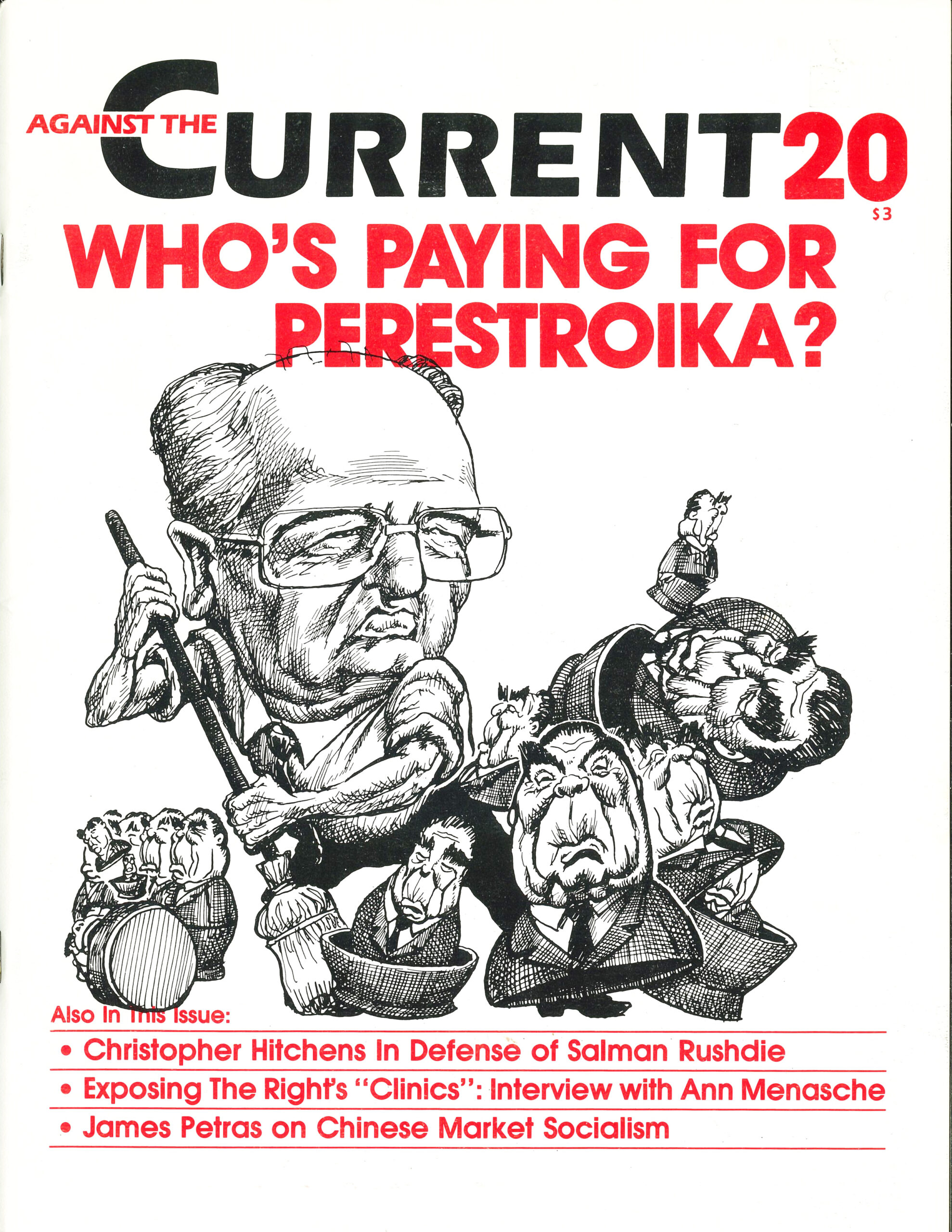

Against the Current, No. 20, May/June 1989

-

Drawing the Line at Eastern

— The Editors -

El Salvador After the Election

— David Finkel -

In Defense of Salman Rushdie

— Christopher Hitchens -

The Right's Phony Abortion Racket

— an interview with Ann Menasche -

The Deadly Health Care Crisis

— Peter Downs -

Contradictions of Market Socialism in China

— James Petras -

Sylvia Pankhurst and the Social Soviets

— Barbara Winslow -

Random Shots: Fat Rulers in Lean Times

— R.F. Kampfer - Viewpoints

-

The Left Press and Puerto Rico

— John Vandermeer -

Child Abuse and the System

— Linda Manning Myatt - Perspectives on Perestroika

-

Conversations in Moscow

— Tom Twiss -

Perestroika and the Working Class

— David Mandel -

Gorbachev: An Appraisal in Human-Rights Terms

— Witold Jedlicki -

Soviet Jewry's Unfinished Agenda

— Larry Magarik - Dialogue on Afghanistan

-

A Further Comment on Afghanistan

— Chris Hobson -

Who's Fighting for What?

— David Finkel -

A Brief Response to Responses

— Val Moghadam - Review

-

1930s Women Writers: A Fresh Look

— Robbie Lieberman

Peter Downs

IN OCTOBER 1983, doctors diagnosed Joe Allen Bennett of College Grove, Tenn., as having lung cancer. They referred him to the Park View Hospital in Nashville for the radiology treatment he needed.

Park View was owned by the Hospital Corporation of America (HCA). That company demanded $500 from Bennett before it would begin treatment. Bennett didn’t have that much money. He lived on a fourteen-acre farm with his disabled wife. Together their monthly income totaled $328, and they had no medical insurance. Nor did Bennett’s sister, Mattie Sue Owens, have $500.

They offered the hospital $300. No deal. It was $500 or no treatment. Upset, Bennett and Owens talked with HCA vice-president John Colton. “HCA doesn’t provide care to anyone without assurance of payment,” he told them.

Bennett and his relatives then managed to scrape together $500. The treatment began, but it didn’t last long. After a few days, HCA upped its demands; Bennett had to pay another $500 or the treatment would stop. He was in great pain and coughing up blood, but his family was out of money.

