Against the Current, No. 125, November/December 2006

-

The End of the Regime?

— The Editors -

Israel, Lebanon and Torture

— an interview with Marty Rosenbluth -

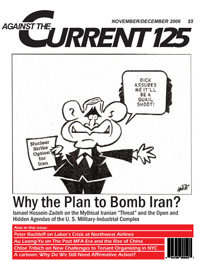

The Profits of War: Planning to Bomb Iran

— Ismael Hossein-zadeh -

Racist Undercurrents in the "War on Terror"

— Malik Miah -

War and the Culture of Violence

— Dianne Feeley -

Creating A Giant Ghetto in Gaza

— Uri Avnery -

George Bush's Unending War and Israel

— Michael Warschawski -

The Post MFA Era and the Rise of China, Part 1

— Au Loong-Yu -

Dual Power or Populist Theater? Mexico's Two Governments

— Dan La Botz -

New Challenges to Tenant Organizing in New York City

— Chloe Tribich -

The Case of Northwest Airlines: Workers' Rights & Wrongs

— Peter Rachleff - Reviews

-

James Green's Death in the Haymarket

— Patrick M. Quinn -

Eliizabeth Kolbert's Field Notes from a Catastrophe

— John McGough -

David Roediger's Working Toward Whiteness

— René Francisco Poitevin -

Paul Buhle's Tim Hector

— Sara Abraham -

Latin America to Iraq: Greg Grandin's Empire's Workshop

— Samuel Farber - In Memoriam

-

Caroline Lund-Sheppard, Sept. 24, 1944-Oct. 14, 2006: A Life Fully Lived

— Jennifer Biddle -

Remembering Dorothy Healey: An Activist with Vision

— Robbie Lieberman

Au Loong-Yu

THE AGREEMENT ON Textiles and Clothing expired in 2005, ending 30 years of a quota system under the Multi-Fibre Arrangement (MFA). Ending the Agreement signalled the World Trade Organization’s (WTO) promotion of free trade in this sector; but phasing in free trade here has proved to be far from frictionless.

Since January 2005, in the face of surging textile imports from China, the United States and European Union used the protectionist clause in China’s WTO accession agreement to restrain China’s imports. China threatened retaliation.

Although the EU and China eventually reached an interim agreement, in practice deferring the abolition of quotas to 2007, the issue remains unsettled. [Legislation pending in the U.S. Senate would slap heavy tariffs on Chinese imports due to China’s alleged undervaluation of its currency — ed.]

While there are basic common interest between the ruling elites and business sector of these three countires, periodic friction can be expected. This essay will not spill too much ink on the current negotiations, but rather focuses on a wider picture: What is at stake for working people around the world with the free trade model as promoted by the WTO in general, and the phasing out of MFA in particular? How does the “rise of China” relate to this question? Is it a zero-sum game or a win-win situation for other developing countries? Should working people in both the developed and developing countries view these changes with apprehension?

China — The Biggest Winner?

The Multi-Fibre Arrangement was always regarded by developing countries as a protectionist attempt by the wealthier countries. In one of the few industrial sectors where developing countries have comparative advantages, the agreement set a quota system for texiles being imported. Although many developing countries had always pressed to eliminate the MFA, it is an irony of history that upon its phasing out, countries like Mauritius, faced with the prospect of China Seizing the lion’s share, called for the MFA’s extension.

On the one hand the quota system was protectionist for the developed countries; on the other it spread out textile production for exports across 200 countries. According to a WTO report, eliminating quotas will eliminate the weaker of the developing countries, leaving only 30 exporting textiles to the wealthier nations. China’s share may be as high as 50% (currently 16%), while India’s is projected at 15% (currently 4%). Mexico, The Philippines, and Indonesia will see textile exports halved, while Mexico will drop from 10% to 3%. Meanwhile over the past four years 350,000 U.S. garment and textile jobs were lost, with probably more than half the remaining 700,000 at risk.(1)

In order to save texile and garment jobs in developed as well as developing countries, the International Textile, Garment, and Leather Workers’ Federation (ITGLWF) also called for the MFA’s extension. In a press release, the ITGLWF said that since the elimination of the quota system in 31 Dec 2004, serious plant closures and jobs losses were reported in Kenya, Cambodia, Mauritius, Sri Lanka, Philippines, and Tunisia. When its call failed, the ITGLWF came close to endorsing the EU’s policy of using the clause in China’s WTO accession agreement to restrict Chinese exports.

