robert Pollin and by James K. Galbraith that have sparked great attention. These, as well as numerous other arguments in a similar vein, mount a spirited defense of job generation through deficit spending as effective counter-cyclical measures.

My purpose here is not to argue whether socialists should or should not endorse specific measures relieving unemployment to stave off mounting poverty and economic insecurity that recessions entail. Clearly there are ways of intervening that are more socially beneficial, as well as those that are patently reactionary, and these judgments are usually noncontroversial in leftist circles.

I do question, however, the left Keynesian understanding of the roots of capitalist crises and the apparently noncontradictory nature of state intervention that flows from that understanding.

Common to all these liberal analyses is the failure to locate the limits of state intervention within the same laws of capital accumulation that govern the system as a whole. It is a view that contains within it the implied belief, or at least the embedded implication, that state intervention provides the key to a peaceful democratic mastery over capitalism short of socialism.

Capitalist crises — and they are indeed capitalist crises, not some generic “economic” crises — are caused in the first instance by a lack of sufficient profits to expand the system, not by a lack of effective “demand.” They are, in other words, crises of capital accumulation. Consumption, academic economics to the contrary, is not the central purpose of capitalist economic activity, but a link in the process of capital self-expansion.

The self-expansion of capital, of profitmaking, is the primary expression and historical tendency of a society whose division of labor is fundamentally determined by its class structure and regulated through the instrumentality of the market. Consumption is a moment in the exchange of wages for labor power, itself a moment in the larger accumulation process whereby capital is simultaneously exchanged against means of production.

Any “lack of effective demand” is therefore primarily a deficiency in capital formation, not a problem of underconsumption. Of course, underconsumption crises are always a possibility given the anarchy of production. They occur when the output of the means of production fails to grow faster than consumer goods as the capital intensity of the system as a whole increases. They are forms of capital misallocation that give rise to a specific character of market disproportionality.

Disproportionalities are both generated and corrected by the reallocation of social labor in pursuit of profit. If the market mechanism were not generally capable of overcoming such disproportionalities, the system as a whole would be in a state of perpetual crisis and capitalism itself would be inconceivable. But the crisis of profitmaking — and therefore of accumulation — is what’s central to the system, central to the reoccurring character of the business cycle.

Producing and Sustaining Profit

To simplify somewhat, labor that generates profits is productive for capital. Output that is embodied in means of production or consumption goods, which can be reabsorbed into the production process to expand capital, is reproductive output. Labor that is embodied in profit-yielding commodities that do not provide the basis for additional capital formation — such as armaments and infrastructural goods — are consumed as revenue for the system. They are functionally analogous to commodities that are personally consumed by individual capitalists. The value of this nonreproductive output is lost to the accumulation process.

State-employed labor, which generally yields no profits, can be employed both in reproductive and nonreproductive activities. However, because state-employed labor is not productive of profit and the product of state-employed labor is not marketed in commodity form by the state, its production costs must be made good by a deduction, through taxes, from private sector-generated profits.

Insofar as state-employed labor provides services that socialize various costs of capital formation — educational and training costs, health care, etc, — such costs are returned to the system as part of the social wage, an aspect of the reproduction of labor-power. Though a reduction from profits, such reproductive activities on the part of the state are provided at cost. They therefore represent a smaller deduction from profit than the equivalent service, were that service provided in commodity form in the marketplace where the surplus labor time would not be sacrificed as a subsidy to private capital formation.

At the same time, state activities eliminate potential opportunities of investment, creating a constant source of political tension to commodify various lines of state activity such as the education and the penal systems, and to prevent the decommodification of health care through single payer. The difficulty of the capitalist state to manage the common affairs of the ruling class against the special interests within that class have been, in the case of health care, been painfully obvious. It has resulted in the most miserable impasse masquerading as a compromise, which is — in reality — no solution at all.

Throughout the process of social reproduction the animating mechanism is profit. It is this that drives the system forward, allows it to accumulate and to live off portions to feed other state-funded but necessary — though subordinate — tasks of social life.

Demand is therefore the obverse of accumulation. So long as profitmaking is robust and accumulation can proceed without interruption, the potential tensions that are inherent in the competing demands on profit can be kept latent. But this always requires a definite limit on nonreproductive activities, lest the loss of profits threaten to overwhelm the accumulation process.

Declining Rate of Profit

At length, however, the system of accumulation itself so increases the organic composition of capital, the ratio of investment in dead to living labor, as to cause the rate of profit to decline. Each additional dollar of investment sets in motion an ever smaller quantity of exploited labor. This decline in profitability can continue only so long as the pace of accumulation outstrips the fall in the rate of profit. As long as this holds, the mass of profits can still grow and the system can continue to expand.