Bennett’s relatives went to Legal Services attorney Gordon Bonnyman for help. He talked with HCA’s counsel, who told him that the company “turned down people in similar circumstances everyday” and would not make an exception for Bennett.

Bonnyman threatened legal action. He prepared to sue HCA for abandonment, denial of emergency care, intentional infliction of emotional distress and extortion. On the day he was to file the complaint, the company agreed to continue treatment. Bennett died in June 1984.(1)

Stories such as Bennett’s appeared on news programs throughout the United States in the early eighties, but the for-profit chains kept growing. By 1986, they controlled over one-seventh of the nation’s hospital beds.

Most of that growth has been in the South and Southwest, where a rapidly growing population combines with few hospital regulations to make expansion cheap and profitable. In California, Florida, Louisiana, Tennessee, and Texas, for-profit companies own approximately 30% of the company hospitals. The top four investor-owned hospital chains, which control over 70% of for- profit hospitals, are headquartered in Tennessee, California, and Kentucky. The largest chain, HCA, has over one-half of its 486 hospitals in only three states: Florida, Texas and Tennessee.(2)

For-profit hospitals have been part of the American health system for a hundred years, ever since advances in controlling infection and in surgery transformed hospitals from being places to die into places where one could also get well. Such hospitals, however, tended to be small and owned by one or a handful of doctors. During the Depression, the number of such hospitals dropped sharply. From 1944 to 1964, they accounted for a fairly stable 2% to 3% of the nation’s hospital beds.(3)

Those traditional proprietary hospitals gave ground to new, growth-oriented, for-profit hospitals in the 1960s. American Medical International claims it invented the “investor-owned hospital industry” in 1960, but the real foundation for today’s proprietary hospital chains was the Medicare and Medicaid legislation of 1965. During the two decades prior to the passage of that legislation, federal spending on hospital care largely took the form of spending on public hospitals or grants given to private hospitals in return for a promise to provide a specified level of charity care.