Along with American conservatives, the AFL-CIO is even more aggressive in attacking China’s surges of cheap imports. The union federation holds China responsible for plant closures and job losses. In 2000 the AFL-CIO fought two losing battles: to stop the Clinton administration from granting Permanent Normal Trade Relations status to China and to make the improvement of workers’ rights as a condition of China’s WTO accession.

In 2004 the AFL-CIO, in holding China responsible for the disappearance of 2.5 million manufacturing jobs, called for the imposition on China of trade remedies (like raising tariffs). Recently it joined the Chinese Currency Coalition to press the Chinese government to revalue the yuan. It seems that the AFL-CIO conceives of protectionism as a good way to keep jobs. Ironically, when it comes to free trade promoted by the North American Free Trade Agreement (NAFTA) and the WTO, the AFL-CIO does not remain loyal to trade protectionism. It opposes NAFTA and the WTO in principle. But in regard to China it was content in trying to append a labor clause on free trade agreements.

To identify China as the main winner and the United States and EU as losers over the end of the MFA is far from true. First, foreign textile companies account for one quarter of all Chinese textile export earnings; they, not Chinese companies, directly benefit from expanding Chinese exports.

Second, Chinese companies do reap the remaining three- quarters of export earnings, but generally their average profit rates are low. The majority subcontract to foreign companies, tus they only earn a fraction of value added, often just 10%.(2) Importers like Wal-Mart and other brand names pocket the major share of profit.

Third, the more China exports textile products, the more it needs to import textile machines from developed countries; Germany is the top textile machine exporting country. In fact China has become the world’s biggest textile machine importer, and is one-and-a-half times higher in more than the second country — Turkey.(3) In the exchange of labour-intensive products (Chinese textile) for capital-intensive products (U.S. and EU machinery), the latter get most of the value added. Therefore, the rise of China as a textile products exporter benefits Chinese, U.S. and EU companies.

Even though textile manufacturers in developed countries may lose market share, by forcing open the capital goods market and services of developing countries, the benefits can be ten times the losses for U.S. capitalists as a whole. In wealthy countries textiles production is a sunset industry. Stopping China’s imports will not save jobs there — Wall-Mart will simply shift sourcing from China to India.

Here it must be noted that China itself is losing textile and garment jobs. Between 1996 and 2001, to be competitive enough to drive others out of business, Chinese textile and garment sectors shed 52.5% and 28% of jobs respectively, amounting to 3.3 million and 0.5 million jobs. Twenty- six million manufacturing jobs were lost in the same period, accounting for 40.5% of all manufacturing jobs(4) — an unheard-of decline over such a short time.

Those retaining jobs in Chinese textile and garment factories saw their wages cut while intensity of labor rose. In July 2005 3,000 textile workers in Guangzhou struck against wage cuts and were suppressed. However, neither the AFL-CIO nor the ITGLWF ever mention China job losses when calculating losses in textile and manufacturing. If we think in terms of classes rather than countries, it is obvious that Chinese, U.S. and EU companies are all winners, while workers in all lands are the losers, albeit to different degrees under different time frames.

Targeting China and letting the U.S. government off the hook, or worse supporting U.S. protectionism, cannot benefit American workers. There is no essential link between protecting the market from cheap imports and keeping jobs. What links exist are weak, never direct, and dependent on many factors that labor cannot control — employers, not employees, control investment decisions and distribution of profit that directly affect labor.

Even in the short-term, when protectionism produces positive side effects that may keep jobs in certain sectors, in the long run there is no basic correlation. In this era of globalization, the link between trade (protectionist or free trade) and job creation, or more generally, the link between growth and job creation, is weaker than ever. To argue otherwise only helps the ruling elite pit workers in all countries against each other. U.S. labor should first and foremost hold the U.S. ruling elite responsible for job losses.

The Global “Race to the Bottom”

Inside and outside the AFL-CIO are dissenting voices against the obviously flawed argument against China. However, in counterbalance to U.S. imperialism, some may leap to the other extreme, embracing the Chinese government as “defender of the interest of developing countries.” In differentiating from those who China bash, they tend to overemphasise engagement with China. Some activists even promote engagement with China’s official trade union, the ACFTU.

