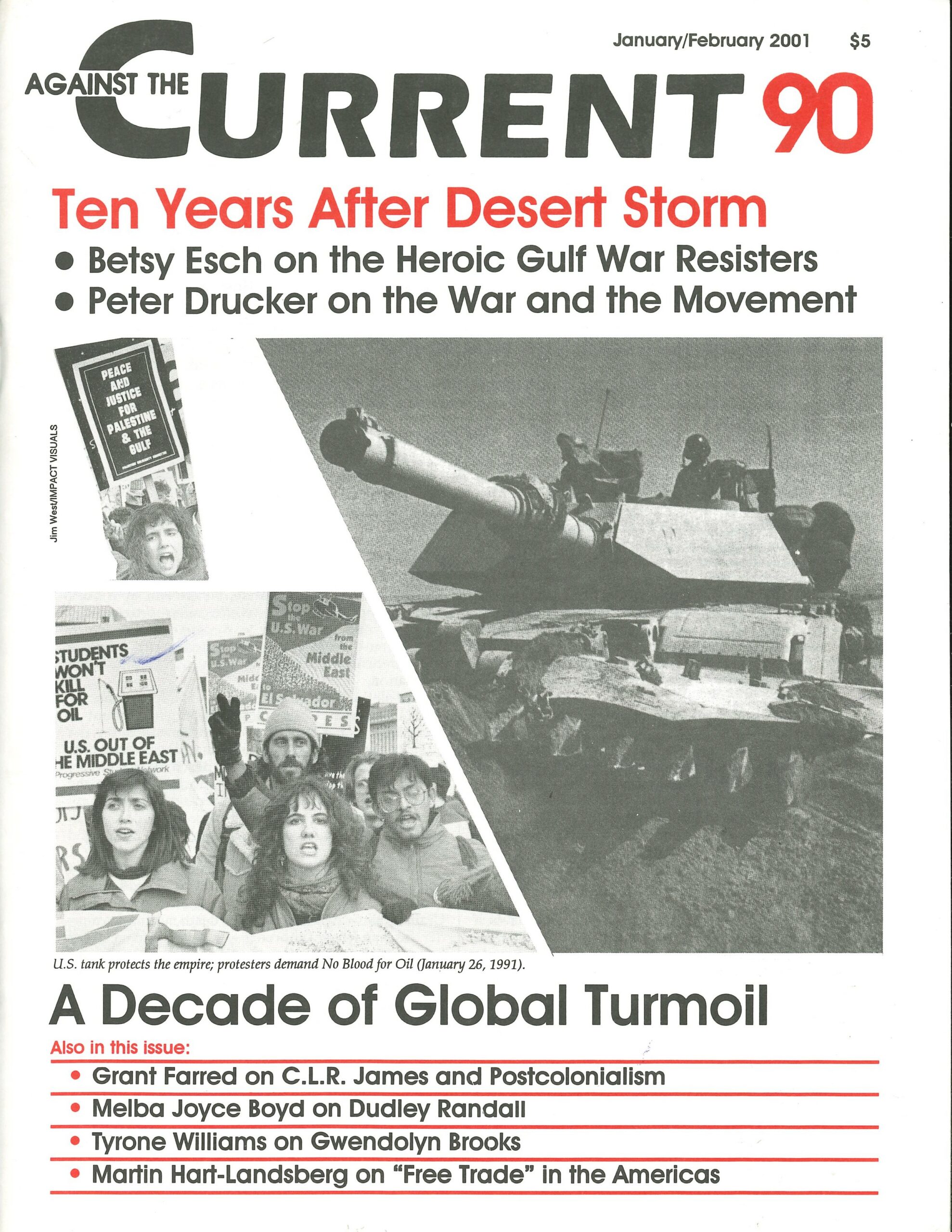

Against the Current, No. 90, January/ February 2001

-

Stolen Vote, Wasted Votes

— The Editors -

Race and Class: The Stolen Vote

— Malik Miah -

Labor for Mumia vs. Reno's Justice

— Randy Christensen -

Showdown for Mumia Abu-Jamal

— Steve Bloom -

School Vouchers Scam Goes Down

— Louise Cooper -

Confronting the School of Assassins

— Peter Olson -

Living Wage Movement: An Update

— Stephanie Luce -

South Africa's Political Change

— Patrick Bond -

Idaho, Mountain Lions and a Rattlesnake Friend

— Hunter Gray -

Ralph Nader and the Legacy of Revolt (Part 3)

— Walt Contreras Sheasby -

The Rebel Girl: Supremes in the Bush

— Catherine Sameh -

Random Shots: Annals of Combat

— R.F. Kampfer -

Letter to the Editors

— Sidney J. Gluck - Chapters in Black History

-

Remembering Dudley Randall

— Melba Joyce Boyd -

Gwendolyn Brooks 1917-2000

— Tyrone Williams -

C.L.R. James and Anti-/Postcolonialism

— Grant Farred - Ten Years After Desert Storm

-

Honoring Our Gulf War Resisters

— Betsy Esch -

Remembering the War and the Movement

— Peter Drucker - Ravages of Corporate Free Trade

-

Metalclad vs. Mexico, Toxic Waste and NAFTA

— Gerard Greenfield -

FTAA, The Hydra's New Head

— Martin Hart-Landsberg - In Memoriam

-

Daniel Singer

— Tariq Ali; David Finkel

Gerard Greenfield

LAST AUGUST 25 the NAFTA Tribunal for the case of Metalclad Corp vs. Mexico ruled in favor of Metalclad, ordering the Mexican government to pay US$16.7 million in compensation. It is the first ruling in an investor-to-state lawsuit under NAFTA.