With the federal government’s “war on poverty,” Congress decided to move away from public hospitals and instead to pay the private sector whatever it charged to provide health care to the elderly and the “deserving poor.” It adopted rules specifically favoring private investment in hospitals. It dictated, for instance, that Medicare and Medicaid payments to for-profit hospitals should cover not only the costs of treatment, but also depreciation of capital investment, interest on debt, and a return on equity that would be higher than the prevailing rate of interest during the year.

At the same time, the government pursued cutbacks in federal hospitals. In the two decades following the enactment of the Medicare/Medicaid legislation, the number of beds in federal hospitals fell by almost one third.(4)

This Congressional “war on poverty” opened a huge new market for health-care services and a new arena for capital investment. For-profit hospitals immediately began to expand, but the major growth did not begin until the seventies, after the average rate of profit for U.S. businesses had fallen to its lowest level in at least twenty years. From 1970 until 1986, for-profit hospital chains grew from approximately 3% of the nation’s hospital beds to 15%.(5)

The growth of the four leading chains was even more phenomenal. American Medical International (AMI), grew twenty-eight fold between 1972 and 1986, when revenues reached $3.5 billion. HCA, which was founded in1968 by the owner of Park View Hospital and the then owner of Kentucky Fried Chicken, had seventy hospitals in 1974 and 486 in 1986. Net revenues multiplied at a compounded rate of 26% a year until, in 1986, they reached almost $5 billion.

Humana, which was founded in 1964, acquired its first acute-care hospital in 1969. By 1982 it had ninety-two and stopped further acquisitions. Company revenues in 1986 reached $3.4 billion. National Medical Enterprises (NME), founded in 1968, owned or managed 160 hospitals and 414 nursing homes in 1986. It had revenues of $3.6 billion that year.

These four firms account for 70% of privately owned hospital beds in the United States in 1986. During the seventies, they consistently earned higher rates of return, and paid out more per share, than the average for American businesses. HCA boasts that in the 1976-86 period its dividends per share increased 25% annually.(6)

In 1965, the average rate of profit of American businesses was at its highest level in thirteen years. Soon, however, the profit rate plunged. In 1970, it reached its lowest level since the Second World War, but it fell even lower in the ensuing decade.

Changes in Corporate Profitability

There has been an almost steady decline until the last few years in the rate of return earned by non-financial businesses on the value of all their plants, machinery and equipment.

Investor-owned hospital chains, meanwhile, earned profits at rates up to double the national average. Capital poured into these firms and fueled their continued growth. Investments in such companies were safe as well as lucrative, since the federal government virtually guaranteed a healthy return on equity. In the 1980s, however, the continued erosion of the profits of American businesses would lead to cost-cutting measures that would rein in the hospital industry.

The growth of investor-owned hospitals affected the operations of not-for-profit hospitals. The for-profit hospital chains set the standards by which the financial markets judge all hospitals. Since not-for-profit and public hospitals borrow money to fund renovations and expansions, the interest rates they have to pay are determined in part by how “well managed” they are in comparison to the standards set by HCA, Humana, and so forth. Investors, after all, want to get their money back in a timely fashion. A hospital’s financial performance determines the investor’s risk in lending to it, and that performance is based on the hospital’s “profitability.”

Investor-owned chains were the first in the healthcare industry to follow consistently the practice of evaluating each part of a hospital’s operations as a profit-and-cost center, with the goal of turning a profit in each. They evaluated room and board, inpatient surgery, out-patient surgery, types of surgery, labs, pharmacy and so on separately, eliminating if possible any part that didn’t generate a profit. Many investor-owned Florida hospitals, for example, abolished maternity wards, while in St. Louis, NME eliminated public-health programs.

Humana evaluates the performances of its hospitals and executives in seven categories: bad debt (includes charity care), staffing costs, overtime costs, accounts receivable, supply expense, quality (determined by patient responses to surveys on waiting time and staff courtesy), and pre-tax revenues. The company headquarters sets the goals in each category for each hospital and bases executive and administrative bonuses on performance relative to the goals.