But even in the absence of a growing capital intensity, the competing demands on gross profits — in the form of taxes, demands and payouts to banks as interest, and to commercial capital as sacrificed profits (the difference between retail and wholesale prices) — can themselves reduce the net profit rate available for accumulation mimicking in effect a decline in the rate of exploitation.

The decade-long disparate and one-sided growth of the financial sector, which fed increasingly on itself by sucking out profits, while effectively denying their recycling into reproductive investment, created an unsustainable bubble. This was the concrete prerequisite to this economic crash.

The financial sector, properly functioning, primarily recycles idle balances into additional capital formation. Years of financial deregulation fostered the creation of new instruments, ever more reliant on Ponzi-like methods of profit acquisition, by reversing this dynamic and sucking profits out of production to expand the financial sector at the expense of productive investment.

With increasing difficulties in generating sufficient outlays from profit to expand production, the nonfinancial sector in turn found itself competing for capital on unfavorable terms against Wall Street. This external financing would have otherwise presented no fundamental problem, if profit margins had kept pace with the requirements of capital accumulation.

Instead, however, the ratio of debt to revenue blossomed out of control. The fragility of this business borrowing became evident insofar as equity asset prices (stock prices — ed.) increasingly bore only the most fictional connection to the underlying profitability of the system as a whole. The relationship between the financial sector and the nonfinancial sector had effectively morphed from symbiotic to parasitic.

Crisis and Regulation

This is the background — underscored by the recent revelations of national and international outrages by Goldman Sachs — of renewed efforts to rein in finance capital and restore it to its proper relationship with the system.

Crises occur when that necessary pace of accumulation can no longer be maintained, when there is an overaccumlation of capital relative to profits. They differ in their concrete particulars, in their historical trail and their empirical unfolding. But the business response to crises remains remarkably similar. Like a desperate man, faced with bankruptcy, who begins to dismantle the house for firewood, capitalism seeks in the first instance to dismantle all competing demands on profits — to strip down the state and drastically curtail its activities — in order to reclaim surplus value for the accumulation process.

That is the political manifestation of the crisis. In recent years that drive has intermittently even raised the issue of Social Security privatization, but has consistently raised the trope of “entitlement” cutbacks. When right wingers rage about the bankruptcy of Social Security, of Medicare, etc., they are really referring to the insolvency crisis of capitalism itself.

Current or future claims by entitlements are held to be too high for the given or anticipated profitability of the system to accommodate. Writing down “entitlements” is part of a larger dynamic in which capitalism seeks to write down the value of its investments, slash costs, eliminate redundancies, consolidate its structures, eliminate incomes of noncapitalist classes and — paramountly — to ever more ferociously drive down wages and living conditions of the working class.

This is how the purgative of crisis restores profitability and allows a recovery of business activity. The unremitting decades-long pressure to dismantle the remnants of the welfare state is a barometer of the unliquidated crisis conditions under which capitalism has been operating since the 1970s.

Crisis recovery is a profoundly dislocating economic imperative, which unleashes unforeseen and potentially uncontrollable and polarizing social forces on both the right and left.

This is where Keynesian liberals step in. On the surface, market problems are problems in effective demand. Where accumulation is too weak to drive demand, the Keynesians argue that the state can step in and boost demand through deficit spending, through the expansion of infrastructure construction, and by boosting and enhancing automatic stabilizers such as unemployment insurance.

Robert Pollin (“18 Million Jobs by 2012,” The Nation, February 18, 2010) argues that “(t)his can be done by combining two broad types of initiatives: measures to buttress the economy’s floor and thereby prevent another 2008-type collapse, and measures to inject job-creating investments into the economy.”

The state, in other clichéd terms, can “prime the pump” of economic activity. But such expansion, as we have shown, replaces capital formation with the production of nonreproductive commodities and state services, or with state services that in any case are not directly productive of surplus value, and only a small portion of which actually represents anything that can remotely be considered subsidy supports to the accumulation process.

Sustainable Intervention?

Ironically, the socialization of health care costs through single payer is one proposal that would have provided a major boost to accumulation but was, in the end, rejected primarily out of fears that its success would spearhead a larger drive to decommission broader sectors of economic activity from profitmaking.

Pollin has elsewhere advocated a “green recovery” that is “environmentally sustainable and morally just.” But the overriding advantage, as Pollin sees it, is that green investment as a tool for fighting recession injects “more money into the economy as quickly as possible” (The Nation, February 16, 2009) than other forms of countercylical activities.