The fairy tale that, in opposition to U.S. hegemony, China is defender of developing countries, denies the most obvious fact: in the name of free trade, but at the expense of her workers and weaker developing countries, China exports immense quantities of goods at ever-lower prices.In doing so China has become a powerful engine in a global race, driving working people across the world to the bottom. Despite occasional squabbles over the spoils, China serves both the interests of her elites and those in the United States, EU and Japan.

Chinese Communist Party leader Deng Xiaoping laid out his program for a new course in March 1989, three months before the Tiananmen Square massacre, saying, “China cannot allow demonstrations to happen too easily,….or else foreign investment will stop flowing in. Our strict control over this aspect will not deter foreign investment. Quite the opposite, they will be more relaxed [in investing]”.(5) Foreign investors are in full agreement with Deng, at least in practice.

Recently The Economist drew the following balance sheet: “The integration of China’s 1.3 billion people will be as momentous for the world economy as the Black Death was for 14th century Europe, but to the opposite effect. The Black Death killed one-third of Europe’s population, wages rose and the return on capital and land fell. By contrast, China’s integration will bring down the wages of low-skilled workers and the prices of most consumer goods, and raise the global return on capital.”(6) (Emphasis added)

The logical conclusion for labor should be to simultaneously oppose the Chinese, U.S., EU and Japanese elites, rather than siding with any of them.

While the media mainly focus on negotiations between China, the United States and the EU, they largely ignore the fact that developing countries like Brazil are also announcing restrictions on China’s textile imports. For Mexico, China’s threat is more pronounced. In 2003 Mexican manufacturers complained that China had overtaken Mexico to become the No. 2 exporter to the United States.(7)

In order to join the WTO the Chinese government made huge concession to the United States and EU. These were concessions that many developing countries like India had previously resisted. Instead of the 10% domestic support in agriculture that developing countries are entitled to, China accepted 8.5%. Her tariff cut is much deeper than India’s.(8) In the current General Agreement on Trade in Services negotiations, the United States and EU are delighted that China was so forthcoming in opening up her services sectors.(9) China’s cutthroat competition also helps the United States and EU to press developing countries to follow China’s example.

China’s competitiveness lies in terribly low wages and effective state control over big and small things. State despotism denies workers and farmers the basic right of free association, robbing them of the elementary tools of self-defense. Governments in developing countries seldom take seriously labor rights as codified in laws. In their Export Processing Zones labor codes are generally not implemented. However, few are as complete in suppressing workers’ rights as China.

The Chinese government removed the right to strike from the constitution in 1982. She only allows the existence of the (fiercely pro-business) officially run trade union, the ACFTU.(10) The official press often admits that the ACFTU practically allows capitalists to set up “trade union branches” with no genuine membership, with plant managers as “chairpersons,” and no collective bargaining. When Western labor activists argue for engagement with the ACFTU, few have little idea that it is hardly a union in the proper sense of the word.

In addition, the government imposes countless measures to exert severe social control over working people, especially the peasants and migrant workers. For instance, the household registration system acts as a kind of social apartheid, which systemically discriminates against migrant workers by barring them from enjoying public provisions in the cities. They simply cannot survive in the cities outside factories and dormitories. This is an effective way to force them to accept starvation wages, appalling working conditions, and forced overtime.

In colluding with the government, employers squeeze the maximum labor within the shortest time possible. This effectiveness in exploitation, rather than low wages alone, makes China so competitive. While wages in Vietnam are lower than in China, U.S. garment buyers are abandoning Vietnam to source from China — because, we are told, while Vietnam manufacturers need four weeks to produce 100,000 pairs of trousers, Chinese companies only need one week.

Aspects of Dependent Development

One of the greatest recent events that will shape global capitalism for years to come is the integration of China into the world market. Economists told us: “the entry into the world economy of China, India and the former Soviet Union has in effect doubled the global labour force (China accounts for more than half of this increase)… China has almost 200 million underemployed workers in rural areas …It will continue to subdue wage growth and global inflation. Profit margins could also remain historically high for a period.”(11) This is indeed good news for business.