Such performance goals have led to some bizarre and inhumane practices. At Humana’s Lake Cumberland Hospital in Somerset, Kentucky, for example, management used to hold newborns hostage until their parents had paid their hospital bills. The hospital stopped that practice following a state attorney general’s order in 1983 and replaced it with a requirement that pregnant women pay a $1200 pre-admission deposit. The nearest alternative facility for women who couldn’t afford the deposit was 100 miles away.(7)

When NME took over the St. Louis public hospital and clinics in 1985, it laid off nurse-midwives, family-planning nurses, family-practice nurse practitioners, social workers and nutritionists, and eliminated home visits to pregnant women and newborns. In less than two years, the number of patients seen by the city’s family planning clinics dropped 33% and the infant mortality rate jumped 13.5%.(8)

Despite the furor aroused by such activities, recent studies demonstrate that not-for-profit hospitals are copying such practices. An analysis of 1983 hospital statistics by the National Academy of Sciences Institute of Medicine revealed that on a national average, not-for-profit hospitals spend no more for charity care than do investor-owned hospitals, about 4% of revenues. In areas where there are public hospitals, both not-for-profit and investor-owned facilities dump patients on the public.

What’s the Difference?

Christine Pesek’s baby was born with pneumonia in March 1986. He was sent to the not-for-profit Children’s Hospital in St. Louis because the public- supported hospital did not have the facilities to care for him. Pesek was a seventeen-year-old single mother. She had gone to the public-supported hospital because neither she, her parents, nor her boyfriend had insurance or money to pay the hospital bill. After a few days at Children’s Hospital, the bill for the baby’s care had reached $19,000. A social worker at the hospital told Pesek to move away from her parents so Medicaid would pick up the bill. Pesek refused. The hospital responded by harassing her with several letters and phone calls each week, threatening to turn her account over to a collection agency. Those events left Pesek hurt, angry, confused and certain that she could not return to that hospital next time her son became ill.(9)

The success of investor-owned chains and pressure from large corporate purchasers of medical-care programs have prompted not-for-profit hospitals to copy the tactics and strategies of for-profit chains. They are cutting charity care, forming their own chains, setting up for-profit subsidiaries, advertising, and specializing in profitable growth-oriented health market sectors.

In 1987, 45% of not-for-profit hospitals belonged to multi-hospital chains. The largest of these, American Healthcare Systems (AHS) with 1,400 hospitals, and Voluntary Hospitals of America (VHA) with 751 hospitals, dwarf the investor-owned chains. Some centrally managed not-for-profit chains, such as the Adventist Health System of Lutheran Hospitals and Homes, rival the major investor-owned chains in size.

Though not centrally managed, AHS, like the for-profits, has a centralized purchasing program and, in a joint venture with Transamerica Occidental and Providence Life Insurance Companies, it markets health-maintenance (HMO) and preferred-provider (PPO) organizations through its member hospitals. (Humana markets such services through Humana Care Plus; HCA does it through a joint venture with the Equitable Life Assurance Society.)

VHA’s for-profit subsidiaries provide management services, hospital laundry and cleaning, psychiatric and alcoholism care, venture capital (in a joint venture with Mellon Bank), and health-maintenance and preferred-provider organizations (in a joint venture with the Aetna Life and Casualty Company.)(10)

The chief reasons that not-for-profit hospitals are coming to resemble the investor-owned chains are the competition for revenues and financing. One aspect of this competition is the vying for group health-plan purchasers. By offering discounts to a group health-plan purchaser, a hospital can become the “provider of choice” under a particular group health plan, and thus secure a particular market for itself HCA’s discounts to large group purchasers (HMOs, PPOs, and private insurance companies) in 1986, for example, totaled $121 million.