In October 1996, Metalclad Corporation, a U.S. waste-disposal company, accused the Mexican government of violating NAFTA’s Chapter 11 when the state of San Luis Potos<161> refused it permission to reopen a waste disposal facility.

The state governor ordered the site closed down after a geological audit showed the facility would contaminate the local water supply. The governor then declared the site part of a 600,000-acre ecological zone. Metalclad claimed that this constituted an act of expropriation and sought US$90 million in compensation.

Other Chapter 11 Cases

In 1997 the U.S. chemicals giant, Ethyl Corp, used NAFTA’s Chapter 11 to sue the Canadian government for a ban imposed on MMT, a gasoline additive produced by Ethyl which is toxic and hazardous to public health. Ethyl claimed that the ban “expropriated” its assets in Canada and that “legislative debate itself constituted an expropriation of its assets because public criticism of MMT damaged the company’s reputation.”

Ethyl sued the Canadian government for US$250 million. A year later, in June 1998, the Canadian government withdrew environmental legislation banning MMT, and paid Ethyl Corp US$13 million to settle the case.

Three more suits are outstanding against the Canadian government, three against the Mexican government and two against the U.S. government.

The case against the United States by a Canadian corporation, Mexthanex, also gained attention with a September 5 article in The National Post announcing that Methanex will seek US$970 million in compensation for environmental laws in California which are “tantamount to expropriation.”

All of these cases are based on the “rights” of investors guaranteed in NAFTA’s Chapter 11, where a broad definition of “expropriation” is combined with the right of investors to directly sue governments for compensation (under “investor-to-state” dispute resolution).

A September 1 article in The Globe & Mail on the Metalclad ruling (again) drew attention to the threat posed by Chapter 11 to government regulations protecting the environment and public health. This may even add to the ongoing (though low-key) debate on whether the wording of investment rules should be revised.

The Root of the “Problem”

It is important, however, to understand the Metalclad ruling in its wider context, not only as an assault on environmental regulation, but in the politics of government regulation as a whole.

In most reports on the Metalclad vs. Mexico case the “problem” was that state legislation caused Metalclad to lose the value of its investment. The debate is then carried out in terms of the validity of the legislation in protecting the environment and public health.

But we should remind ourselves that this kind of legislation does not appear out of thin air. As with most social and environmental regulation protecting the rights and interests of working people, it was the result of sustained local struggle:

- “Metalclad wants to reopen and expand a toxic dump site in Guadalcazar County in the northern part of the north-central state of San Luis Potos<161>. That the company might succeed in doing so—despite the opposition of many local officials and citizens—has kept Guadalcazar residents on edge. Residents do not trust the federal government to enforce environmental laws. When the Mexican company that Metalclad bought its toxic dump from refused to obey federal orders to close down in 1991, local residents—-brandishing machetes—enforced the order themselves.”—Multinational Monitor, (October 1995)

- “When local authorities ignored the complaints of outraged community members, citizens brandishing machetes mobilized in September 1991, preventing tractor trailers from unloading more toxic wastes.”—Multinational Monitor (October 1995)

From this perspective it is clear that the “problem” began not with the environmental regulations but with a well-organized protest by the local community. This struggle from below forced the municipal government of Guadalcazar to impose the ban, which in turn forced the state governor to respond.

Thus the NAFTA ruling in favor of Metalclad is not just an assault on environmental regulation. It is an assault on the original local struggle that brought this legislation into being.

- In another case, it was reported that “. . . peasants held a week-long sit-in at the end of September 1998, at Metalclad’s construction site for the latest proposed industrial toxic waste site in Mexico, in El Llano, Aguascalientes.”

From the very beginning the federal government of Mexico supported Metalclad’s investment project and attempted to force the state of San Luis Potosi to reverse its ban. Though the NAFTA ruling against Mexico means that the federal government must pay compensation to Metalclad, the federal government can still treat it as a “victory” against San Luis Potos<161> and a warning to other states.

This not only applies to the case of Mexico. In the United States and Canada the reality is that federal governments are often willing to “lose” these cases in order to discipline provincial, state or municipal governments that have adopted progressive social and environmental policies. Where federal governments do not have the legal or political power to reverse such legislation, it can allow the “external” intervention of NAFTA to act on its behalf.

“Regulatory Expropriation”

Over the last ten years the concept of “regulatory expropriation” has become an important part of the neoliberal or “free trade” agenda. It is well known that this agenda involves breaking down barriers to trade and investment, creating more freedom for corporations to pursue profits at any social or ecological cost.