After 13 years of rapid marketization, China’s GDP now ranks sixth in the world; she is also the fourth biggest exporting country. In 2003 she produced half the world’s cameras and 30% of the world’s air conditioners and TVs. Since 2003 China has been the top foreign direct investment (FDI) inflow country. Although capital export is still small, it is rising quickly. When Larry Summers was with the World Bank, he projected that China’s GDP would surpass that of the US in 2010. He soon retreated from such gross exaggeration but others simply deferred the date to 2020.(12)

Nonetheless, and despite the neo-conservatives’ China bashing, China’s development is that of a dependent nature, and first and foremost dependent on the United States. While China ranked sixth in global GDP terms in 2002, it ranked 111 in per capita terms. China is the fourth biggest exporting country, but more than half of the amount is from foreign investors. Much of the profit made will sooner or later be repatriated. What is more, half of the exports contain imported capital goods and spare parts, which means that China is largely processing imported goods with little value added. For example, although China exports large quantities of electronic goods, only 15% of the value is domestically added.(13)

The United States can tolerate China’s huge trading export surplus because, apart from what has been said, China has used her dollar savings to buy a huge amount of U.S. bonds. China can produce high end products, but this must be qualified by the fact that the core technique has to rely on developed countries. Chips in computers and mobile phones, laser readers in DVDs, high quality steel for making cars, compressors in air conditioners, display tubes in televisions, etc. still largely depend on imports from developed countries.

As many as two-thirds of capital goods, 85% of chips, 80% of petrochemical equipment, 70% of numerical controlled machine tools, 100% of optical fabric manufacturing equipment and so forth, must be imported.(14) The Beijing Daily complained that although 70% of the world DVDs are made in China, the country has to pay $18 for royalties for every set of DVD sold, and domestic producers can only pocket $1 profit.(15)

The huge inflow of FDI to China has also taken its toll on domestic producers, with foreign firms accounting for 31% of manufacturing output in 2003, up from 17% in 1997(16); in 1992 it was only 9.5%. In telecommunications the situation is more significant, with foreign capital accounting for 46.5% of output and 75.6% of export in 2000 respectively.(17) Once fiercely autarkic, China today is dependent on foreign capital and foreign markets. Any significant slow down of FDI and shrinking of foreign markets spells disaster for China.

Developmental Potential of Capitalist China

Every discussion about China must take into account that the country is full of contradictions. Huge in both size and population, China is fast developing new branches of industry.

Although far from overtaking the Japanese, U.S. or EU economies, by 2002 China was already the world top producer in 80 items, including color TV, washing machines, DVDs, cameras, refrigerators, air-conditioners, motor bikes, microwaves, PC monitors, tractors, bicycles.(18) China is also able to upgrade manufacturing quickly. For example, China developed IT products from scratch.

The rise of China, not only as a big country but also a country which is more and more export oriented, implies greater competition than ever. More factories in developing countries throughout Asia, or even as far away as Mexico, are closing down and moving China. This is resulting in millions of job losses. A tremendous restructuring of global division of labor among is under way.

Old supply chains in Asia gave way to a new supply chain. Up until the 1980s, there were three tiers: The Japanese used the analogy of a flock of flying geeseto describe the chain, with Japan the leading goose as the chief Asian investor, pocketing the largest share of value added; “the four dragons” (Hong Kong, Singapore, Taiwan and South Korea) as the middle tier; the chief Overeseas Emerging Markets producers for Japan; with the Association of South East Asian Nations (ASEAN) countries occupying the third tier. Despite the fact that the ASEAN countries got only a small part of the value added, at least these countires were able to partially industrialize their country within a relatively short period of time.

The rise of China greatly transforms the old order of this flock, putting at risk the weaker members. Given China’s manufacturing potential, it is probable that someday China can produce everything from low-end to high-end product. This poses a big competitive threat to ASEAN countries — or even Taiwan and Korea. The Japan external trade organization reported that for electronic products, China can now produce 20-30% cheaper than the ASEAN counterparts.(19)

The Economist tried to comfort developing countries with the remark that China is also importing in great quantity from Asia, and as such promotes economic growth there too. It is true. In fact ASEAN countries enjoy favorable balances of trade with China. So does Taiwan. When ASEAN countries are losing their U.S. market share to China, they are compensated with a growing share in China market.