Large corporate purchasers of medical care have joined “coalitions” to foster such competition. The St. Louis Business Health Coalition, for example, formally organized in 1982 after several years of informal existence. Membership is limited to businesses that purchase medical care but do not provide such care. Of the twenty-nine large employers belonging to the group, seventeen are Fortune 500 companies with headquarters in St. Louis. Their national policies are influenced by discussions in the coalition. The members share information on policies and prices, according to the group’s executive director, James Stutz, but make few group decisions.

One decision, made in 1983, was to implement a utilization review program of all medical-care providers to members of the St. Louis Business Health Coalition. That program required all medical plans to institute pre-admission review of hospital use. In other words, workers covered by a medical plan were required to get the plan’s permission before entering a hospital, or they might have to pay for the stay themselves.

The group is now working with hospitals to establish standard medical-care units, so that it can compare hospitals solely on the basis of price. Such information helps companies decide how much of a discount to ask from a hospital, and is part of determining how much they should pay for medical insurance. The business coalition has completed a pilot study for the program and is awaiting a Justice Department ruling that it will not violate anti-trust laws.

The St. Louis Business Health Coalition is one of ten such coalitions in the country, representing the majority of large corporate medical care purchasers.(11)

Discounts increase the financial pressure on hospitals to cut back on charity care and other unprofitable services by reducing the surplus earned off paying patients.

The effect of all this on public hospitals has been drastic. Such hospitals, spurned in part because of the mistaken notion that Medicare and Medicaid were taking care of the health-care needs of the poor, and restricted from receiving the same level of federal payments as private hospitals, were condemned to decay. They lost paying patients because they could not compete with better-financed private hospitals.

When the latter began shunning the poor, public institutions found they had to do more with less. Local politicians castigated such institutions for losing money, and bond markets demanded high rates of interest in return for loaning money to such poor fiscal managers. But to critics’ complaints that taxpayers’ money was being used to make up for the public hospital’s operating losses, one St. Louis hospital administrator responded that public hospitals “are supposed to ‘lose’ money, they’re caring for people who can’t pay.” In the mid-eighties, the profits of the private hospital chains suddenly began to fall. They were victims of the same crisis in profitability that had fueled their growth. Employers across the country sought to raise corporate profit rates by cutting back on employee benefits. One of their favorite items to cut was health benefits.

General Motors, for example, cut yearly employee health-care costs by$500 million between 1983and 1987. Employers imposed co-payments on workers when they went into the hospital, switched to “managed health plans” (HMOs or PPOs) and placed restrictions on hospitalizations, such as prior approval by a health-plan physician.

The administrators of such plans in turn demanded discounts from participating hospitals. At the same time, corporations were successfully cutting their effective tax rate. By shifting the federal tax burden to individuals, they provided the basis for popular demands for budget cuts to provide tax relief.

Medicare and Medicaid became targets for such cuts. In 1983, the federal government began phasing in the Prospective Payment System (PPS), under which the government would pay a hospital for treating a patient’s condition (as determined by the DRG-Diagnosis Related Group), regardless of what the hospital does for the patient or how long the patient remains under hospital care. This prompted hospitals to limit patient stays, leading to scandals about early patient discharges. In 1985, the federal government froze its payment rates.

In 1986, all four of the major firms suffered losses. HCA’s profits fell 48%, Humana’s 14%, AMI suffered a $97 million loss, and NME’s profits declined by 43%, although all the chains generated more gross revenues than the year before. Even so, Medicare and Medicaid still accounted for 42% of the revenues of the major investor-owned hospital chains in 1986.(12)

The major firms responded to the cuts by vertically integrating or concentrating on areas that had no restrictions on reimbursements. Since 1984, HCA and NME have doubled their numbers of psychiatric and substance-abuse hospitals and moved into rehabilitative care. Private insurance programs are expanding such coverage and federal programs still pay on a “reasonable cost” basis.

AMI moved into this area in 1986 when it formed a joint venture with McLean Hospital (affiliated with Harvard and with Massachusetts General Hospital) to market psychiatric treatments nationally and internationally.

