Against the Current, No. 57, July/August 1995

-

What Is the Main Danger?

— The Editors -

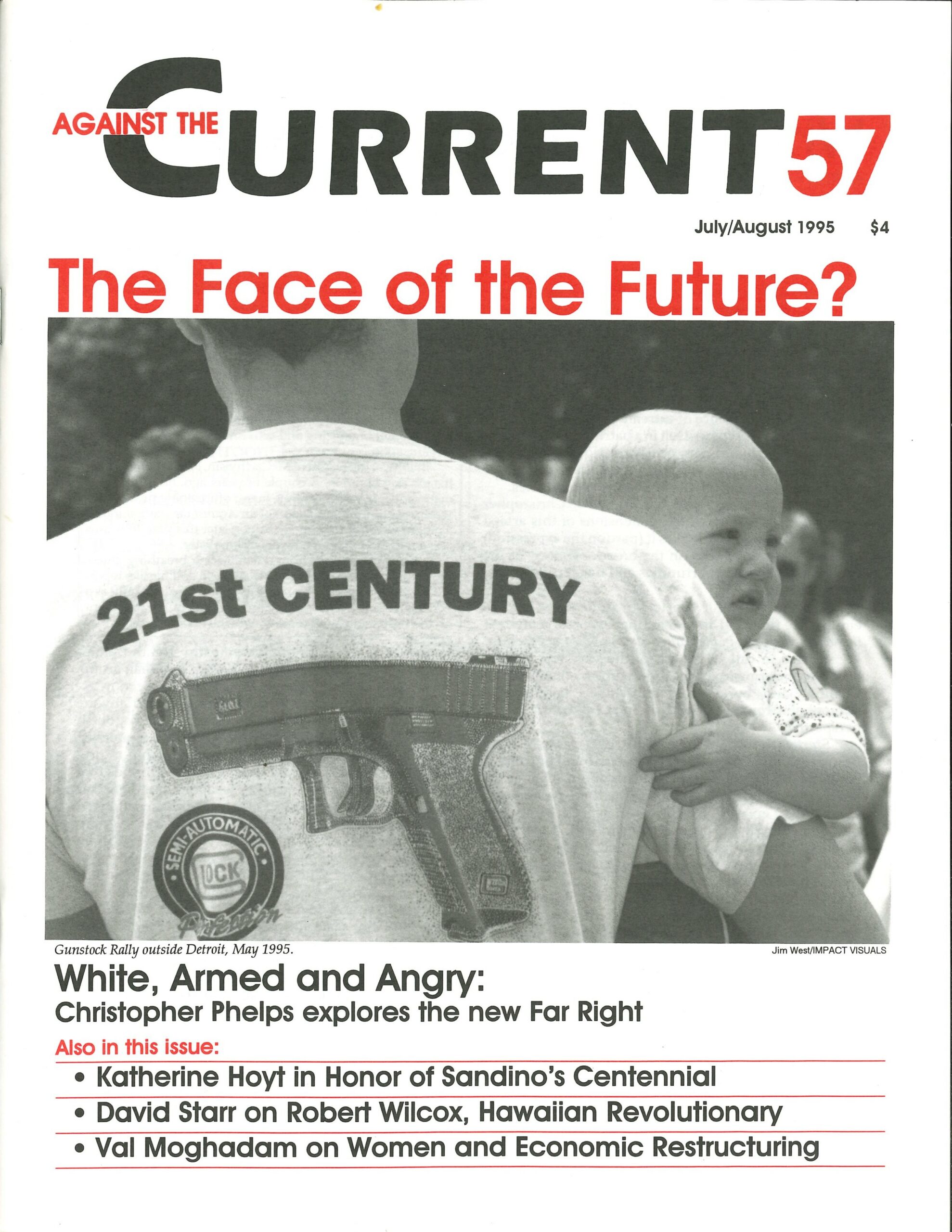

The Explosive Rise of an Armed Far Right

— Christopher Phelps -

Fighting the Far Right

— interview with Jonathan Mozzochi -

Why Is the Far Right Growing?

— Christopher Phelps -

Closing the Courthouse Doors

— Michael Steven Smith -

Robert Wilcox and the Revolution of 1895: Hawaiian Revolutionary Honored

— David Starr -

Gender & Post-Communist Economic Restructuring: How Women Pay the Price

— Val Moghadam -

Race, Class and Sandino's Politics

— Katherine Hoyt -

Finance & Industrial Capital in the Current Crisis

— Mary Malloy -

Open Letter to an Israeli Settler: I Will Not be Your Guard!

— Sergio Yahni - Letters to Against the Current

-

On Bosnia and the Left

— Attila Hoare -

Radical Rhythms: In Honor of Two Musical Titans

— Kim Hunter -

Rebel Girl: Sports Equality, Where Money Talks

— Catherine Sameh -

Random Shots: PROgress and CONgress

— R.F. Kampfer - Reviews

-

Power, Money, Marxist Theory

— Charlie Post -

Shachtman and His Legacy

— David Finkel - Dialogue on American Trotskyism

-

American Trotskyism: A Response

— Frank Lovell -

The Lessons of Working-Class History

— Archie Lieberman - In Memoriam

-

John Evans

— David Finkel

Michael Steven Smith

AS PART OF their contract on America, the Republicans in the House of Representatives — with some Democratic help — passed three bills which would radically change our judicial system. These measures would deny victims of negligence their right to a jury trial in cases involving product liability, medical malpractice and security fraud.

Then, after some public debate, the Senate took up the measures passed by the House and only approved one of them, albeit a significant one, which would cap punitive damages on product liability cases involving gross malfeasance on the part of reckless corporations. The bills now await a House/Senate conference, another vote in each chamber, and the action of President Clinton.