The notion that the rise of China need not be a zero-sum game for developing countries should be qualified by the fact that there are great differences among the latter. For smaller and weaker countries, their economic performances are at risk. We must also bear in mind the need to think in terms of social classes rather than national boundaries.

It is not so much that China’s rise as a major exporting country necessarily stops other developing countries from enjoying economic growth. Rather it necessarily implies a tremendous economic restructuring. The result implies downward pressure on jobs and wages in many countries, something that rarely bothers the business sector. For example, between 1985 and 2000, Korea and Taiwan saw their new value added in light industry as proportional to their GDP shrank from 14% to 4%(20), resulting in severe jobs relocations and downward pressure of wages.

Hong Kong’s manufacturing is close to leaving for Mainland China altogether, with the same downward social mobility for industrial workers. The next wave is the relocation of many service sector jobs. The relocation of manufacturing and service sector jobs from Taiwan, Korea and Hong Kong to Mainland China does not necessarily bring about a decrease in their economic growth or profit growth, but it necessarily means jobs losses and downward social mobility for workers.

In ASEAN countries, it seems that the scale of restructuring is less significant, but much more research needs to be done before conclusions can be made. What is more, it is less a matter of things as they are today, but more a matter of what will be coming in the next five to ten years.

[Part 2 of this essay will appear in our next issue.]

Notes

- “Trading down,” David Moberg, The Nation, posted 22 December 2004 (10 January 2005 issue).

back to text - Hong Kong Economic Journal, 17 Sept 2005.

back to text - Ming Pao, Hong Kong, 8 June 2005.

back to text - Wo Guo Zhong Chang Qi Shi Ye Wen Ti Yan Jiu. (Research on medium- and long-term unemployment problems in China). Jiang Xuan, 2004, Publishing House of the Renmin University of China, 79-181.

back to text - Deng Xiaoping wenxuan (Writings of Deng Xiaoping), vol III, People Publishing House, Beijing, 1993, 286.

back to text - “The Dragon and the Eagle,” The Economist, 30 Sept 2005.

back to text - Some Mexican manufacturers, after traveling to China, were dispirited and had this to say: hey [Chinese) have extremely aggressive tax incentives, low salaries, very aggressive worker training, and a supply chain that allows them to have immediate access to the latest technology. Business Week, 22 December 2003.

back to text - For instance, see hina and the WTO: An Economic Balance sheet by Daniel H. Rosen, Institute for International Economics web site.

back to text - Commerce Secretary Bo Xilai boasted that China has opened 62 percent of its service sectors, compared to 20-40 percent for developing countries in general. Hong Kong Economic Journal, 10 June 2005.

back to text - http://news.xinhuanet.com/focus/2004-09/27/content_2014769.htm.

back to text - “China and the World Economy,” The Economist, 28 July 2005.

back to text - China on the Brink, by Callum Henderson, 1999, McGraw-Hill, US, 37.

back to text - China Economic Review, Hong Kong, October 2005, vol 15, no.10, 35.

back to text - Quanqiuhua shidai de zhongguo zhizao (Chinese manufacturing in an age of globalisation), edited by Zhu gaofeng, published by Shehui kexue wenxian chubanshe, 2003, Beijing, 51.

back to text - Beijing Daily, 11 March 2005, quoted in Ming Pao, Hong Kong, 8 Sept 2005.

back to text - Jingji quanqiuhua qushixia de guojia jingji anquan yan jiu (Research on National Economic Security Under Economic Globalisation), by Chen shuxiong, Hunan People Press, 2005, 132.

back to text - Higashi Asia Kokusai Bungyo To Chugoku, by Kimura Fukunari, 2002, Tokyo. Chinese version, 2004, Taipei, 26.

back to text - 2003 Zhongguo Guoji Diwei baogao (2003 China’s place in the world), published by Shanghai Far East Press, 2003, Shanghai, 75.

back to text - Higashi Asia Kokusai Bungyo To Chugoku, by Kimura Fukunari, 2002, Tokyo. Chinese edition, 2004, Taipei, 194.

back to text - The Five Great Myths About China and the World, by John Anderson and Hu zuliu, Chinese edition, 2003, Beijing, China Finance Press, 63-70.

back to text

1

ATC 125, November-December 2006