Hospitals also shifted many services to an out-patient basis, again because outpatient charges were not subject to the PPS until 1988. Outpatient revenues at HCA’s 400-plus hospitals increased by 225% from 1984-86. In the latter year, HCA hospitals began to emphasize programs tailored to specific marketing groups, such as wellness programs and women’s health centers-the latter because “women typically make most health care decisions for the family” so if the hospital can attract women patients, it will get the whole family’s business.

Advertising for such programs also increased. Citizens’ Action claims that last year alone, hospital’s spent $500 million on advertising.

All the major chains also have acquired university teaching hospitals to serve as flagships for local markets. The acknowledged leader in this strategy is Humana, which has created an integrated system of pre paid health-care plans and doctors’ clinics to feed patients to its core of hospitals. Through its university hospital and twenty-three “centers of excellence,” Humana aggressively seeks research grants for its doc tors and reputedly is one of the leaders in genetic engineering research in medicine.

According to the company’s senior vice-president for medical affairs, F. David Rollo, “There is a definite marketing advantage for being on the cutting edge of these technologies. If a hospital has a drug or a technology that’s new and that works, people will travel to get this premier treatment.” That marketing advantage, and the establishment of a brand name in hospital care, was the avowed reasons that Humana sponsored the use of the artificial heart.

The other side of this market orientation is the pressure to cut costs. In the last two years there has been a sharp decline in the rate of increase in nurses’ wages and benefits, which make up 55% of hospital costs.(13)

Despite public lamentations about a nursing shortage, administrators are likely to continue trying to cut that part of their budget. One method, pioneered by the for-profit chains, is to reduce the number of full-time nurses and employ more part-time nurses on call. That allows administrators more easily to vary staffing levels with the number of patients and the seriousness of their conditions while saving on wages and benefits.

Another cost-cutting measure is the denial of care to those who can’t pay for it. The Robert Wood Johnson Foundation estimates that37 million Americans lack medical insurance, and that two million Americans were denied medical care last year because of their inability to pay for it. Such denials of medical care have aroused such an outcry of condemnation that Congress is considering several bills on the matter. It just approved revisions in Medicare to provide “catastrophic” coverage to the elderly.

The National Association of Counties, arguing that public hospitals instead of the not-for-profits are providing indigent care, has asked Congress to repeal the tax-exempt status of not-for-profit organizations. Several other approaches for dealing with the problem are also before Congress. A lobbyist for HCA seeks Congressional action because “no one has a right not to have health insurance.”

Meanwhile, leftists have been mostly concerned with local struggles. They have fought to keep public hospitals open, to pressure local hospitals to abide by federal regulations requiring the provision of emergency medical care to the poor, and for increased state funding for indigent care. While people have been fighting such struggles throughout the country, they have been fighting them largely in isolation from each other. In the past year, however, that has begun to change, and activists again are looking towards a national health program as the only realistic way to pro vide adequate health care to all.

Public opinion polls show that an overwhelming majority of Americans believe that access to health care should not be dependent on income. The government of Massachusetts, for example, developed a “universal” health services plan only after voters approved by a two-to-one margin a referendum that called on the state to “urge the United States Congress to enact a national health program which: provides high quality comprehensive personal health care including preventive, curative and occupational health services; is universal in coverage, community controlled, rationally organized, equitably financed, with no out-of-pocket charges, is sensitive to the particular health needs of all, and is efficient in containing its cost; and whose yearly expenditure does not exceed the proportion of the Gross National Product spent on health care in the immediately preceding fiscal year.”

For most Americans, access to quality health care is a question of basic fairness. Over the last several decades, however, the United States has demonstrated that private enterprise is neither fair nor efficient at providing health care. The United States spends more on health care than any other country on earth, but its health indices consistently are worse than most of the rest of the industrialized world. It is one of only two industrialized countries without any sort of national health plan. The other is South Africa.