For green production, which is not currently economically profitable — and therefore not immediately capitalistically justifiable — to attain the economies of scale necessary to displace fossil fuels nevertheless requires massive government subsidies, and will continue to do so for an unpredictably protracted period of time. But until the point is reached where green energy supplants existing energy sources, state-induced production compounds the existing problems of private production.

If capital cannot create the conditions for a new upswing from its own resources, subsidized green production will be of little use to it. Government-induced green production will remain during the transition period as overhead costs for the system at large, costs that must be subtracted from the surplus value that would otherwise be available for the expansion and reorganization of capital needed to overcome the crisis.

The extension of the sphere of production at the expense of capital formation would of course have a positive impact on eliminating the excess capacity that accompanies overaccumulation. The portion of capital that cannot be employed capitalistically — that is for the self-expansion of capital — can be put to use by state demand.

Keynesian measures can change the shape of economic downturns, so that total social consumption does not decline and total demand and total production can maintain their pre-crisis levels. Of course, as the capital intensity of production has grown over time, the Keynesian income multiplier, which — in actuality — is based not on the psychological propensity to spend, but on the investment division in working capital between means of production and wages which structures demand, tends to weaken.

That is why economists in general have underestimated the needed stimulus to restore employment. In any case, the fact that total demand and total production could be maintained at pre-crisis level is poor consolation for the system itself, insofar as the noncapitalist stimulus to demand results in output which is largely useless to the formation of additional capital.

While the individual capitalist is indifferent to how his/her production is stimulated, for the system as a whole state spending has an entirely different implication. State spending annexes unused liquidity in the form of taxes or public debt to purchase commodity values that will not be put to use to expand the overall mechanism of profitmaking. For capital as a system, capital as a whole, this is tantamount to an annexation of a portion of unused capacity for noncapitalist purposes as the annexed liquidity is exchanged for state contracts.

Financing state activities through the issuance of public debt mobilizes unused liquidity to activate capitalistically dormant spheres of production. As James Galbraith indicates (“In Defense of Deficits,” The Nation, March 22, 2010) this debt in practice is never repaid — only the interest on the debt will be paid.

The additional demand generated in this way, including the profits realized, are exchanged not against capital but against public obligations, the interest on which is repaid through the appropriation of future taxes, itself a form of expropriation. But a debt that cannot be repaid is a debt that is in effect also expropriated insofar as the capital that this debt represents is forced to satisfy itself with a specific interest rate, which in the long run may well be below the prevailing rate of profit.

Deficit is Stopgap Solution

Deficit spending can function, unless and until capital finds its way in raising the level of exploitation and restructuring, only if production for consumption — that is noncapitalist production — penetrates ever more deeply into the production for profits.

Unless capital finds the impetus to expand production on its own terms, state-induced production will eventually lose its projective force and become an additional obstacle that must be overcome. The production of surplus value in the private sector is the determining factor in the development of the overall system.

If state activities improve the conditions of accumulation to the benefit of private capital in the sphere of production, while also accommodating rising living standards and the annexation and reconversion of surplus value into improved social entitlements, a capitalist prosperity meaningful to working people can be restored.

This is particularly unlikely insofar as capitalist prosperity generally first requires a sufficient purge of capital values and cuts in working-class living standards to reestablish the conditions of capital accumulation on a profitable basis. Measures that restore full employment through the expansion of state activities at the expense of the private sector can only create a pseudo-prosperity that leaves the immediate causes of economic instability latent.

But even if the state can temporarily contribute to the creation of a meaningful capitalist prosperity, it cannot arrest and eradicate the recurrent causes of economic crises — causes that are embedded in the fundamental class divisions of society. This is the dilemma of state intervention. This is what is lost in the liberal-left debate.

ATC 147, July-August 2010

I found this article to be highly complex and very difficult to get through. Mr. Finger approaches a complicated subject matter and actually makes it more complicated. I have subscribed to ATC for a couple years, I read a wide variety of publications on the left and in the center, I attend graduate school and found myself struggling to get through this material. Please consider a different approach when attempting to discuss such complex, multi-faceted material.

Also, since I’m critiquing ATC, please consider changing the font. This font type coupled with its small size (10 pt?) makes it difficult to work through the material. Consider something like Garamond or Times New Roman (Monthly Review and Foreign Affairs have great font type and size). Just suggestions…I’m a big fan and want to see more people read ATC…

Regards,

ML