Litigation Explosion?

This attempt to close the courthouse doors to many victims of negligence has been waged by foisting a number of myths on the public in what Ralph Nader described as “one of the most unprincipled public relations scams in the history of American industry.”

These are the myths: We have too many lawyers. We litigate too much. Jury verdicts are too high. Too many punitive damage awards are given. American industry has been rendered non-competitive and indeed our health delivery system has been compromised.

Former Vice-President Dan Quayle told the American Bar Association that America has 70% of the world’s lawyers and asked if we really need that many. He was lawyer bashing, but in fact he was victim bashing. There is no basis for his estimate. The truth is the number is estimated to be between 25-35%, which is not surprising considering the nature and global reach of the American economy.

Under capitalist relations of production most law concerns property. Everything is reduced to a commodity, everything has a cash nexus, and lawyers are necessary to put forward the rights of property on behalf of contending claimants.

Mr. Quayle headed the President’s Council on Competitiveness. Its well-publicized report began with an untruth: “America has become a litigious society.” The fact is Americans are suing at about half the rate they did at the beginning of the 19th century. The National Center for State Courts keeps these statistics and found no evidence of any “litigation explosion.”

In fact, the number of tort cases filed in state courts, about 5% of all civil cases, is going down. No proponent of civil justice “reform” has ever suggested limiting the cases that truly have multiplied in recent years: businesses suing businesses.

Malpractice cases amounted to only 7% of tort cases filed in state courts in 1992. That is 70,000 cases, compared with more than 80,000 deaths annually and several hundred thousand serious injuries caused by medical malpractice. Only about 10% of medical malpractice incidents generate a claim.

What about the size of verdicts? The Rand Corporation’s Institute for Civil Justice, which is funded by insurance companies and business interests, reported that over the last twenty-five years, tort verdicts overall have remained even with inflation. The total cost of the tort system is $29 to $36 billion, not the $300 billion Mr. Quayle wildly charged before the American Bar Association, where he claimed the tort system put America at “a self- inflicted competitive disadvantage.”

Are punitive damages running crazy? Hardly. They are seldom awarded in personal injury cases. In the area of product liability, which is the center of the current controversy, the statistics are revealing. Only 355 punitive damage awards came down between 1965

to 1990.

The myth of the litigation explosion, the stepped-up lawyer bashing and the current attack on the civil justice system can be traced back a decade when the insurance industry lost money as interest rates plummeted and investment income could not offset claims.

The industry was criticized for mismanagement. In March 1986, the Insurance Information Institute launched a $6.5 million PR campaign to “change the widely held perception that there is an `insurance’ crisis to the perception of a `lawsuit crisis’.” This campaign was adopted and given greater legitimacy by a Reagan Administration task force chaired by Ed Meese and then taken up by Gingrich and his minions.

Meanwhile, as the victims were blamed for the “crisis,” the insurance industry, after losing $5 billion in 1985, made a comeback. The industry earned $6 billion in 1986, $14 billion in 1987 and $16 billion in 1988.

The Content of the “Reforms”

The three new bills wending through congress this year are the Common Sense Product Liability and Legal Reform Act, the Attorney Accountability Act, and the Securities Litigation Reform Act.

Their passage was helped by the stereotype many people have of lawyers. In Jurassic Park, after all, the dinosaur ate a lawyer, not a chiropractor or a C.P.A.

Apart from their Orwellian designations, these bills would, for the first time in our history, impose federal standards on what had been the rights of states. Punitive damages would be capped, as would damages for victims’ suffering and physical pain.

Retailers would be let off the hook for selling a defective product and big businesses or its insurance companies in these cases would be responsible only for the proportion of the harm they caused.

In defective or dangerous product cases, injured citizens will be discouraged from going to court or encouraged to settle for less than they deserve because of a modified “loser pays” rule. This concept is governed from the British class ridden justice system and makes the injured victim pay the cost of the corporate or insurance company legal defense if a jury verdict is less than what had been offered in settlement.

The number of cases filed on behalf of injured victims will go down. Lawyers who represent consumers and whose fees are contingent on victory cannot afford to take the cases. They will be particularly discouraged in difficult cases like suing the tobacco industry for knowingly addicting consumers to cancer-causing products. Investors will be discouraged from bringing lawsuits charging companies with fraud.

Commercial litigation is excluded from the limits on damages. “If a machine blows up at a factory, the workers would be limited, but the factory owner isn’t,” Association of Trial Lawyers of America’s Stewart said, pointing out the hypocrisy of the Republican sponsors.

The civil jury system was established in our country as a byproduct of the American Revolution. It allows an injured party to appeal to a jury from his or her community for just compensation for negligent conduct.

In the landmark case of Marbury v. Madison, Chief Justice Marshall wrote: “The very essence of civil liberty certainly consists in the right of every individual to claim the protections of the laws, whenever he receives an injury. One of the first duties of government is to afford that protection.”

But rather than protecting or even expanding the rights of our citizens, the pendulum is swinging the other way. Not coincidentally the abolition of trial by jury occurred in Germany in 1924; Italy in 1931; Portugal in 1927; Spain in 1936, and Vichy France in 1941.

Our country, unlike other industrial countries, lacks universal health care protection. Likewise, we do not have guaranteed disability income for those unable to work. A negligently injured person is protected — more or less — as a practical matter, only if the defendant is insured. So it still is a hit-or-miss system. And even this has been constricted and is further threatened.

Those of us who practice labor law, constitutional law, or criminal law have seen this erosion of industrial rights over the last dozen years as the American economy has shifted its wealth from the poor to the rich. Closing the courthouse doors to victims of negligence is part of this trend, and the myth of “litigation crisis” has served only to oil the hinges on a door that continues to close.

ATC 57, July-August 1995