These barriers include the regulation of corporate activities by governments, such as laws on employment, environmental protection and public health. It also includes government regulation in the form of public sector services and utilities, where private industry is excluded.

From the perspective of corporations, this kind of government regulation reduces the value of their potential profits. In other words, it prevents them from making even higher profits. This then is tied to the concept of expropriation.

According to a strict legal definition, expropriation is understood as the taking of private property (land) by the government. For example, if a government builds a highway that goes through private property, confiscation is considered an act of expropriation and typically compensation is paid to the private owner.

However, NAFTA and other recent international treaties use an expanded definition of expropriation. There are three important aspects of this expanded definition:

- Private property not only refers to land and physical assets, but the market-determined commercial value of property, including a company’s asset value and future profit earnings.

- Traditionally compensation was awarded only when the whole value of property was lost. Under the new definition it applies when any part of its commercial value is lost.

- It is not only expropriation but acts “tantamount to expropriation” that require compensation. This means that a wide range of government policies, laws or administrative measures can be treated as having a similar effect as expropriation.

In this way the neoliberal attack on government regulation is combined with a very broad definition of expropriation to produce the new legal-political concept of regulatory expropriation:

- Any national or subnational government regulations (laws, treaties, administrative measures, policies) which reduce or limit the value of the private commercial property can be considered a form of “regulatory expropriation.”

Regulatory expropriation not only changes the meaning of expropriation, adding to the list of foreign investors’ rights, but redefines the meaning of government regulation. A wide range of government policies, administrative measures and laws which restrict, moderate, guide, adapt or deter the activities of foreign investors can now treated as acts of taking away the property of these corporations.

The “Takings” Movement

It is important to recognize that regulatory expropriation is not just a new concept in international trade and investment treaties, but a political project of a well-organized corporate movement. This movement began under the Reagan administration and is referred to as the “takings movement” or “takings project.”

Under Reagan, right-wing judges and lawyers used a series of Supreme Court cases to redefine the meaning of the “takings clause” in the Fifth Amendment of the U.S. Constitution. This clause reads: “. . . nor shall private property be taken for public use without just compensation.” By applying an expanded definition of “private property” and “taking,” it was ruled that government regulations which limited the commercial value of investment projects or restricted profit earnings could be treated as acts of expropriation.

Most of these cases concerned lawsuits by property developers against local and state governments for laws on ecological zoning and environmental protection. Property developers claimed that this legislation negatively affected their commercial value (including future profits). As a result local governments were forced to pay compensation to these companies for “regulatory takings” (expropriation).

Some states passed laws to protect companies against “regulatory takings” but by the end of the 1980s attempts to pass this kind of legislation were less successful. When attempts to pass federal laws on “regulatory takings” failed, the right-wing judicial/corporate movement shifted its focus to NAFTA.

One of the most important outcomes of the “takings movement” was that local governments were forced to do a “takings assessment” before introducing new laws. Draft laws were being watered down or revised to avoid the possibility of expensive lawsuits in the future. This fear of being sued for expropriation by corporations became part of the law-making process. NAFTA has had a similar effect at a trinational level.

Conclusion

A Free Trade Area of the Americas (FTAA) negotiating group on investment rules was formed in 1998 and is currently drafting the investment chapter of the FTAA. This will be ready by January 2001 at the latest, and will be finalized in Argentina in April 2001 immediately before the Summit of the Americas in Quebec City. Despite opposition to the inclusion of NAFTA Chapter 11 or MAI-like rules in the FTAA, there are strong indications that this is going ahead.

Although an investor-to-state complaint system might be successfully opposed, there is a real risk that the expanded definition of expropriation will be included.

It is important to recognize that the U.S. “takings movement” and NAFTA’s model of an expanded definition of expropriation has already been included in several new bilateral investment agreements in the region. The United States has signed such agreements with Argentina, Bolivia, Ecuador, Honduras, Jamaica, Nicaragua, and Trinidad & Tobago. Canada has signed such agreements with Argentina, Barbados, Costa Rica, Ecuador, Panama, Uruguay, Venezuela and Trinidad & Tobago.

The vague wording “tantamount to expropriation,” “equivalent to expropriation” or “expropriation, nationalization or measures which have a similar effect” allows a broad definition of acts of expropriation to include government regulations.

As part of the broader fight against free trade and investment regimes, we must fight to exclude the concept of regulatory expropriation from international agreements.

This involves reinstating the primacy of national regulations on public health, health care, education, environment, community development, employment protection, trade union and labour rights, natural resources (e.g. water), genetic resources (e.g. seed), etc, over and above trade agreements. This means effectively excluding the above-mentioned social sectors from the overall terms of trade agreements.

In short, with regard to investment rules on regulatory expropriation our immediate priorities must be:

- Severely restrict the definition of expropriation.

- Narrowly define the meaning of property so that it cannot be interpreted to include market-determined commercial asset value or future profit earnings.

- Expand the definition of “public purpose” that allows for expropriation without compensation. Therefore regulations on the social sectors listed above should be treated as a legitimate public purpose. This would effectively exclude these regulations from corporate compensation claims.

Gerard Greenfield is a labor research activist working in East and Southeast Asia.

ATC 90, January-April 2001