For twenty years, policy makers in the United States have tried to make our health-care system more rational and efficient. Through the Comprehensive Health Planning Act (1966) and the National Health Planning and Resources Development Act (1974), Congress tried to get health-care competitors to cooperate and integrate their services. It didn’t work. The health-care systems that emerged are competitive systems that compete with others in many localities. Prices continued to soar, while services declined.

The high cost and inaccessibility of health care is a national political issue. Four basic approaches have emerged to deal with the problems: the competitive model, the mandated insurance model, the welfare model and the socialist model.

Spokespeople for corporations, large and small, argue that if there were real price competition among hospitals and health-care providers, the cost of health care would come down. Groups such as the St. Louis Business Health Coalition, for instance, have begun publicizing the average charges for common medical procedures at the hospitals their employees use. The Business Health Coalition argues that by publicizing prices it is introducing price competition among hospitals. It also gives insurance companies and large corporations better ideas of how much to demand in discounts for directing workers to a particular hospital.

Regardless of how effective the price competition was to become, it still would do nothing for those too poor to afford medical care, or for workers saddled with larger co-payments or deductibles. The competitive model is popular with business, however, because it leaves companies free to reduce medical benefits and pass on the cost of health care to their employees.

Many in corporate America are willing to admit that the competitive model does nothing for the indigent. They are willing to accept something like Medicaid for everyone who is without medical insurance, provided that working people disproportionately bear the tax burden and the medical coverage is meager. Yet, in many parts of the country, doctors and hospitals refuse to accept Medicaid patients because Medicaid doesn’t pay them enough. The welfare model fails the indigent, as well as insured workers.

The third approach to America’s health-care quagmire is to legislate that employers provide their workers with a minimal medical insurance plan. Several labor unions, such as the United Auto Workers, have moved away from traditional support for national health insurance to back mandated care. Some insurance companies and hospital chains also support mandated care, for the obvious reasons. In theory, mandated care suffers from the failure to address inefficient competition in medical care: the race for beds, high technology and more patients (because a hospital that invests in expensive equipment wants patients to use it, whether they need it or not).

In practice, mandated care has other problems as well. First of all, it wouldn’t actually be mandated for everyone. Since many small businesses habitually totter on the brink of ruin, Congress would exempt them from the law. Current proposals call for exempting businesses with fewer than fifty employees. They also would set deductibles and co-payments at a high level.

The only universal health plan is socialized health care. A properly organized national health program would make medical care accessible to all and allow people a wide choice of primary-care physicians, much like some existing managed-care programs.

The universal availability of preventive and primary care should reduce total health-care costs because it is cheaper to prevent a disease, or treat it in its early stages, than it is to treat the same disease in an advanced stage. A national health program also could reduce medical costs by eliminating wasteful hospital competition to acquire excess beds, equipment and specialties.

Finally, such a program could improve health by coordinating medical care with action on other factors that affect health: nutrition, shelter and environmental pollution/sanitation.

Notes

- Bennett’s story is from an interview with Gordon Bonnyman.

back to text - American Hospital Association, Hospital Statistics (annual) and Hospital Corporation of America, Annual Reports.

back to text - Hospital Statistics.

back to text - Hospital Statistics.

back to text - Hospital Statistics.

back to text - Corporate data is from corporate annual reports and 10-K reports.

back to text - Geri Dallekand Linda Lowe, “The For-Profit Hospital Juggernaut,” Southern Exposure 23, no. 2-3.

back to text - Interviews with St. Louis and Missouri health officials and public health-care workers.

back to text - Interviews with Christine Pesek and representatives of St Louis Children’s Hospital.

back to text - Modern Healthcare annual survey of hospital chains, and April 24, 1987, May 22, 1987, and June 5, 1987. See also Hospital Statistics.

back to text - Interview with James Stutz, executive director of the St. Louis Business Health Coalition.

back to text - Calculated from the 10-K reports of the four major firms. Such government payments account for 40% of hospital revenues nation-wide, according to the Hospital Financial Management Association.

back to text - Hospital Statistics.

back to text

May-JUne 1989, ATC 20